Market Insights

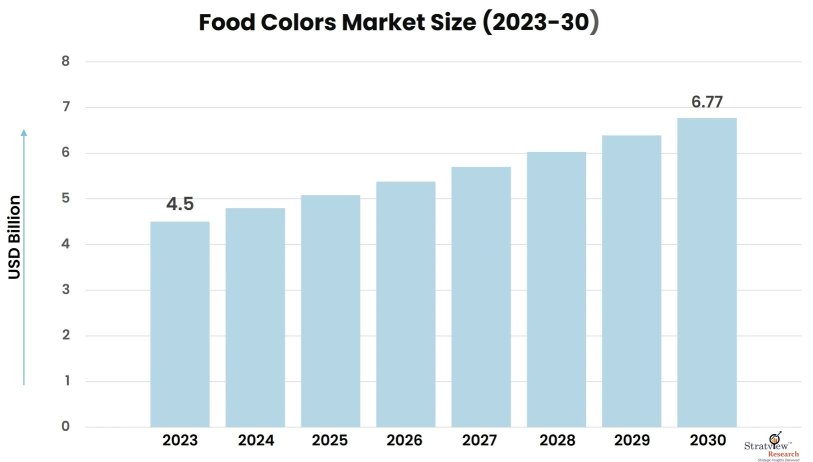

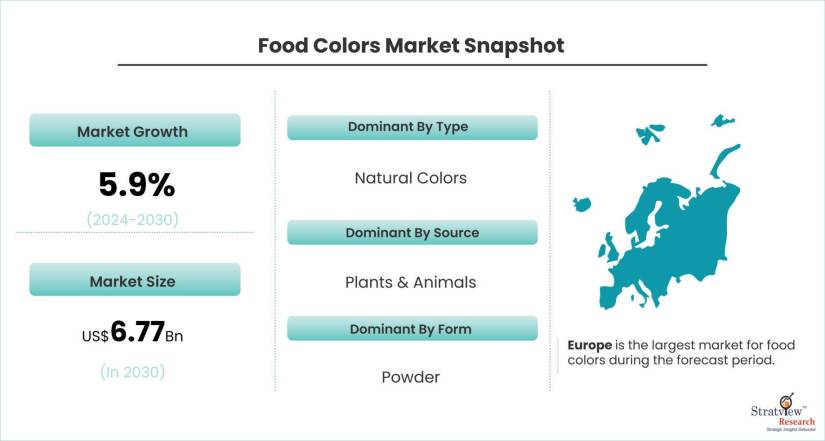

“The food colors market was estimated at USD 4.5 billion in 2023 and is likely to grow at a CAGR of 5.9% during 2024-2030 to reach USD 6.77 billion in 2030”.

Want to know more about the market scope? Register Here

Market Dynamics

Introduction

Food colors, referred to as a color additive include dyes, pigments, or substances, in liquid, powder, or gel used to change the color of food and beverages. It is utilized in food manufacturing and household cooking to improve the presentation of food items by enhancing attractiveness and restoring lost colors during processing or signaling specific flavors.

Sought by consumers looking for "clean" or "natural" ingredients, the food coloring market is adopting the coloring extracted from plants and insects as natural colors. This change is further underlined by the rule of the darker ingredients because of the tighter regulations on artificial colors that leave naturally sourced ones compliant with the laws. Conveniently, saturation hasn’t been altered yet but I hope it never is. Natural colors as we now know have an extra range of shades at their disposal and some of them also include additional healthy properties. At last, natural colors have eco-friendly properties with an increasingly improving interest in sustainability, and so they become the rule of the game in the market.

Recent Market JVs and Acquisitions:

A huge number of strategic alliances including M&As, JVs, etc. have been performed over the past few years:

- In July 2022, Oterra acquired India-based Akay Group, expanding Akay's access to natural colors and manufacturing and R&D capabilities, further solidifying its position in the growing natural food colors market.

- In January 2021, GNT and Anshul signed a distribution agreement following the publication of new standards for Coloring Foods by the Food Safety & Standards Authority of India. This highlights the increasing regulatory focus on food coloring safety in India, a key factor driving the natural colors segment.

- In April 2019, ADM introduced a clean-label paprika extract with exceptional heat stability across all pH levels. This extract maintained its vivid orange hue even when exposed to heat, offering a fresh color option for various food products. Such innovations in natural color functionality are crucial for wider adoption in food manufacturing.

- In April 2019, San-Ei Gen F.F.I., Inc. launched "Red radish food coloring," featuring a unique purification method to eliminate unwanted flavors and achieve a striking yellowish-red hue, particularly effective at low pH levels. This exemplifies the ongoing advancements in natural color extraction techniques, leading to a wider range of vibrant and stable colors.

- In March 2019, Naturex expanded its production capabilities with a new extraction line dedicated to spirulina production, reflecting the growing demand for clean-label blue and green food colors. This highlights the increasing popularity of specific natural colors within the market.

Want to have a closer look at this market report? Click Here

Recent Product Development:

- In June 2023, Avient and BASF collaborated on colored Ultrason® for high-performance polymers, blending BASF’s Ultrason® PAES with Avient’s Colorant Chromatics™ expertise.

- In February 2023, DSM introduced Lucidiris, an AI technology for adding color to materials, aiming to accelerate product development and expand application possibilities.

- In October 2022, IFF invested USD 30 million in a Singapore innovation center to strengthen its business and enhance customer accessibility in Asia.

- In June 2022, Sensient acquired Endemix Doal Maddeler AS, bolstering its position as a leading provider of natural color solutions.

- In September 2020, Chr. Hansen launched FruitMax®, a clean-label turmeric-derived product offering a vibrant yellow color with minimal off-taste.

Segments Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High Growth Opportunity

|

|

Type Analysis

|

Natural Colors (Carmine, Anthocyanins, Caramel, Annatto, Carotenoids, Chlorophyll, Spirulina, and Others), Synthetic Colors (Blue, Red, Yellow, Green, Amaranth, Carmoisine, and Other), and Natural-Identical)

|

Natural Colors is expected to hold the largest share of the market during the forecast period.

|

|

Source Type Analysis

|

Plants & Animals, Minerals & Chemicals, and Microorganisms

|

The Plants & Animals segment is said to be dominated by the source of the market during the forecast period.

|

|

Form Type Analysis

|

Liquid, Powder, and Gel

|

The liquid segment is said to be holding the largest share of the market during the forecast period.

|

|

Solubility Type Analysis

|

Dyes and Lakes

|

The Dyes segment is said to be holding the larger share in the market during the forecast period.

|

|

Application Type Analysis

|

Food Products (Processed Food Products, Bakery & Confectionery Products, Meat, Poultry, and Seafood, Oils & Fats, Dairy Products, and Others) and Beverages (Juice & Juice Concentrates, Functional Drinks, Carbonated Soft Drinks, and Alcoholic Beverages)

|

Food Products is said to be holding the largest share in the market during the forecast period.

|

|

Regional Analysis

|

North America, Europe, Asia-Pacific, and Rest of the World

|

Europe is the largest, Whereas North America is the fastest-growing market for food colors during the forecast period.

|

By Type

“Natural Colors is expected to hold the largest share of the market during the forecast period”.

- The food colors market is segmented into Natural Colors (Carmine, Anthocyanins, Caramel, Annatto, Carotenoids, Chlorophyll, Spirulina, and others), Synthetic Colors (Blue, Red, Yellow, Green, Amaranth, Carmoisine, and Others), Natural-Identical.

- Natural Colors is expected to hold the largest share of the market during the forecast period.

- Nature-based food colorings have grown to become a lucrative subsector of organic foods as the move towards healthy and clean food increases. Health-conscious and more cautious customers are indeed seeking artificial ingredient-free products, including additives and colors. This shift is driven by a two-pronged concern: health risks specifically out of their synthetic colors like allergies and hyperactivity as well as for the tendency of the natural ingredients to be simpler.

- The market is witnessing an increase in strict codes of conduct on additive foods by governments across the globe which forces manufacturers to turn to natural colorings. Besides, the growing popularity of sustainability in the international arena offers a reason why natural colors are gaining their ground because they are perceived as a more ecological alternative by people.

By Source Type

“Plants & Animals segment is said to be dominating by the source of the market during the forecast period”.

- The market is segmented into Plants & Animals, Minerals & Chemicals, and Microorganisms.

- Plants & Animals segment is said to be dominating by source in the market during the forecast period.

- The Plants & Animals sector is the center of attention. Such dominance is caused by multiple factors in the consumer and regulatory environment. Users who are concerned about vegan and healthy lifestyles are attracted to 'the natural label', which fruits, vegetables, and even insects fulfill this requirement. Additionally, the regulations that are tough around synthetic colors are prompting manufacturers to settle on the use of naturally sourced colors as they are compliant.

- This current trend in choosing natural colors doesn’t imply that it is purely about mere conformity. Innovation in extraction methods has brought some alive and vivacious colors making natural dyes as richly-hued as the industrial one. Few natural colors even bring extra health effects, like antioxidants, which are other reasons for your preference. Besides, the green tendency of the natural colors is highly focused on the modern generation who sort out their purchasing products with much care of sustainability hence pushing them to the top of the food coloring market.

By Form Type

“Liquid segment is said to be holding the largest share of the market during the forecast period”.

- The market is segmented into Liquid, Powder, and Gel.

- The liquid segment is said to be holding the largest share of the market during the forecast period.

- Liquid food dye is highly sought after in the industry, as it is easy to handle and offers guaranteed results. First, liquids mix together naturally, which contributes to uniform coloring in various foodstuffs such as beverages, dairy, and sweets where the same appearance is a must. Additionally, large-scale production systems necessitate the use of liquid colors to support product consistency and keep the color differences between batches very low.

- Liquid colors incorporate different advantages which make them a perfect option for the industrial space. Which is just a matter of changing the amount used is a major plus point. Besides, the extra resilience of liquids during common kitchen routines such as pasteurization and homogenization guarantees stable vibrancy and depth of color in the marketable product.

By Solubility Type

“Dyes segment is said to be holding the larger share in the market during the forecast period”.

- The market is segmented into Dyes and Lakes.

- The Dyes segment is said to be holding the largest share in the market during the forecast period.

- Dyes are of particular importance to the food markets to make colors that are intense and consistent. They are water-soluble and they, therefore, can produce a wide assortment of hues as well as intensity, which makes them very suitable for beverages and processed food where stable and colorful looks are important. The expansion of the processed food sector primarily creates a climate for demand for dyes as the manufacturers’ priority is to produce visually appealing products to spark consumers’ interest.

- The improvements in dye technology have been part of introducing new and safer dye alternatives which are also more stable. Nowadays, new dietary supplements comply with the very rigorous regulations on food safety, and the former complaints are taken care of. The aesthetic influence of social media and food photography is also credited as one of the reasons for the growing popularity of dyes. They add very vivid and beautiful colors to food presentations on social media and this contributes to the aesthetic appeal.

By Application Type

“Food Products is said to be holding the largest share in the market during the forecast period”.

- The market is segmented into Food Products (Processed Food Products, Bakery & Confectionery Products, Meat, Poultry, Seafood, Oils & Fats, Dairy Products, and Others), Beverages (Juice & Juice Concentrates, Functional Drinks, Carbonated Soft Drinks, Alcoholic Beverages).

- Food Products is said to be holding the largest share in the market during the forecast period.

- The huge range of food products practically allows them to become giants of the food coloring market. As opposed to beverages, food includes huge varieties of manufactured products, tempting sweets, and healthy dairy products. Another outcome of the diversity is that food coloring assumes more than a single function. In processed foods, it remakes the colors that may be lost in production, thus presenting a more pleasing visual appearance for consumers. Furthermore, coloring food causes psychologically influenced flavor perception by building up subconscious connections – for instance, strawberry coloring brings up the strawberry idea. Likewise, besides aesthetics, there are other colors that have particular functions such as pinpointing the respective ingredients in a product.

- Food coloring is very adaptable and this feature ensures that food products are so popular as the best consumers of this colorant as compared with any other kinds of the food industry. Their growing applications coupled with their ability to improve both visual allure and food clues, and also to render certain functionality strongly position the first place for them in the market.

Regional Insights

“Europe is the largest, Whereas North America is the fastest growing market for food colors during the forecast period”.

- In terms of regions, Europe is expected to be the largest, Whereas Asia-Pacific is the fastest-growing market for food colors during the forecast period.

- Europe witnessed strong growth in the colorant market which is likely a result of the combination of consumer and the industry driver. People in Europe, who are focused on keeping healthy, are pushing a trend of natural and organic goods. Therefore, in the EU, the selection of food coloring also goes in a natural and tasty direction. The case of EU rules on food additives thus echoes this choice towards natural ingredients. On another note, take into consideration the fact that vegetable-based colors are a well-known alternative in the field of sustainability and clean-label products.

- European companies' technology options for food processing and innovations in this area are increasingly taking a fundamental part. The manufacturer's effort is about high quality and innovative color solutions in releasing the product fulfilling the customers` demand for premium and artisanal foods. The emergence of decisions with a green appellation and ethical practices alongside food production opens up another market of the market, further impacting the practice of use of food coloring across Europe.

Know the high-growth countries in this report. Register Here

Key Players

The market is partially fragmented across the region. Most of the major players compete in some of the governing factors including price, service offerings, regional presence, etc. The following are the key players in the food colors market:

Here is the list of the Top Players (Alphabetical Order)

- CHR Hansen

- DD Williamson

- DSM

- BASF SE

- Cargill

- International Flavors & Fragrances, Inc.

- GNT Group

- Lycored Ltd.

- Naturex

- SAN-EI GEN F.F.I. INC

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Write to us at [email protected]

Report Features

This report provides market intelligence most comprehensively. The report structure has been kept so that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market.

What Deliverables Will You Get in this Report?

|

Key questions this report answers

|

Relevant contents in the report

|

|

How big is the sales opportunity?

|

In-depth Analysis of the Food Colors Market

|

|

How lucrative is the future?

|

Market forecast and trend data and emerging trends

|

|

Which regions offer the best sales opportunities?

|

Global, regional, and country-level historical data and forecasts

|

|

Which are the most attractive market segments?

|

Market Segment Analysis and Forecast

|

|

Which are the top players and their market positioning?

|

Competitive landscape analysis, Market share analysis

|

|

How complex is the business environment?

|

Porter’s five forces analysis, PEST analysis, Life cycle analysis

|

|

What are the factors affecting the market?

|

Drivers & challenges

|

|

Will I get the information on my specific requirements?

|

10% free customization

|

Research Methodology

- This strategic assessment report from Stratview Research provides a comprehensive analysis that reflects today’s food colors market realities and future market possibilities for the forecast period.

- The report segments and analyzes the market in the most detailed manner in order to provide a panoramic view of the market.

- The vital data/information provided in the report can play a crucial role for market participants as well as investors in the identification of the low-hanging fruits available in the market as well as to formulate growth strategies to expedite their growth process.

- This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools.

- More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data.

- We conducted more than 15 detailed primary interviews with market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

- Detailed profiling of additional market players (up to three players)

- SWOT analysis of key players (up to three players)

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Service portfolio, geographical reach, regional presence, and strategic alliances

Custom Research: Stratview Research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected]