Market Insights

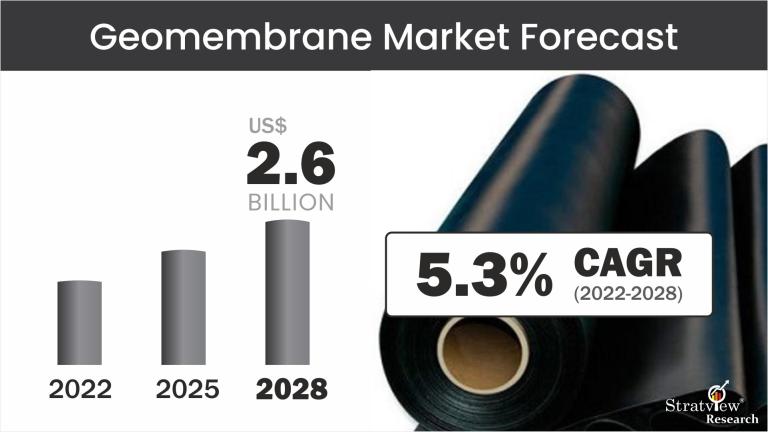

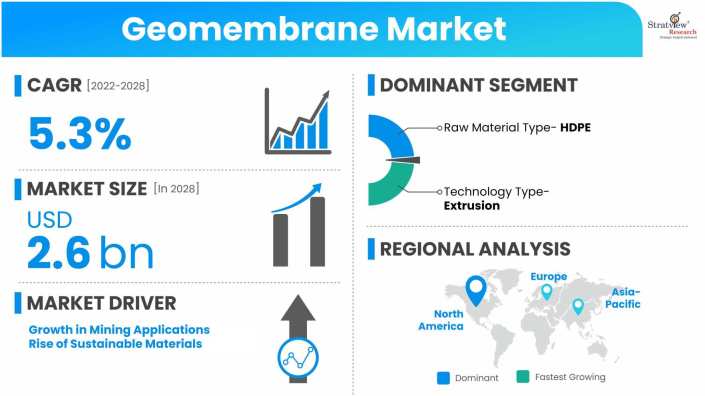

The geomembrane market was estimated at USD 1.9 billion in 2021 and is likely to grow at a CAGR of 5.3% during 2022-2028 to reach USD 2.6 billion in 2028.

Want to know more about the market scope? Register Here

Market Dynamics

Introduction

Geomembranes are synthetic materials used in the construction industry to control the flow of fluids and gases in a variety of applications, such as the lining of ponds, landfills, reservoirs, canals, and tunnels. The geomembrane market has grown significantly over the years due to its high performance, durability, and cost-effectiveness.

Market Trends

- Increasing Environmental Regulations: Various sectors are using geomembranes for pollution control and containment as a result of stricter environmental regulations implemented worldwide.

- Growth in Mining Applications: Expanding the use of geomembranes in heap leach pads and tailings dam liners in mining operations due to the requirement for sustainable mining methods.

- Rise of Sustainable Materials: There is growing demand from consumers for recyclable and environmentally friendly geomembranes, such as those made from biodegradable or recycled plastic.

- Technological Advancements: Development of high-performance geomembranes for challenging applications that have enhanced UV stability, chemical resistance, and durability.

- Increasing Water Management Projects: Rising investments in infrastructure for water management and conservation, increasing the usage of geomembranes in reservoirs, canals, and water treatment facilities.

- Expansion in Agricultural Applications: The growing use of geomembranes in agriculture reduces soil erosion, retains water, and protects crops.

- Emerging Markets Growth: The demand for geomembranes is rising across a range of industries due to the rapid industrialization and infrastructural development occurring in emerging economies.

These trends demonstrate how geomembranes are becoming more and more significant in resource management, environmental protection, and sustainable development in a variety of industries.

Want to have a closer look at this market report? Click Here

Here are some recent examples of investments in the geomembrane industry:

- 2021, Expansion: GSE Environmental announced the expansion of its manufacturing plant in Suzhou, China. The expansion includes the addition of new production lines for geomembranes and geosynthetic clay liners (GCLs) to meet the growing demand in the Asia-Pacific region.

- 2020, Expansion: AGRU America announced the expansion of its production facility in Charleston, South Carolina. The expansion includes the addition of a new extrusion line for the production of large-diameter HDPE pipes and geomembranes.

- 2020, Acquisition: Solmax International announced the acquisition of TenCate Geosynthetics, a leading manufacturer of geosynthetics and industrial fabrics. The acquisition has enabled Solmax to expand its product portfolio and strengthen its position in the global geomembrane market.

- 2020, Acquisition: Raven Industries announced the acquisition of Colorado Lining International, a leading manufacturer and installer of geomembranes and other geosynthetics. The acquisition has enabled Raven Industries to expand its product offerings and strengthen its position in the North American geomembrane market.

These examples highlight the significant investments being made by companies in the geomembrane industry to expand their production capacity, acquire new capabilities, and strengthen their market position.

Segment Analysis

|

Segmentations

|

List of Sub-Segments

|

Dominant and Fastest-Growing Segments

|

|

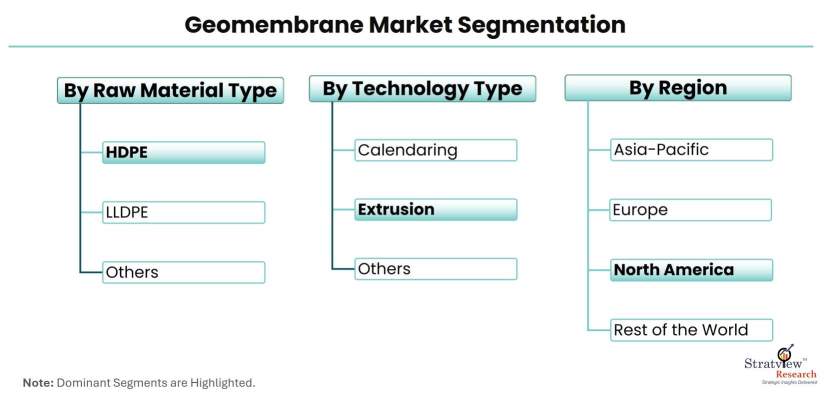

Raw Material Type Analysis

|

High-Density Polyethylene (HDPE), Linear Low-Density Polyethylene (LLDPE), Polyvinyl Chloride (PVC), Ethylene Propylene Diene Monomer (EPDM) and Polypropylene

|

HDPE is the most commonly used raw material in the geomembrane market, accounting for the largest share of the market.

|

|

Technology Type Analysis

|

Extrusion, Calendaring and Others

|

The extrusion segment is likely to account for the largest market share.

|

|

Regional Analysis

|

North America [The USA, Canada, and Mexico], Europe [Germany, France, The UK, Russia, and Rest of Europe], Asia-Pacific [China, Japan, India, South Korea, and Rest of Asia-Pacific], and Rest of the World [Brazil, Saudi Arabia, Israel, and Others]

|

North America accounted for the largest market share.

|

By Raw Material Type

"The HDPE segment accounted for the largest market share."

The market is bifurcated into HDPE, LLDPE, PVC, EPDM and Polypropylene. HDPE is the most commonly used raw material in the geomembrane market, accounting for the largest share of the market. HDPE geomembranes offer excellent chemical and UV resistance, high tensile strength, and durability, making them ideal for a wide range of applications such as waste containment, mining, and water management.

EPDM geomembranes are used in applications where high flexibility and low permeability are required. EPDM geomembranes are commonly used in pond liners, decorative water features, and irrigation canals.

By Technology Type

"The extrusion segment is likely to account for the largest market share."

The geomembrane market can also be segmented based on the technology used in their manufacturing process. The main technologies used for producing geomembrane include extrusion, calendaring, and others. Extrusion is the most common technology used in the production of geomembranes. In this process, the raw material is melted and extruded through a die to form a continuous sheet.

HDPE and LLDPE geomembranes are mostly produced using the extrusion process. Extrusion offers excellent control over the thickness and width of the geomembrane and can produce geomembranes with thicknesses ranging from 0.5 mm to 3 mm. In calendaring technology, the raw material is passed between two or more rollers to create a continuous sheet of the required thickness.

The calendaring process is used mainly for producing PVC and PP geomembranes, which have a lower melting point than HDPE and LLDPE. Other technologies used in the production of geomembranes include spread coating, lamination, and hot-air welding. Spread coating technology involves applying a liquid or semi-liquid material onto a substrate using a spreader or roller.

Regional Insights

"North America accounted for the largest market share."

In terms of regions, North America is a significant market for geomembranes, driven by stringent regulations for waste management and the construction of new landfill sites. The United States is the largest market for geomembranes in this region, accounting for the majority of the demand. Canada is also a significant market for geomembranes, with a growing demand for these products in mining and water management applications.

The European geomembrane market is driven by the increasing demand for sustainable waste management practices and the rising focus on environmental protection. Germany, France, and the UK are the largest markets in Europe, with a significant demand for geomembranes in the construction and mining sectors.

Know the high-growth countries in this report. Register Here

Key Players

Some of the key players in the geomembrane market include

- Agru America Inc.

- Anhui Huifeng

- New Synthetic Material Co.

- Atarfil SL

- Carlisle Syntec Inc.

- Colorado Lining International Inc.

- Environmental Protection Inc.

- Firestone Building Products Company, LLC

- Geofabrics

- GSE Environmental LLC

- Naue GmbH

- Nilex Inc.

- Officine Maccaferri Spa

- Plastika Kritis S.A.

- Rowad

- Solmax International Inc.

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Write to us at sales@stratviewresearch.com

Research Methodology

This strategic assessment report, from Stratview Research, provides a comprehensive analysis that reflects today’s geomembrane market realities and future market possibilities for the forecast period of 2022 to 2028. After a continuous interest in our geomembrane market report from the industry stakeholders, we have tried to further accentuate our research scope to the geomembrane market to provide the most crystal-clear picture of the market. The report segments and analyses the market in the most detailed manner to provide a panoramic view of the market. The vital data/information provided in the report can play a crucial role for the market participants as well as investors in the identification of the low-hanging fruits available in the market as well as to formulate the growth strategies to expedite their growth process.

This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools. More than 1000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data. We conducted more than 15 detailed primary interviews with the market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Report Features

This report provides market intelligence in the most comprehensive way. The report structure has been kept such that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market. The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

- COVID-19 impact and its recovery curve

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors

Market Segmentation

This report studies the market, covering a period of 12 years of trends and forecasts. The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The geomembrane market is segmented into the following categories:

By Raw Material Type

- High-Density Polyethylene (HDPE)

- Linear Low-Density Polyethylene (LLDPE)

- Polyvinyl Chloride (PVC)

- Ethylene Propylene Diene Monomer (EPDM)

- Polypropylene

By Technology Type

- Extrusion

- Calendaring

- Others

By Application Type

- Mining

- Water Management

- Agriculture

- Tunnel Liners & Civil Engineering

- Marine and Waste Management High-Density

By Region

- North America (Country Analysis: the USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, the UK, Russia, Spain, and Rest of Europe)

- Asia-Pacific (Country Analysis: China, Japan, India, South Korea, and Rest of Asia-Pacific)

- Rest of the World (Sub-Region Analysis: Latin America, the Middle East, and Others)

Click Here, to learn the market segmentation details.

Report Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

- Detailed profiling of additional market players (up to three players)

- SWOT analysis of key players (up to three players)

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Product portfolio, geographical reach, regional presence, and strategic alliances

Custom Research: Stratview Research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to sales@stratviewresearch.com