Market Insights

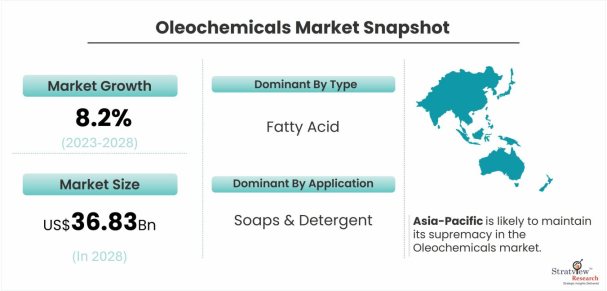

The oleochemicals market was estimated at USD 22.89 billion in 2022 and is likely to grow at a CAGR of 8.2% during 2023-2028 to reach USD 36.83 billion in 2028.

Want to know more about the market scope? Register Here

Market Dynamics

Introduction

Natural raw materials like plant or animal fat are used as the main source of oleochemical production. Fatty acids and their derivatives are routinely purified, decolored, and deodorized using activated carbon. Oleochemicals are environmentally benign because they are biodegradable and have low toxicity. These products are regarded as natural, green, organic, secure, renewable, and biodegradable by both scientists and the general public. Scientists and consumers alike consider these items to be natural, green, organic, secure, regenerative, and biodegradable.

Market Drivers

The primary factors influencing the market for oleochemicals are the rise in demand for green chemicals, the high demand from end-use industries, and the accessibility of raw materials. Oleochemicals can now enter the market and take the place of the currently utilized petroleum-based goods as a result of tightening environmental restrictions and the depletion of non-renewable resources.

Oleochemicals are utilized to make food contact surface sanitizers and FDA-approved food packaging. Triple-pressed stearic acid is used as a mold-release agent in the food and beverage sector. The oleochemicals market is anticipated to experience growth due to rising oleochemical usage in the food sector and the expansion of the food industry in developing nations.

Additionally, oleochemicals are utilized in the manufacture of cleaning solutions for both domestic and commercial use, including degreasers, emulsifiers, surfactants, and cleaning agents. The Asia-Pacific oleochemicals industry is predicted to benefit greatly from the rise in disposable income and population in China and India.

Increasing adoption and demand of oleochemicals in major end-user industries is one of the major factors that contributes towards the growth of the global oleochemicals market during the forecast period. Oleochemicals are widely used in end-user industries such as food & beverages, polymers, pharmaceuticals, cosmetics and personal care, soaps & detergents, etc.

According to the American Cleaning Institute (ACI), oleochemicals are widely used in soap and detergent industries for the manufacture and production of detergent surfactants. Fats and oils present in the oleochemicals contain chains of hydrocarbon that are attracted to oil and grease and repelled by water. These sources of hydrocarbon chain are then used to make water-repellant surfactant molecules of detergents and soaps, as per the American Cleaning Institute.

Further, according to the Palm Oil Information Online Service (PALMOILIS), palm oleochemicals are widely used in the cosmetics and toiletries industry. A series of dihydroxy stearates ((DHSA-esters, oleochemical) are non-irritants to the skin and are used as a major ingredient in cosmetics and toiletries, as per the Palm Oil Information Online Service. Such wide range of applications of oleochemicals in major end-user industries would fuel its adoption as well as demand. This is expected to promote the growth of the global oleochemicals market during the forecast period.

The manufacturing process for the oleochemicals had been disrupted by delays and disturbances in the logistical services, increased limitations, a lack of manpower, and a technical personnel deficit. There was a major threat to the environment because of the depletion of fossil resources and rising global pollution. These issues can be solved by using biofuels like biodiesel more frequently. Oil and fat are used as the natural feedstock in the production of biodiesel. It is anticipated that the use of these fuels would open up opportunities for market expansion.

Want to have a closer look at this market report? Click Here

Key Players

The following are the major players in the oleochemicals market:

- BASF SE

- Eastman Chemical Company

- P&G Chemicals

- Wilmar International Ltd

- Evonik Industries

- Cargill Incorporated

- Arizona Chemical Company LLC

- Others

There is stiff competition in the Oleochemicals market. The growth of the companies is directly dependent on the industry conditions and government support. These companies differentiate their Oleochemicals based on their quality and penetration in the target and emerging markets. Also, some major mergers and acquisitions in the industry recently have significantly influenced the competitive dynamics. For example-

- Emery Oleochemicals and Omya Inc. increased their distribution cooperation in November 2019. The business is utilizing Omya's skills to offer technical assistance for Green Polymer Additives (GPA) products, such as release agents, antifogging, lubricants, and speciality plasticizers, to Emery's U.S. customers.

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Write to us at sales@stratviewresearch.com

Segment Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High Growth Opportunity

|

|

Type Analysis

|

Fatty Acid, Fatty Alcohol, Glycerin, and Other types

|

The fatty acids market holds the largest share in 2022.

|

|

Application Type Analysis

|

Food & beverages, pharmaceuticals & personal care, polymers, soap & detergents, and other applications

|

Soaps & detergents hold the largest market share in the application segment in 2022.

|

|

Regional Analysis

|

North America, Europe, Asia-Pacific, and Rest of the World

|

Asia Pacific is likely to maintain its supremacy in the oleochemicals market throughout the forecast period.

|

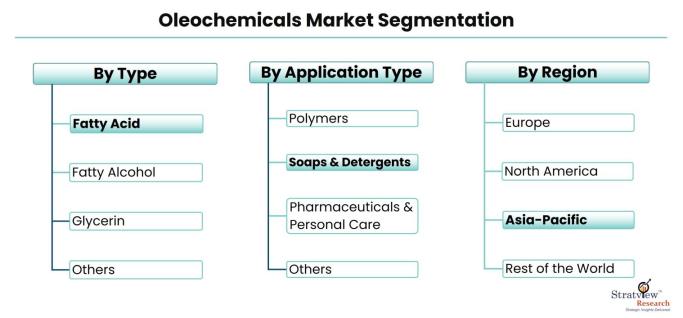

By Type

Fatty acid, fatty alcohol, glycerin, and other types are the types of oleochemicals. The fatty acids market holds the largest share in 2022. Rising fatty acid application in soaps & detergents and the personal care industry is expected to increase fatty acid demand. Further, fatty alcohol has witnessed significant capacity additions over the past decade particularly in Western Europe and Southeast Asia owing to its increasing demand in soaps & detergents, lubricants, personal care, and other downstream chemical industries.

By Application Type

Food & beverages, pharmaceuticals & personal care, polymers, soap & detergents, and other applications comprise the application category. Soaps & detergents hold the largest market share in the application segment in 2022. The high share is mainly attributed to the widespread adoption of oleochemicals in the soaps and detergent sector. The growth of the oleochemical industry is driven by factors such as increasing demand for natural and sustainable ingredients, advancements in technology, and the growing pharmaceutical industry.

Regional Insights

Asia Pacific is likely to maintain its supremacy in the oleochemicals market throughout the forecast period. Japan, India, and China are the prominent countries with a huge demand for oleochemicals. Further, rising applications of oleochemicals in the soaps and detergents industry are promoting investments in the oleochemicals market.

Moreover, the demand for oleochemicals is rising in the pharmaceuticals & personal care companies as consumers are becoming conscious of the environmental benefits coupled with the cost-effectiveness offered by oleochemicals. India is one of the major producers of High Erucic acid content rapeseed oil which can be utilized to make higher chain fatty acids, alcohols, amines, and their derivatives which drives the oleochemicals market in this region.

The two countries that produce the most oleochemical-based products are Indonesia and Malaysia. Over half of the world's production of oleochemicals is produced in the Asia Pacific, which is also the largest consumer and producer combined. The quick growth of the end-use industries and the simple accessibility of feedstock are credited for this high percentage.

Over the projected period, demand for the product is anticipated to increase due to manufacturers' preference for natural chemicals in the production of oleochemicals. From 2022 through 2028, North America is expected to have rapid growth. The growth of the regional market is predicted to be supported by the expansion of a number of end-user sectors in the U.S., including pharmaceuticals personal care, and cosmetics.

Know the high-growth countries in this report. Register Here

Research Methodology

- This strategic assessment report from Stratview Research provides a comprehensive analysis that reflects oleochemicals market realities and future market possibilities for the forecast period.

- The report segments and analyzes the market in the most detailed manner in order to provide a panoramic view of the market.

- The vital data/information provided in the report can play a crucial role for market participants as well as investors in the identification of the low-hanging fruits available in the market as well as to formulate growth strategies to expedite their growth process.

- This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools.

- More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data.

- We conducted more than 15 detailed primary interviews with market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Report Features

This report provides market intelligence in the most comprehensive way. The report structure has been kept such that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market. The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

- COVID-19 impact and its recovery curve

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors.

Market Segmentation

This report studies the market covering a period of 12 years of trend and forecast. The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The oleochemicals market is segmented into the following categories.

By Type

- Fatty Acid

- Fatty Alcohol

- Glycerin

- Other types

By Application Type

- Food & beverages

- Pharmaceuticals & personal care

- Polymers

- Soap & detergents

- Other applications

By Region

- North America (Country Analysis: The USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, The UK, Russia, and The Rest of Europe)

- Asia-Pacific (Country Analysis: Japan, China, India, and the Rest of Asia-Pacific)

- Rest of the World (Country Analysis: Brazil, Argentina, and Others)

Click Here, to learn the market segmentation details.

Report Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

- Detailed profiling of additional market players (up to three players)

- SWOT analysis of key players (up to three players)

Competitive Benchmarking

- Benchmarking of key players on the following parameters: product portfolio, geographical reach, regional presence, and strategic alliances.

Custom Research: Stratview Research offers custom research services across the sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to sales@Stratviewresearch.com.