Market Insights

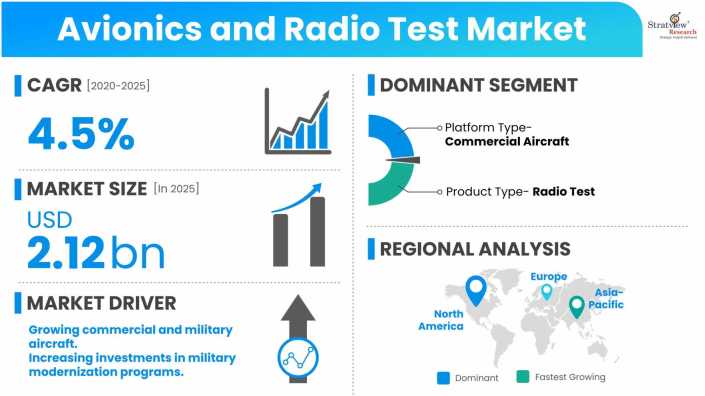

The avionics and radio test market was estimated at USD 1.61 billion in 2019 and is likely to grow at a CAGR of 4.5% during 2020-2025 to reach USD 2.12 billion in 2025.

Wish to get a free sample? Register Here

Market Dynamics

Introduction

Avionics and radio test is a critical process that helps in verifying the performance, safety, reliability, and functionality of avionics and radio systems in any aircraft. This process is vital since the functionality of avionics and radio systems are responsible for several critical functions, including flight and engine control, surveillance, navigation, communication, and more.

The aerospace and defence industry are one of the most critical end-user segments for the avionics and radio test markets. In civil aircraft, avionics are majorly powered by using 14- or 28-volt Direct Current (DC) electrical systems, whereas military and combat aircraft use alternative current (AC) systems operating at 400 Hz, 115-volt AC. Avionics and radio systems continue to advance at a rapid pace in the aviation industry.

With the increased complexity of avionics and radio systems in the aerospace and defense industry, customers are facing challenges in the testing, validation, and verification of these modern systems. This trend is changing the face of the test equipment market as well as accelerating the need for flexible and scalable test solutions. The increasing pace of technology change, system complexity, and changing standards and regulations are contributing significantly to changing dynamics of the test equipment market.

Analogously, built-in-test equipment (BITE) is used in commercial as well as military aircraft, which refers to fault management and diagnosis of the avionics and radio equipment built in the airborne system.

Market Drivers

The demand for global avionics and radio test equipment is rapidly rising owing to the growing aerospace industry that has been vigorous over the past few years. Both civil and military aviation coupled with ongoing advancements combinedly account for the growing aerospace industry that happens to be one of the biggest end-users of avionics and radio test equipment.

The demand for avionics and radio test solutions is driven by various factors, such as:

- Growing commercial and military aircraft: Emerging economies are witnessing rapid growth in the aviation sector. This is driving demand for avionics and radio test equipment from commercial and military aircraft.

- Increasing investments in military modernization programs: Governments across the world are increasing their investments in military modernization programs. Countries like China, U.S., India etc. are raising their spending on military modernization in the coming years. Their motive includes the procurement of new military aircraft and the upgrading of existing aircraft and their test equipment.

Want to have a closer look at this market report? Click Here

Key Players

The supply chain of this market comprises avionics and radio test equipment suppliers, avionics and radio system manufacturers, distributors/part brokers, and end-users.

The key players in the avionics and radio test market are:

- Viavi Solutions, Inc.

- Tel-Instrument Electronics Corporation

- Astronics Corporation

- Lockheed Martin Corporation

- Keysight Technologies, Inc.

- National Instrument Corporation

- Rohde and Schwarz GmbH & Co. KG

- General Dynamics Corporation

- the Boeing Company

- Teradyne, Inc.

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Write to us at [email protected]

Formation of long-term contracts, new product developments, and strategic alliances are the key strategies adopted by major players to gain a competitive edge in the market.

In 2019, CCX Technologies launched a new product: T-RX avionics radio tester. It is designed in such a manner to test 16 different systems and will conduct more than 100 different tests, which will include Instrument Landing System (ILS), Very High Frequency Omni-directional Radio (VOR), Distance Measuring Equipment (DME) Test, High Frequency Comm Generation, Transponder Mode A/C, Transponder Mode S, SELCAL Tone Generation, TCAS, and others.

Segment Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High Growth Opportunity

|

|

Platform Type Analysis

|

Commercial Aircraft and Defense and Security

|

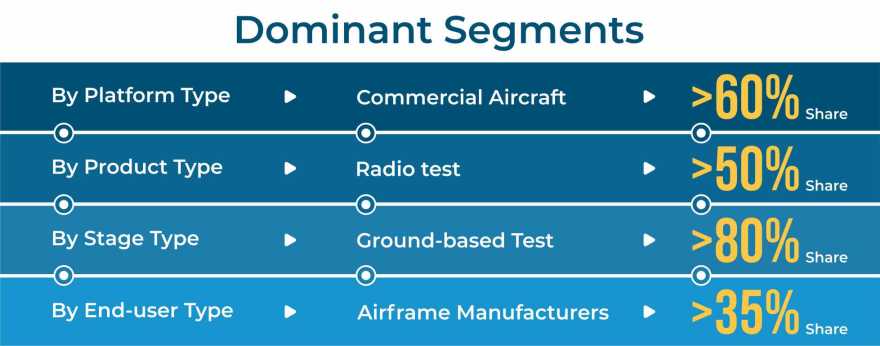

Commercial aircraft is expected to remain the larger segment of the market during the forecast period.

|

|

Product Type Analysis

|

Avionics Test, Radio Test, and Synthetic Test

|

Radio test is expected to remain the dominant segment during the forecast period.

|

|

Regional Analysis

|

North America, Europe, Asia-Pacific, and Rest of the World

|

North America is projected to remain the largest market for avionics and radio tests during the forecast period.

|

By Platform Type

Based on the platform type, the market is segmented into commercial aircraft and defense and security. Commercial aircraft is expected to remain the larger segment of the market during the forecast period. Increasing deliveries of commercial and regional aircraft to support rising air passenger traffic, growing demand for fuel-efficient aircraft, and expanding aircraft fleet size are the key growth drivers of the segment’s market. A320neo family, B787, and A350XWB would remain the growth engines of the market.

Boeing anticipated that there would be total deliveries of 44,040 commercial aircraft worth US$ 6.8 trillion in the global marketplace during 2019-2038. Asia-Pacific and North America would be the biggest demand generators with a combined share of 60.2% of the total commercial aircraft deliveries during 2019-2038. An expected healthy CAGR of 4.8% in air passenger traffic during 2019-2038 will chiefly drive the demand for commercial aircraft. This factor will create a sustainable demand for avionics and radio test equipment during the foreseen period.

Defense & Security is also estimated to generate a sizeable demand for test equipment in the coming five years. Increasing tension in different parts of the world, especially between the USA and China, is pushing countries to increase their defense budget to further solidify their defense capabilities. The USA, the world’s largest military expenditure country, has been raising its military expenditure for the last two years after several years of decline. Other major economies, including China, India, and South Korea are also raising their defense budget, which is positively imprinting the demand for test and measurement equipment.

Want to know more about the market scope? Register Here

By Product Type

Based on the product type, the market is segmented into avionics test, radio test, and synthetic tests. Radio test is expected to remain the dominant segment during the forecast period. Radio test systems are primarily used to test military radio and private mobile radio in commercial aircraft. However, recent developments in the areas of synthetic test are likely to transform the present market scenario. It is expected that synthetic test systems will be used to test various applications of avionics and radio systems used in aircraft and helicopters.

Regional Insights

In terms of region, North America is projected to remain the largest market for avionics and radio tests during the forecast period. The USA is the growth engine of the region’s market and has one of the largest fleets of commercial and military aircraft in the world. The increasing defense budget from the past three years (2016-2018) coupled with increasing demand for F-35 and KC-46 Pegasus aircraft is the pith behind the growing demand for test and measurement equipment in the country. Mexico, a diminutive market in front of the giant USA, is also estimated to grow at a healthy pace in the coming five years, propelled by higher proximities of the country to the USA. Aerospace companies are opening their plants in the country to leverage the country’s business-friendly policies, high proximity to the USA, and low-cost labor.

Asia-Pacific is likely to witness the highest growth in the market during the forecast, driven by a host of factors including increasing demand for commercial aircraft to support rising passenger traffic, increasing defense budgets of key economies, the opening of assembly plants of Boeing and Airbus, and upcoming indigenous commercial and regional aircraft (COMAC C919 and Mitsubishi MRJ). The region owns the largest fleet of commercial aircraft for which there is a colossal requirement for test and measurement equipment.

Know the high-growth countries in this report. Register Here

Research Methodology

- This strategic assessment report from Stratview Research provides a comprehensive analysis that reflects avionics and radio test market realities and future market possibilities for the forecast period.

- The report segments and analyzes the market in the most detailed manner in order to provide a panoramic view of the market.

- The vital data/information provided in the report can play a crucial role for market participants as well as investors in the identification of the low-hanging fruits available in the market as well as to formulate growth strategies to expedite their growth process.

- This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools.

- More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data.

- We conducted more than 15 detailed primary interviews with market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Report Features

This report provides market intelligence in the most comprehensive way. The report structure has been kept such that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market. The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

- COVID-19 impact and its recovery curve

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors.

Market Segmentation

This report studies the market, covering a period of 12 years of trend and forecast. The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The avionics and radio test market is segmented into the following categories:

By Platform Type

- Commercial Aircraft

- Defense and Security

By Stage Type

- Aircraft-based Test

- Ground-based Test

By Product Type

- Avionics Test

- Radio Test

- Synthetic Test

By End-User Type

- Avionics and Radio Manufacturers

- Airframe Manufacturers

- Worldwide Government & Military Entities

- Defense Contractors

By Region

- North America (Country Analysis: The USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, The UK, and Rest of Europe)

- Asia-Pacific (Country Analysis: China, Japan, India, and Rest of Asia-Pacific)

- Rest of the World (Sub-Region Analysis: Latin America, The Middle East, and Others)

_87200.webp)

Click here to learn the market segmentation details.

Report Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

- Detailed profiling of additional market players (up to 3 players)

- SWOT analysis of key players (up to 3 players)

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Product portfolio, geographical reach, regional presence, and strategic alliances.

Custom Research: Stratview Research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected].