Market Insights

The composite surfacing films market is forecasted to grow at an impressive rate over the next five years to reach an estimated value of US$ 320.3 million in 2024. An organic growth of the aircraft industry coupled with an increased penetration of composites in the structural sections of the next-generation aircraft is the primary driver of the sustainable demand for composite surfacing films in the aerospace & defense industry. Airbus anticipated that there would be total deliveries of 37,390 aircraft worth US$ 5.8 trillion in the global marketplace during 2018-2037. Asia-Pacific and North America would be the largest demand generators with a combined share of 59.4% of the total aircraft deliveries during 2018-2037. An expected healthy CAGR of 4.4% in air passenger traffic during 2018-2037 will chiefly drive the demand for the aircraft. This factor will create a sustainable demand for composite parts incorporating composite surfacing films for aircraft exteriors in the foreseeable future.

Composite materials have a disruptive journey of more than seven decades. For instance; during the 1940s, the first-generation glass fiber-reinforced composites for the aerospace industry were developed and created ample opportunities for the researchers and scientists to develop stiffer and stronger composites in order to avoid undesirable flaws such as micro-cracks on the surface. In the early stages, structural film adhesives were used to cover the prepregs in the mold, which does not provide a sufficient blemish-free surface to composite parts. Thus, it requires an extra set of activities such as sanding and polishing to make it smooth and paint-ready. These activities increase the workload of labor as well as add significant cost and processing time. This has led to the development of the resin-rich, adhesive-based composite surfacing films to reduce the surface defects by approximately 95%, making the manufacturing easier. The newly developed composite surfacing films protect the composite surface from sanding and bead blasting required for paint stripping activities and eliminate surface imperfections. It is also tough to resist any cracks during thermocycling. In addition, composite surfacing film provides protection to exposed composite parts against UV radiation and lightning strike, when it is embedded with expanded copper or aluminum metallic foils.

Rising demand for the aerodynamic surface, high-quality surface finish with reduced imperfections and paint preparation activities have created an ample growth opportunity for composite surfacing film manufacturers in the aerospace industry. Increasing usage of non-conductive composites in the exterior parts of the next-generation aircraft has also increased concerns of airlines regarding the safety and security of inboard passengers and crew members against lightning strikes. Integration of metallic mesh with composite surfacing films not only solves the problems of lightning strikes but also creates an easy handling, storage, and application of thin metallic mesh or foil.

There is a host of factors driving the demand for composite surfacing films in diverse range of applications. Among all, the biggest driving factor is the increasing use of composites in the aerospace, defense, automotive, wind energy, and marine industries. Increasing penetration of composites in the key aircraft programs, such as the development of all-composite wings and fuselage structures of B787 and A350XWB aircraft programs, is the major factor driving the growth of composite surfacing films in the aerospace & defense industry. Increasing usage of CFRP in the automotive body panels along with a high demand for getting Class-A body painted surface finish has created ample opportunities for the composite surfacing film manufacturers to develop and innovate composite surfacing films for the automotive industry.

Another factor which is acting as a catalyst to the growth of composite surfacing films, is consistently-increasing automobile production. Currently, the global automobile production has been at its peak with all the four regions marking positive developments. China, India, Southeast Asia, and North Africa will fuel the growth of the automotive industry in the coming five years. It is very important for the composite surfacing film manufacturers to realign themselves based on the shifting opportunities from the developed economies to the developing economies such as China and India.

Segments' Analysis

Wish to get a free sample? Register Here

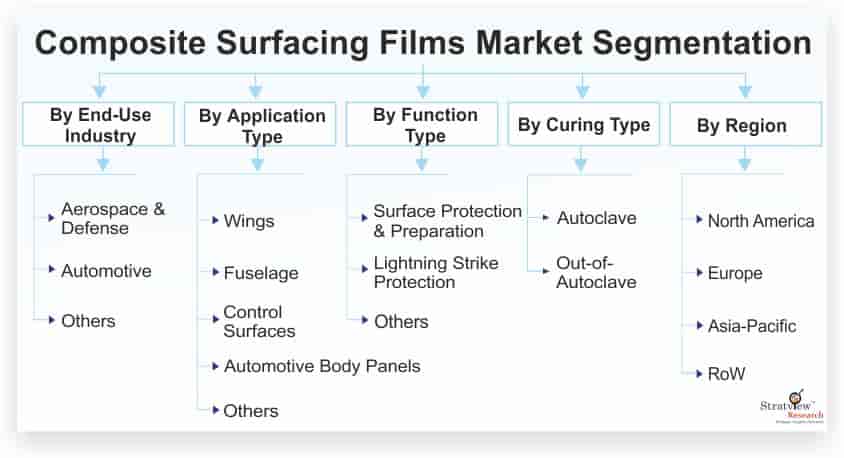

Composite Surfacing Films Market Share by End-use Type

The market is segmented based on the end-use industry type as Aerospace & Defense, Automotive, and Others. The aerospace & defense industry is expected to remain the growth engine of the market during the forecast period of 2019 to 2024. Increasing production rates of the key aircraft programs, such as B737, B787, A320, and A350XWB; introduction of variants of the best-selling aircraft programs (A320neo, B737 Max, B777x, and A330neo); market entry of new aircraft (C919 and MC-21); increasing demand for high-quality and lightweight components in the aerospace industry; and increasing penetration of composites in the aerospace industry are the major growth drivers of composite surfacing films in the aerospace & defense industry. Wind energy, automotive, and marine are the other major end-use industries of composite surfacing films.

Composite Surfacing Films Market Share by Application Type

Based on the application type, the market is segmented into Wings, Fuselage, Control Surfaces, Automotive Body Panels, and Others. The fuselage application segment is expected to maintain its dominance in the market during the forecast period, driven by increasing penetration of composites in the segment. The wings application is also likely to grow at an impressive rate in the coming five years.

Composite Surfacing Films Market Share by Curing Type

Based on the curing type, the market is segmented into Autoclave and Out-of-Autoclave. A higher usage of the autoclave process by major tier players across regions has made the segment dominant in the composite surfacing films market. However, out-of-autoclave curing type is expected to witness a higher growth during the forecast period.

Regional Insights

In terms of region, North America is expected to remain the largest market during the forecast period. The USA is the growth engine of the region’s market with the presence of all major aircraft OEMs, tier players, composite surfacing film suppliers, and raw material suppliers.

Asia-Pacific is likely to witness the highest growth during the same period, driven by a host of factors including increasing demand for commercial aircraft to support rising passenger traffic, the opening of assembly plants of Boeing and Airbus in China, upcoming indigenous commercial and regional aircraft (COMAC C919 and Mitsubishi MRJ), and rising aircraft fleet size.

Know which region offers best growth opportunities. Register Here

Market Scope & Segmentation

|

Research Scope

|

|

Trend & Forecast Period

|

2013-2024

|

|

Regions Covered

|

North America, Europe, Asia-Pacific, Rest of the World

|

|

Size in 2023

|

US$ 320.3 million

|

|

Countries/Subregions Covered

|

The USA, Canada, Mexico, Germany, France, The UK, Italy, Russia, China, Japan, India, Latin America, The Middle East and others

|

|

Figures & Tables

|

>150

|

|

Customization

|

Up to 10% customization available free of cost

|

The composite surfacing films market is segmented into the following categories.

Composite Surfacing Films Market Size, Share & Forecast, by End-Use Industry Type:

- Aerospace & Defense (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

- Automotive (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

- Others (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

Composite Surfacing Films Market Size, Share & Forecast, By Application Type

- Wings (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

- Fuselage (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

- Control Surfaces (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

- Automotive Body Panels (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

- Others (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

Composite Surfacing Films Market Size, Share & Forecast, By Function Type

- Surface Protection & Preparation (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

- Lightning Strike Protection (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

- Others (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

Composite Surfacing Films Market Size, Share & Forecast, By Curing Type

- Autoclave (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

- Out-of-Autoclave (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

Composite Surfacing Films Market Size, Share & Forecast, By Region

- North America (Country Analysis: The USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, The UK, Italy, Russia, and Rest of Europe)

- Asia-Pacific (Country Analysis: China, Japan, India, and Rest of Asia-Pacific)

- Rest of the World (Sub-Region Analysis: Latin America, The Middle East, and Others)

Want to know the most attractive market segments? Register Here

Key Players

The supply chain of this market comprises raw material suppliers, composite surfacing film manufacturers, composite part fabricators, distributors, aircraft and automotive OEMs, airlines, aircraft leasing companies, and MRO companies.

The key composite surfacing film manufacturers are-

- Solvay S.A.

- Koninklijke TenCate B.V.

- The 3M Company

- Gurit Holding AG

- Henkel AG & Co. KGaA

- Hexcel Corporation

- Park Electrochemical Corporation

- Axiom Materials, Inc.

The development of high-performance composite surfacing films, expansion in untapped and growing markets, and execution of mergers & acquisitions are the key strategies adopted by the major players to gain a competitive edge in the market.

Research Methodology

For calculating the market size, our analysts follow either Top-Bottom or Bottom-Top approach or both, depending upon the complexity or availability of the data points. Our reports offer high-quality insights and are the outcome of detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders and validation and triangulation with Stratview Research’s internal database and statistical tools. We leverage multitude of authenticated secondary sources, such as company annual reports, government sources, trade associations, journals, investor presentation, white papers, and articles to gather the data. More than 10 detailed primary interviews with the market players across the value chain in all four regions and industry experts are usually executed to obtain both qualitative and quantitative insights.

Report Features

This report, from Stratview Research, studies the composite surfacing films market over the trend period of 2013 to 2018 and the forecast period of 2019 to 2024. The report provides detailed insights into the market dynamics to enable informed business decision making and growth strategy formulation based on the opportunities present in the market. The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, product portfolio, product launches, etc.

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors.

Report Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respectable clients:

Competitive Assessment

- Competitive Benchmarking of key players (up to three players)

- SWOT analysis of key players (up to three players)

Regional Segmentation

- Current market size (2018) of composite surfacing films in the USA by End-Use Industry Type

Custom Research: Stratview research offers custom research services across the sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry at sales@stratviewresearch.com.