Market Insights

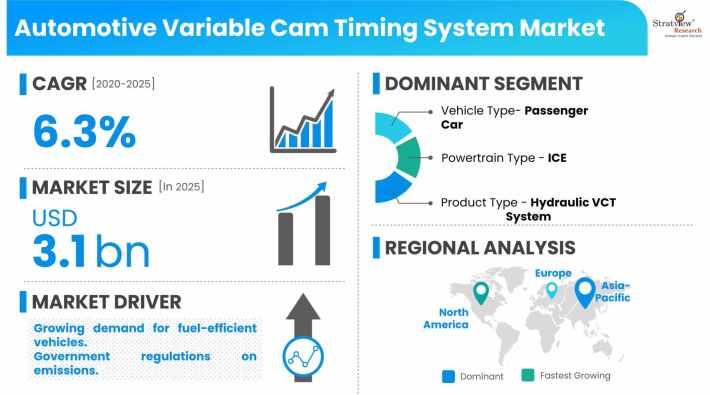

The automotive variable cam timing system market was estimated at USD 2.9 billion in 2019 and is likely to grow at a CAGR of 6.3% during 2020-2025 to reach USD 3.1 billion in 2025.

Wish to get a free sample? Register Here

Market Dynamics

Introduction

Variable Cam Timing (VCT) is a technology used in internal combustion engines, especially in the automotive industry, that enables the adjustment of the timing of the opening and closing of the engine’s intake and exhaust valves. The engine can effectively respond to varying operating conditions and optimize the engine’s performance and efficiency.

The variable cam timing system plays an important role in providing an optimum air-fuel ratio to reduce the quantum of unburnt hydrocarbons during the combustion cycle of the internal combustion engine. It also reduces the amount of residual gas in the combustion and exhaust phases of the engine.

The performance of variable cam timing systems is highly proportional to the organic growth of vehicle production, or say, the auto industry. However, a rapid increase in the penetration of variable cam timing systems in the past few years, especially in HEVs, proved to be a factor, weakening the impact of industry challenges.

COVID-19 Impact

The global economic slowdown led by the US-Sino trade war and other such reasons have impacted the auto industry, due to which the industry has witnessed a huge downturn in the last few years. The outbreak of the COVID-19 pandemic intensified the already deteriorating automotive industry, leaving a dent in the growth of the automotive variable cam timing system market.

Market Drivers

The global market for automotive variable cam timing systems is impacted due to several factors. Below given are some key growth factors impacting the global market:

- Growing demand for fuel-efficient vehicles: Consumers are increasingly looking for fuel-efficient vehicles. VCT systems are proven to help improve fuel efficiency of any vehicle by adjusting the valve timing and improving the engine’s performance.

- Government regulations on emissions: Carbon dioxide concentrations are rising mostly because of the fossil fuels that people are burning for energy. Greenhouse gas (GHG) emissions from transportation accounts for ~29% of total U.S. greenhouse gas emissions, making it the largest contributor of U.S. GHG emissions, states the United States Environmental Protection Agency (US EPA). To reduce this emission level, several governments are passing regulations to reduce the emissions caused by transportation. VCT systems are a suitable solution to reduce emissions generated by vehicles.

Want to have a closer look at this market report? Click Here

Key Players

The supply chain of this market comprises raw material suppliers, component manufacturers, VCT system manufacturers, automotive OEMs, and tier players.

The key automotive variable cam timing system manufacturers are:

- Aisin Seiki Co., Ltd.

- BorgWarner Inc.

- Schaeffler AG

- Denso Corporation

- Hitachi Ltd.

- Mikuni Corporation.

The development of high-performance, lightweight, and compact VCT systems and the formation of strategic alliances with OEMs or engine manufacturers, are the key strategies adopted by the key players to gain a competitive edge in the market.

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Write to us at [email protected]

Segment Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High Growth Opportunity

|

|

Vehicle Type Analysis

|

Passenger Cars and Commercial Vehicles

|

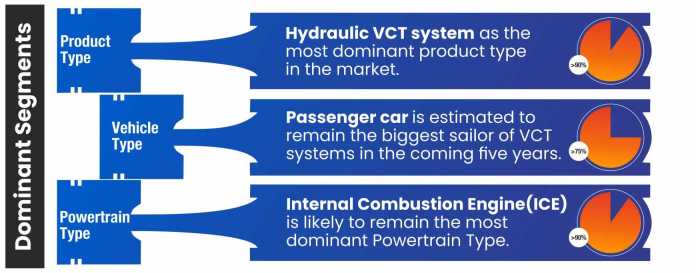

Passenger car is estimated to remain the biggest sailor of automotive variable cam timing systems in the coming five years.

|

|

Powertrain Type Analysis

|

ICE and Hybrid Engine

|

Stratview’s study on the engine-based segment highlights the irrefutable dominance of the internal combustion engine (ICE) in the automotive variable cam timing system market.

|

|

Product Type Analysis

|

Hydraulic VCT System and Electric VCT System

|

The Hydraulic VCT system as the most dominant product type in the market.

|

|

Regional Analysis

|

North America, Europe, Asia-Pacific, and Rest of the World

|

Asia-Pacific, the largest producer of automobile producer, is projected to maintain its dominance in the automotive VCT system market in the foreseen future in terms of both value and units.

|

By Vehicle Type

Firstly, the market is segregated by vehicle types as passenger cars and commercial vehicles, are the most crucial market segment. Passenger car is estimated to remain the biggest sailor of variable cam timing systems in the coming five years. The large production of passenger cars coupled with the high penetration of variable cam timing systems is a key factor behind the dominance of the passenger car segment in the market. Furthermore, increasing the production of hybrid electric vehicles is further corroborating the market potential of variable cam timing systems in passenger cars.

By Powertrain Type

The use of VCT systems also varies from engine to engine. Stratview’s study on the engine-based segment highlights the irrefutable dominance of the internal combustion engine (ICE) in the market. ICE, the traditional technology, is still most prevalent across regions with a fair penetration of variable cam timing systems. Hybrid engines, a relatively new technology, is subjected to record higher growth post-pandemic. The high focus of automakers on the development of hybrid vehicles with the use of advanced technologies, including VCT systems, aiming to curb carbon emissions, may drive the segment’s market in years to come.

Want to know more about the market scope? Register Here

By Product Type

Variable cam timing systems are primarily of two types: hydraulic VCT systems and electric VCT systems. The study based on the types of VCT systems identifies the Hydraulic VCT system as the most dominant product type in the market. However, the electric variable cam timing system is likely to exhibit faster growth in the long run. Electric variable cam timing system exhibit better phasing performance as compared to conventional hydraulic variable cam timing systems.

Regional Insights

The assessment of the pandemic reveals a mammoth change in both short- as well as long-term regional business perspectives. The outbreak of the pandemic plummeted vehicle production as well as undermined the VCT systems’ penetration rate. Despite several setbacks caused by maturing indigenous demand, fading export, and the pandemic’s impact, Asia-Pacific, the largest producer of automobile producer, is projected to maintain its dominance in the automotive variable cam timing system market in the foreseen future in terms of both value and units.

China is estimated to maintain its leadership in the global market in the coming five years despite decreasing vehicle production in the past two years as well as a substantial plunge in production in the year 2020 triggered by the pandemic. The country’s auto stakeholders have been meticulously investing in new automotive technologies with a high focus on HEVs comprised of VCT systems.

Europe, the second-largest market, is also likely to exhibit a sizeable demand for VCT systems during the forecast period. The region is estimated to be one of the two worst-impacted regions of the market. The region was already facing massive decline, engulfed by several industry-related challenges, including declining demand from China since 2018, the uncertainty of Brexit, delays in adopting EVs, and the diesel-gate scandal with stringing emission norms, leading to a huge decline in diesel car sales. The pandemic has exacerbated the regional market conditions by taking the key economies into its grip.

Know the high-growth countries in this report. Register Here

Research Methodology

- This strategic assessment report from Stratview Research provides a comprehensive analysis that reflects automotive variable cam timing system market realities and future market possibilities for the forecast period.

- The report segments and analyzes the market in the most detailed manner in order to provide a panoramic view of the market.

- The vital data/information provided in the report can play a crucial role for market participants as well as investors in the identification of the low-hanging fruits available in the market as well as to formulate growth strategies to expedite their growth process.

- This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools.

- More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data.

- We conducted more than 15 detailed primary interviews with market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Report Features

This report provides market intelligence in the most comprehensive way. The report structure has been kept such that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market. The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

- COVID-19 impact and its recovery curve

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors.

Market Segmentation

This report studies the market covering a period of 12 years of trend and forecast. The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

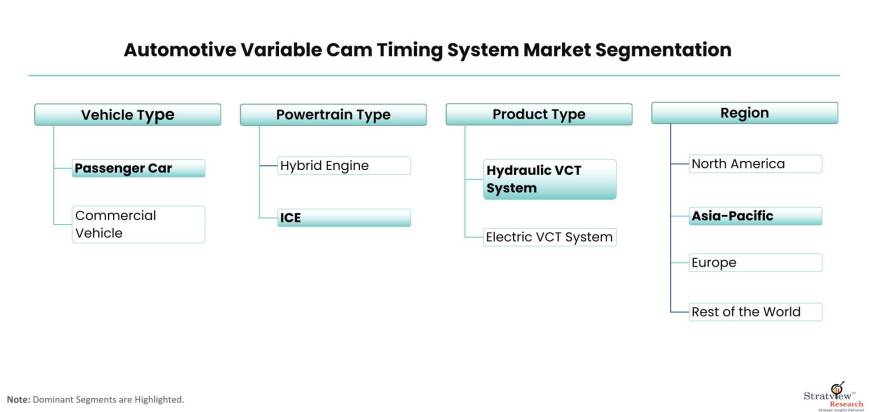

The automotive variable cam timing systems market is segmented into the following categories.

By Vehicle Type

- Passenger Car

- Commercial Vehicle

By Powertrain Type

- Internal Combustion Engine

- Hybrid Engine

By Product Type

- Hydraulic VCT System

- Electric VCT System

By Region

- North America (Country Analysis: The USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, the UK, Russia, Italy, and Rest of Europe)

- Asia-Pacific (Country Analysis: China, Japan, India, South Korea and Rest of Asia-Pacific)

- Rest of the World (Country Analysis: Brazil, Argentina, and Others)

Click Here, to know the market segmentation details.

Report Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

- Detailed profiling of additional market players (up to 3 players)

- SWOT analysis of key players (up to 3 players)

Market Segmentation

- Current market segmentation of any one of the product types by vehicle type.

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Product portfolio, geographical reach, regional presence, and strategic alliances.

Custom Research: Stratview Research offers custom research services across the sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected].