Aerospace 3D Printing Market Insights

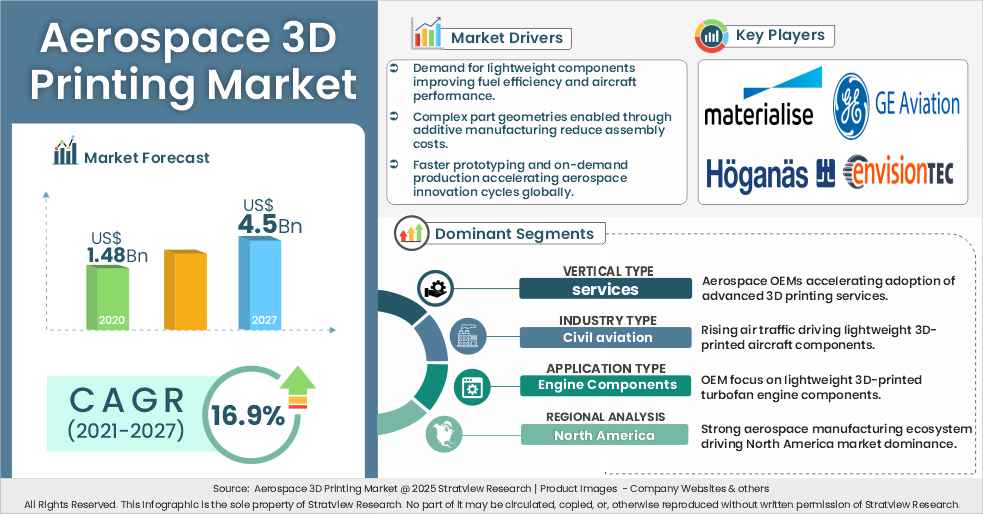

“The global aerospace 3D printing market is estimated at US$ 1.48 billion in 2020 and is expected to grow at a strong CAGR of 16.9% over the next five years to reach US$ 4.5 billion by 2027.”

Want to get a free sample? Register Here

Market Dynamics

Aerospace 3D Printing Market Drivers

The aerospace industry accounted for a share of 16.8% of the 3D-printing market in 2019 and is likely to grow at a fast rate in years to come, generating huge growth opportunities for market participants. Both aircraft, as well as engine manufacturers, have eagerly been relying on the technology to develop lightweight parts.

Some of the factors driving long-term growth in the market are listed below:

-

Resumption of B737 Max,

-

An expected recovery in production rates of the best-selling aircraft programs such as the A320 and B787

-

Introduction of fuel-efficient variants of aircraft programs such as B777x and E-2 jets.

-

Growing global satellite industry

-

An expected recovery in the production of LEAP engines.

-

Exceptional benefits of 3D printing technologies across the supply chain of the aerospace industry

-

Advancements in 3D printing technologies

In the industry, a handful of players are proactively ramping up their capabilities to leverage 3D printing in mainstream applications among which GE leads the pack. Most of the tier players are waiting on the sidelines as they are still hammering hard for the development of technological know-how and capabilities. They are looking for some real-world case studies and mainstream applications before committing to capitalize on 3D printing manufacturing setups.

COVID-19 Impact

The global aerospace 3D printing market grew continuously in the trend period and was estimated to maintain its upward growth trajectory in 2020 as well. However, the rapid spread of COVID-19 ruined the market expectations. The pandemic exacerbated the existing challenges of the aerospace industry and weakened the industry sales to their lowest figure of the decade.

Disruptions in the supply chain and operating activities due to the lockdown in several countries have worsened the market conditions. As per the recent estimates of IATA, the airline industry is estimated to record a massive decline of -65.9% in RPKs in 2020 from 2019 amid the pandemic. As a result, the aerospace 3D printing market has shown a sharp decline in 2020, crushing the market sales near its 2018-market level.

Based on industry estimates by IATA and ICAO, the study of market recoveries in previous downturns (The Great Recession, SARS, etc.), and primary interviews with the key market stakeholders, Stratview estimates suggest that the market for aerospace 3D printing is likely to commence recovery from 2021 onwards, followed by maintaining sequential growth till 2027.

Strong fundamentals of the market, such as huge order backlogs of Boeing and Airbus (11,179 aircraft at the end of January 2021), an expected increase in the demand for narrow-body aircraft with the early resumption of domestic air travel, and market entry of new aircraft programs such as A321XLR, C919, and MC-21; and variants of existing aircraft programs such as B777X, are the factors that are asserting healthy long-term growth opportunities in the aerospace 3D printing market once the aftermath of the pandemic ends.

Segments' Analysis

|

Segmentations

|

List of Sub-Segments

|

Dominant and Fastest-Growing Segments

|

|

Vertical Type

|

Hardware, Software, Material, and Services

|

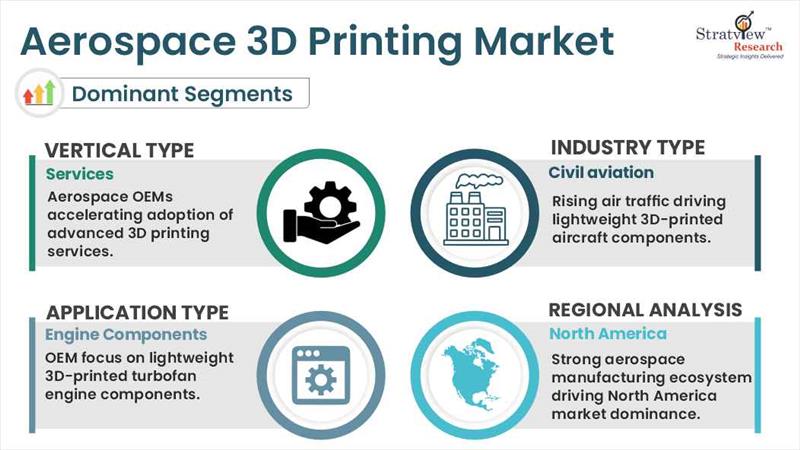

The services segment dominates the market during the forecast period.

|

|

Industry Type

|

Civil Aviation, Military Aircraft, and Spacecraft

|

Civil aviation accounts for the maximum share of the market during the forecast period.

|

|

Application Type

|

Engine Components, Structural Components, and Space Components

|

The engine components segment accounts for the largest share of the market during the forecast period.

|

|

Region Analysis

|

North America, Europe, Asia-Pacific, and the Rest of the World

|

North America dominates the market whereas Asia-Pacific is expected to recover at the fastest pace during the forecast period.

|

Vertical Insights

“The services segment dominates the market during the forecast period.”

The aerospace 3D printing market is segmented based on the vertical types as hardware, software, material, and services. The services segment is expected to witness the highest growth in the post-pandemic market developments, owing to the use of a wide range of materials to print engines and structural components.

Furthermore, the development of new materials for 3D print components to withstand high temperatures and extreme environments is likely to boost the demand for 3D printing materials in the years to come. Major aircraft manufacturers, such as Boeing and Airbus, are expediting the adoption of this technology to achieve a faster production process, reduce wastage, and shorten the supply chain.

Industry Insights

“Civil aviation accounts for the maximum share of the market during the forecast period.”

The market is segmented into Civil Aviation, Military Aircraft, and Spacecraft. Civil Aviation is expected to account for the largest market share during the forecast period. It was the most impacted segment due to COVID-19, experiencing a massive decline in RPKs. However, with the anticipated recovery of the civil aviation industry and rising demand for lightweight, complex aircraft parts with high quality and shorter lead times, this segment is projected to drive market growth

GE Aviation is a major company that has already started producing engine components in mass volume using 3D printing technology. Rolls-Royce is another engine manufacturer that started making 3D-printed parts for its engines including Trent. Other major engine OEMs are also on the same path and have been working hard for the development of 3D-printed parts.

Furthermore, an expected rise in air passenger traffic is likely to create a higher demand for new aircraft. After the pandemic, airlines will be back on track and again demanding lightweight aircraft to enhance their profitability. Major airframers are increasingly working on the development of advanced technologies including 3D printing to develop lightweight parts at a faster rate.

Want to get a free sample? Register Here

Application Insights

“The engine components segment accounts for the largest share of the market.”

The aerospace 3D printing market is segmented into engine components, structural components, and space components. The engine components segment accounts for the largest share of the market during the forecast period. The engine components segment experienced a huge decline in the market in 2020 in the wake of the pandemic. However, all three applications are expected to expand with significant CAGRs over the next five years, owing to an expected recovery in aircraft deliveries coupled with growing penetration of lightweight materials and the development of parts with high precision at reduced time.

The engine components segment is projected to witness the highest growth during the same period, driven by a high focus on major engine manufacturers including GE, Pratt & Whitney, and Rolls-Royce to develop engine parts for turbofan engines using 3D printing technology. GE Additive and Pratt & Whitney prove to be the game changers in the aerospace 3D-printing engine segment in which GE Additive holds the preeminent position.

Regional Insights

“North America dominates the market during the forecast period.”

Despite there has been a massive decline in the market across the world, North America is expected to remain the largest market for aerospace 3D printing till 2027. The region is the world’s manufacturing capital of the aerospace industry with the presence of many large and small-sized OEMs, tier players, and raw material suppliers.

Major 3D printer manufacturers are also located in the region to cater to the growing regional demand for 3D printers as well as materials. Asia-Pacific is expected to recover at the fastest pace, with impressive growth in the aerospace 3D printing market during the forecast period, primarily driven by an expected early recovery of emerging economies like China and an increasing presence of OEMs and tier players to tap the growing local demand from the key economies, such as China, Japan, and India.

Want to get a free sample? Register Here

Key Players

The market is highly populated with the presence of several local, regional, and global players. The supply chain of this market comprises raw material suppliers, 3D printer manufacturers, tier players, engine and aircraft OEMs, and airlines.

The following are the key players in the aerospace 3D printing market (arranged alphabetically).

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Write to us at [email protected]

New product development, regional expansion, and long-term relations with customers are some of the key strategies adopted by the major players to gain a competitive edge in the market.

Research Methodology

This strategic assessment report, from Stratview Research, provides a comprehensive analysis that reflects today’s aerospace 3D printing market realities and future possibilities for the forecast period 2021 to 2027. The report segments and analyzes the market most comprehensively to provide a panoramic view of the market. The strategic report also studies and analyzes the impact of COVID-19 on the market and provides a detailed overview of the possible market recoveries in the long run. The vital data/information provided in the report can play a crucial role for market participants as well as investors in the identification of low-hanging fruits available as well as formulating growth strategies.

This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools. More than 1000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data. We have conducted more than 15 detailed primary interviews with the market players across the value chain in all five regions and industry experts to obtain both qualitative and quantitative insights.

Report Features

This report provides market intelligence most comprehensively. The report structure has been kept such that it offers maximum business value. It provides critical insights into the market dynamics and will enable strategic decision-making for the existing market players as well as those willing to enter the market.

What Deliverables Will You Get in this Report?

|

Key questions this report answers

|

Relevant contents in the report

|

|

How big is the sales opportunity?

|

In-depth Analysis of the Aerospace 3D Printing Market

|

|

How lucrative is the future?

|

The market forecast and trend data and emerging trends

|

|

Which regions offer the best sales opportunities?

|

Global, regional, and country-level historical data and forecasts

|

|

Which are the most attractive market segments?

|

Market Segment Analysis and Forecast

|

|

Who are the top players and their market positioning?

|

Competitive landscape analysis, Market share analysis

|

|

How complex is the business environment?

|

Porter’s five forces analysis, PEST analysis, Life cycle analysis

|

|

What are the factors affecting the market?

|

Drivers & challenges

|

|

Will I get the information on my specific requirements?

|

10% free customization

|

Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

- Detailed profiling of additional market players (up to 3 players).

- SWOT analysis of key players (up to 3 players).

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Product portfolio, geographical reach, regional presence, and strategic alliances.

Custom Research: Stratview Research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected]