Market Insights

The can & closure sealants market is projected to grow at a plausible rate over the next five years to reach US$ 647.7 million by 2025. Rapid urbanization, rising disposable income, and changing lifestyles and consumer preference towards packaged food products instead of bulk products are extrapolated to continue driving the demand for packaging products, benefiting the metal packaging as well as the sealants used in metal cans and closures. Another trend that is the further fuelling the growth of the can & closure sealants market is the demand for personalized and sophisticated packaging.

The sealants market for can & closure applications has undergone a remarkable evolution over the years. Also, the functions of sealants have grown beyond simply allowing easy access. Packaging is a convoluted process that requires meticulous attention of a multitude of things from distribution to shelf life including materials used for packaging, products that are packaged, and technology used to maintain product quality as well as freshness. Sealants are preferably used in the packaging industry to preserve products with a prime aim to extend their shelf life.

However, the advancements in technologies have a dual-edge impact on the demand for sealants used for cans and closures. For instance; in recent years, the metal can packaging industry has experienced a transition from three-piece can to two-piece can as a result of which the market has depicted a decline in sealant sales.

The global can & closure sealants market is consolidated with the presence of a few global and a handful of local players. Furthermore, the market recorded a sizeable number of M&A activities over the years. The most noticeable one is the acquisition of Darex Packaging Technologies from GCP Applied Technologies by Henkel at US$ 1.05 billion on a cash and debt-free basis in 2017. At the time of the acquisition, Darex Packaging Technologies had 700 employees located across 20 sites in 19 countries. This acquisition not only enhanced Henkel’s position in the total adhesives and sealants business, but also made it the leading supplier of sealants for can & closure applications.

Segment Analysis

Wish to get a free sample? Register Here

Can & Closure Sealants Market by Application Type

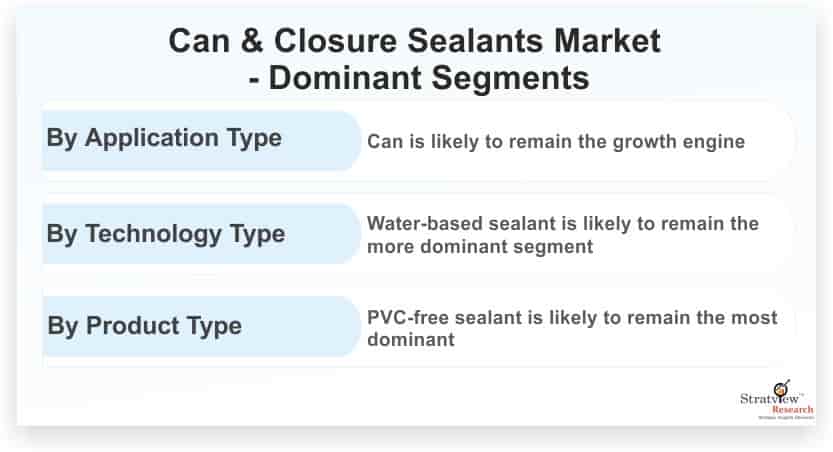

The market is segmented based on the application type as can & closure. Can is likely to remain the growth engine of the market during the forecast period. Plastic pollution is one of the most important environmental concerns today. The Ocean plastic is being directly linked to health concerns as it breaks down and gets into the food and water supplies that human consume. Due to this, the demand for metal can packaging for RTD (ready-to-drink) tea and coffee drink, craft beer, packaged water, wine, etc. has been soaring.

Can & Closure Sealants Market by Technology Type

Based on the technology type, the market is segmented as water-based sealants and solvent-based sealants. Water-based sealant is likely to remain the more dominant as well as the faster-growing segment over the next five years in terms of both value as well as volume. Water-based sealant is gaining traction in the metal can & closure application because they are suitable for all types of cans used for food, beverages as well as general-line packaging. This sealant offers a wide range of benefits to the can & closure manufacturers as well as to the environment.

Can & Closure Sealants Market by Product Type

Based on the product type, the market is classified as PVC-free sealants and PVC-based sealants. PVC-free sealant is likely to remain the most dominant as well as the faster-growing product type during the forecast period. PVC-based sealants are rarely used for food and beverage packaging because of undesired substances that may get migrated into food.

Can & Closure Sealants Market by End-Use Industry Type

Based on the end-use industry type, the market is segmented as food, beverage, aerosol, and others. Food is likely to remain the largest consumer of can & closure sealants over the next five years in terms of value, whereas, in terms of volume, beverage is likely to remain the largest consumer of can & closure sealants. Aerosol is likely to witness the highest growth over the next five years.

Can & Closure Sealants Market by Material Type

Based on the material type, the can & closure sealants market is segmented as silicone, polyurethane, acrylic, and others. Silicone is likely to remain the most dominant as well as the fastest-growing sealant material during the forecast period. Polyurethane is likely to remain the second-largest sealant material type over the same period.

Regional Insights

In terms of regions, Asia-Pacific is projected to remain the largest and the fastest-growing market during the forecast period. China and India are the growth engines of the Asia-Pacific’s can & closure sealants market. Globally, China is likely to remain the second-largest can & closure sealants market during the forecast period.

Know which region offers best growth opportunities. Register Here

North America and Europe are also likely to generate even-handed demand for can & closure sealants in years to come. The North American market is largely driven by the USA which is expected to remain the largest can & closure sealants market globally during the forecast period, driven by a fair growth in the metal packaging industry coupled with the presence of a large number of tier players including metal can manufacturers and distributors.

Market Scope & Segmentation

|

Research Scope

|

|

Trend & Forecast Period

|

2014-2025

|

|

Regions Covered

|

North America, Europe, Asia-Pacific, Rest of the World

|

|

Size in 2026

|

US$ 647.7 million

|

|

Countries/Subregions Covered

|

The USA, Canada, Mexico, Germany, the UK, France, Germany, Italy, China, Japan, India, South America, the Middle East and others

|

|

Figures & Tables

|

>150

|

|

Customization

|

Up to 10% customization available free of cost

|

The market is segmented into the following categories:

Can & Closure Sealants Market Size, Share & Forecast, By Application Type

- Can (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

- Closure (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

Can & Closure Sealants Market Size, Share & Forecast, By Technology Type

- Water-Based Sealants (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

- Solvent-Based Sealants (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

Can & Closure Sealants Market Size, Share & Forecast, By Product Type

- PVC-Free Sealants (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

- PVC-Based Sealants (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

Can & Closure Sealants Market Size, Share & Forecast, By End-Use Industry Type

- Food (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

- Beverage (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

- Aerosol (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

- Others (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

Can & Closure Sealants Market Size, Share & Forecast, By Material Type

- Silicone (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

- Polyurethane (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

- Acrylic (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

- Others (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

Can & Closure Sealants Market Size, Share & Forecast, By Region

- North America (Country Analysis: The USA, Canada, and Mexico)

- Europe (Country Analysis: the UK, France, Germany, Italy, and Rest of Europe)

- Asia-Pacific (Country Analysis: China, Japan, India, and Rest of Asia-Pacific)

- Rest of the World (Sub-Region Analysis: South America, the Middle East, and Others)

Want to know the most attractive market segments? Register Here

Key Players

The supply chain of this market comprises raw material suppliers, sealant manufacturers, food & beverage packaging companies, and end-users. Siloxane, glycol, PVC, isocyanate, and other polymers are some of the raw materials used to make sealants.

Some of the major suppliers of sealants for can & closures globally are-

- Henkel AG & Co. KGa

- Altana A

- UBIS (Asia) Public Company Limite

- Fukuoka Packing Co., Ltd

- Tekni-Plex, Inc

- Advanced Chemical Industries S.A.E.

It is anticipated that the market is likely to remain consolidated in years to come. New product development, application development, and execution of M&As are the imperative growth strategies, adopted by most of the market participants in order to better position themselves in the market.

Report Features

This 255-page comprehensive report, from Stratview Research, on the can & closure sealants market is one of its kind and estimates the current as well as future growth opportunities for the market participants until 2025. The report segments and analyses the market in the most detailed manner in order to provide a panoramic view of the market. The vital data/information provided in the report can play a crucial role for the market participants as well as investors in the identification of the low-hanging fruits available in the market as well as to formulate the growth strategies in order to expedite their growth process.

The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, product portfolio, product launches, etc.

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors.

Research Methodology

For calculating the market size, our analysts follow either Top-Bottom or Bottom-Top approach or both, depending upon the complexity or availability of the data points. Our reports offer high-quality insights and are the outcome of detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders and validation and triangulation with Stratview Research’s internal database and statistical tools. We leverage multitude of authenticated secondary sources, such as company annual reports, government sources, trade associations, journals, investor presentation, white papers, and articles to gather the data. More than 10 detailed primary interviews with the market players across the value chain in all four regions and industry experts are usually executed to obtain both qualitative and quantitative insights.

Report Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

- Detailed profiling of additional market players (up to 3 players)

- SWOT analysis of key players (up to 3 players)

Market Segmentation

- Current market segmentation of any one of the applications by printers’ technology type

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Product portfolio, geographical reach, regional presence, and strategic alliances

Custom Research: Stratview Research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry at [email protected].