Market Insights

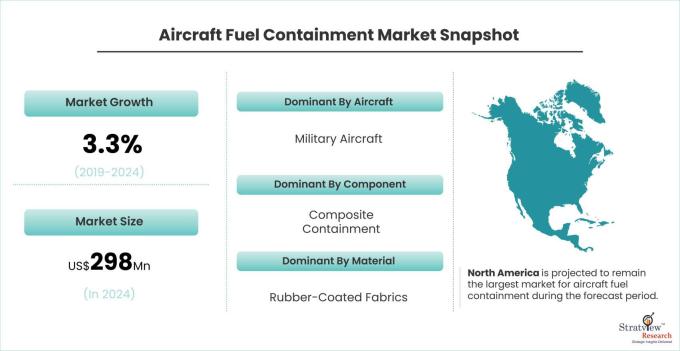

The aircraft fuel containment market is likely to grow at a CAGR of 3.3% during 2019-2024 to reach a value of USD 298 million in 2024.

Want to have a closer look at this report? Click Here

Market Dynamics

Introduction

Aircraft fuel containment refers to the design and implementation of systems and structures within an aircraft to prevent the uncontrolled release of fuel in the event of a rupture or damage to fuel tanks. These systems are crucial for enhancing safety by minimizing the risk of fuel-related fires or explosions during emergencies, such as crashes or accidents. Aircraft fuel containment measures typically include the use of robust tank materials, fuel tank liners, and structural reinforcements to ensure that fuel remains securely contained within designated compartments, protecting both the aircraft and its occupants from the potential hazards associated with fuel leakage.

Market Drivers

Increasing aircraft deliveries to support rising air passenger traffic, rising military expenditure, and increasing demand for self-sealing fuel bladders are the major factors that are escalating the demand for fuel containments in the aircraft industry.

The market is marked by a handful of players, who are currently enjoying their healthy shares. These players own extraordinary capabilities in the market, securing their vanguard in the market. The market is registering further consolidation because of a fair number of mergers & acquisitions over a period of time. All the major players that hold a large chunk of the market, gained expertise in the market by acquiring core fuel containment manufacturers. For instance, Meggitt gained expertise by acquiring Engineered Fabrics Corporation, which originally gained the expertise from Goodyear. Similarly, Amfuel gained expertise from Uniroyal, which originally gained it from US Rubber. In the past few years, there has been a series of acquisitions including the acquisition of the advanced composite business of Cobham plc by Meggitt PLC, the acquisition of GKN Aerospace by Melrose Industries, and the acquisition of Zodiac Aerospace by Safran SA.

Want to have a closer look at this market report? Click Here

Key Players

The supply chain of this market comprises raw material suppliers, aircraft fuel containment manufacturers, airframers, and end-users.

Some of the key players in the aircraft fuel containment market are:

- Meggitt PLC

- Safran SA

- GKN Aerospace

- Marshall Aerospace

- Amfuel

- Floats & Fuel Cell Inc.

Strategic collaborations, the formation of long-term contracts, and the development of highly efficient and lightweight products are the key strategies adopted by major players to gain a competitive edge in the market.

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Write to us at sales@stratviewresearch.com

Segments' Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High Growth Opportunity

|

|

Deployment Model Type Analysis

|

Military Aircraft and Civil Aircraft

|

Military aircraft are likely to remain the dominant segment of the market during the forecast period.

|

|

Component Type Analysis

|

Composite Containment and Flexible Fuel Bladder

|

Composite containment is projected to remain the most dominant component type in the aircraft fuel containment market over the next five years.

|

|

Material Type Analysis

|

Rubber Coated Fabric, Polyurethane, and Others

|

Rubber-coated fabrics are likely to remain the dominant segment of the market during the forecast period.

|

|

Regional Analysis

|

North America, Europe, Asia-Pacific, and Rest of the World

|

North America is projected to remain the largest market for aircraft fuel containment during the forecast period.

|

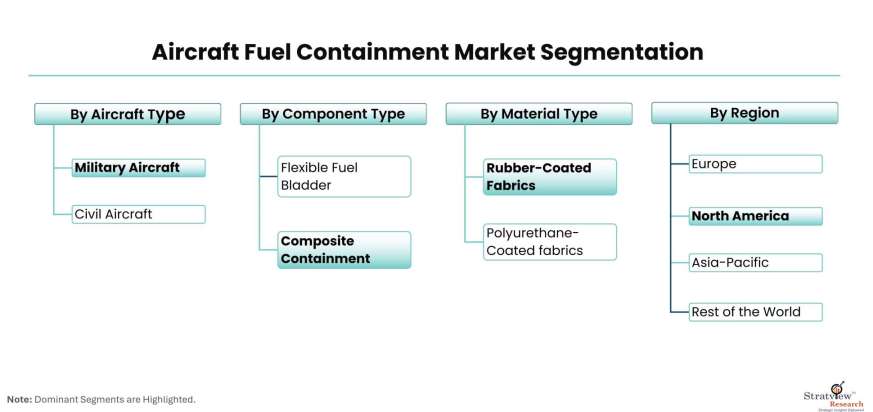

By Aircraft Type

The aircraft fuel containment market is segmented based on the aircraft type as military aircraft and civil aircraft. Military aircraft are likely to remain the dominant segment of the market during the forecast period. Both military fixed-wing and rotorcraft are likely to generate sizeable opportunities for market participants in the coming five years. There is a growing interest among defense communities in the development of efficient fuel containment that substantially mitigates aircraft vulnerability.

By Component Type

Based on the component type, the market is segmented as composite containment and flexible fuel bladder. Composite containment is projected to remain the most dominant component type in the market over the next five years. Rubber-coated fabric is the major type of material used in such containments. The demand for flexible fuel bladders is largely driven by the military aircraft segment, which generally has such types of fuel containment. Meggitt, Safran SA, and GKN Aerospace are leading players, supplying fuel bladders.

By Material Type

Based on the material type, the market is segmented as rubber-coated fabric, polyurethane-coated fabrics, and others. Excellent resistance to petroleum fluids and chemicals, superior heat resistance, and high strength-to-weight ratio are some key factors that have led to the mass adoption of rubber-coated fabrics in the aircraft fuel containment market. ContiTech and Colmant Coated Fabrics are leading suppliers of rubber-coated fabrics for aircraft fuel containments.

Regional Insights

In terms of regions, North America is projected to remain the largest market for aircraft fuel containment during the forecast period, largely driven by massive demand from defense organizations such as the U.S. Department of Defense (DoD) and Defense Logistics Agency (DLA). Asia-Pacific currently represents a relatively small market opportunity; however, is subjected to grow at a handsome rate in the coming years, largely driven by China. China is projected to add a growth propulsion engine to the global demand for fuel containments.

Get the full scope of the report. Register Here

Research Methodology

- This strategic assessment report from Stratview Research provides a comprehensive analysis that reflects aircraft fuel containment market realities and future market possibilities for the forecast period.

- The report segments and analyzes the market in the most detailed manner in order to provide a panoramic view of the market.

- The vital data/information provided in the report can play a crucial role for market participants as well as investors in the identification of the low-hanging fruits available in the market as well as to formulate growth strategies to expedite their growth process.

- This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools.

- More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data.

- We conducted more than 15 detailed primary interviews with market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Report Features

This report provides market intelligence in the most comprehensive way. The report structure has been kept such that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market. The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

- COVID-19 impact and its recovery curve

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors.

Market Segmentation

This report studies the market covering a period of 12 years of trend and forecast. The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The aircraft fuel containment market is segmented in the following ways.

By Aircraft Type

- Military Aircraft

- Civil Aircraft

By System Type

- Rotorcraft System

- Fixed Wing System

By Component Type

- Composite Containment

- Flexible Fuel Bladder

By Material Type

- Rubber-Coated Fabrics

- Polyurethane-Coated Fabrics

- Others

By Containment Type

- Self-Sealing/Crash Resistant Bladder

- Fuel Bladder

- Fuel Tank

By Region:

- North America (Country Analysis: The USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, Italy, Russia, and Rest of Europe)

- Asia-Pacific (Country Analysis: China, Japan, India, and Rest of Asia-Pacific)

- Rest of the World (Sub-Region Analysis: Latin America, the Middle East, and Others)

Click Here, to learn the market segmentation details.

Report Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

- Detailed profiling of additional market players (up to 3 players)

- SWOT analysis of key players (up to 3 players)

Market Segmentation

- Current market segmentation of any one of the component types by application type.

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Product portfolio, geographical reach, regional presence, and strategic alliances.

Custom Research: Stratview Research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to sales@stratviewresearch.com.