Market Insights

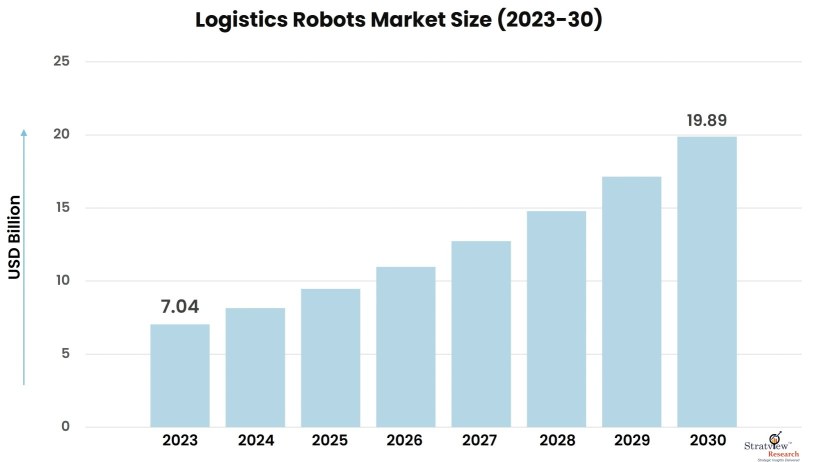

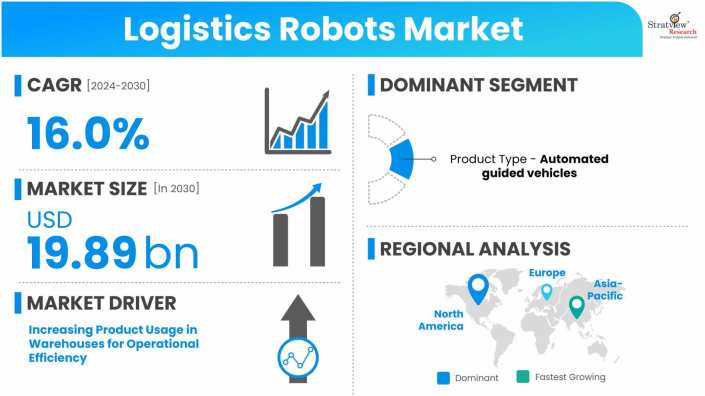

The logistics robots market was estimated at USD 7.04 billion in 2023 and is likely to grow at a CAGR of 16.0% during 2024-2030 to reach USD 19.89 billion in 2030.

Want to know more about the market scope? Register Here

Market Dynamics

Introduction

Logistics robots are autonomous machines designed to automate various tasks in logistics operations, including material handling, order picking, transportation, and inventory management. These robots can work alongside human workers or operate independently in a warehouse or distribution center.

Logistics robots leverage advanced technologies such as artificial intelligence, machine learning, and computer vision to navigate through complex environments, identify objects, and make decisions. They can also communicate with other robots and computer systems, enabling seamless integration into existing logistics systems.

Logistics robots are becoming increasingly popular as they can help streamline operations, reduce labor costs, and improve efficiency and accuracy. By automating repetitive and mundane tasks, logistics robots can free up human workers to focus on more complex and higher value-added tasks. Additionally, they can help mitigate the labor shortages faced by the logistics industry and address the challenges associated with the increasing demand for faster and more reliable deliveries. As a result, logistics robots are expected to play a crucial role in the future of logistics and supply chain management.

Driver: Increasing Product Usage in Warehouses for Operational Efficiency

In recent years, there have been significant advancements in the warehouse and logistics industries aimed at reducing truck operation times. Robotics is playing an increasing role in in-house logistics operations. Various industries, including pharmaceuticals and automotive, are embracing robotics to improve their manufacturing processes and increase efficiency and quality.

Articulated robots, which can perform complex operations accurately and in less time, are becoming a vital aspect of Industry 4.0. The use of warehouse shuttles and mobile robots also helps simplify warehouse management operations. Consequently, there is a growing trend towards end-to-end automation in warehouses to enhance operational efficiency in logistics and to streamline supply chain processes, resulting in an increased demand for these robots.

The market is experiencing a growing trend towards reducing operation time and improving customer satisfaction, leading to new opportunities. The COVID-19 pandemic resulted in the adoption of work from home culture, which presented cost-saving opportunities for individuals and boosted the e-commerce sector. To address the challenges of inventory and delivery operations, the logistics industry requires innovative and efficient solutions.

Robotic technology giants such as ABB and Siemens are developing six-axis and operation-specific robots that can handle complex logistics and manufacturing operations, leading to a surge in demand for logistics robots. Moreover, startups and tech enthusiasts are taking advantage of the latest developments in 3D printing technology to develop their own robots, which is minimizing the manufacturing cost for small-scale industries.

Logistic robots are being combined with Artificial Intelligence and Machine Learning to manage inventory and its transfer. Stakeholders prefer robots that are easy-to-use, have a simple interface, and are low maintenance for warehouse logistics operations.

Want to have a closer look at this market report? Click Here

Key Players

The major players operating in the logistics robots market are:

- Toshiba Corporation

- ABB

- Toyota Industries Corporation

- Kawasaki Heavy Industries Ltd.

- KUKA AG

- FANUC CORPORATION

- Vecna Robotics

- Yaskawa America Inc.

- Dematic

- Omron Corporation

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Write to us at [email protected]

Segment Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High Growth Opportunity

|

|

Product Type Analysis

|

Automated Guided Vehicles, Autonomous Mobile Robots, Robot Arms

|

Automated guided vehicles account for a significant market share driven by rising AGV adoption.

|

|

Regional Analysis

|

North America, Europe, Asia-Pacific, and Rest of the World

|

In 2022, North America held the highest market share in the logistics robots market.

|

By Product Type

Automated guided vehicles account for a significant market share driven by rising AGV adoption. The market is categorized into several types, including automated guided vehicles, autonomous mobile robots, robot arms, and others (UAVs). The automated guided vehicles (AGV) segment is expected to dominate the market due to their increased adoption across various industries for automation solutions and material handling equipment. In the manufacturing industry, AGVs are becoming more prevalent due to their reliable operation and ability to reduce labor costs.

Autonomous mobile robots (AMR) are becoming increasingly popular in various industries due to their user-friendliness, cost-effectiveness, and reliability. As autonomous technology continues to advance, the use of AMRs is expected to expand into even more industries. AMRs are capable of working in extreme conditions and offer services in manufacturing, warehousing, logistics, healthcare, retail, banking, hospitality, agriculture, and the public sector.

The demand for robot arms is rising due to the pandemic-induced work-from-home policy and the shifting business operations of companies. Additionally, the adoption of advanced technologies and warehouse advancements are contributing to the increasing adoption of robot arms.

Regional Insights

In 2022, North America held the highest market share in the logistics robots market, thanks to the rapid construction of warehouses and distribution centers. Investments in smart factories and automated warehouses are also driving the increased sales of logistics robots in the region. E-commerce, retail, and healthcare are also major contributors to revenue growth.

The rising demand for logistics robots to save time and costs in logistics operations is driving the growth of the market in North America. Furthermore, due to the increase in accidents in warehouses and storage units, companies are turning to logistics robots, and strict safety standards and regulations to avoid hazardous environments containing gases and substances will further boost the growth of the logistics robots market in the region.

The Asia Pacific region is expected to experience robust growth in the logistics robot market, primarily due to the presence of manufacturing businesses. China, in particular, is a major buyer of logistics robots in the region, and it leads in terms of robot density.

Governments in the Asia Pacific region are also investing in healthcare infrastructure, encouraging medical facilities to replace traditional open surgery with laparoscopic surgery and other minimally invasive techniques. For instance, medical institutions in Japan have already begun to adopt these technologies, including robotic surgery.

The e-commerce sector's growth and expansion are also driving demand for logistics robots in the region. Developing countries such as India and China are expected to become major contributors to the market share in the region.

China is a prominent consumer of logistics robots, and research shows that it leads the way in terms of robot density across various industries, including logistics, automotive, chemicals, and electronics. Market players such as ABB, KION GROUP AG, and FANUC CORPORATION are focusing on merger and acquisition strategies to improve their penetration rate in the Chinese logistics robotics market.

The Chinese government is planning to rely on robots over laborers due to the aging population, and manufacturers are tapping into new locations and regions to establish a stronger and more efficient supply chain.

Know the high-growth countries in this report. Click Here

Research Methodology

- This strategic assessment report from Stratview Research provides a comprehensive analysis that reflects today’s logistics robots market realities and future market possibilities for the forecast period.

- The report segments and analyzes the market in the most detailed manner in order to provide a panoramic view of the market.

- The vital data/information provided in the report can play a crucial role for market participants as well as investors in the identification of the low-hanging fruits available in the market as well as to formulate growth strategies to expedite their growth process.

- This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools.

- More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data.

- We conducted more than 15 detailed primary interviews with market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Report Features

This report provides market intelligence in the most comprehensive way. The report structure has been kept such that it offers maximum business value. It provides critical insights into the market dynamics and will enable strategic decision-making for the existing market players as well as those willing to enter the market. The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market Environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, Product Portfolio, New Product Launches, etc.

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors.

The logistics robots market is segmented into the following categories.

By Product Type

- Automated Guided Vehicles

- Autonomous Mobile Robots

- Robot Arms

By Function Type

- Pick and Place

- Palletizing and Depalletizing

- Transportation

- Packaging

By Technology Type

- Healthcare

- Warehouse

- Hospitality

By Region

- North America (Country Analysis: The USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, The UK, Russia, and the Rest of Europe)

- Asia-Pacific (Country Analysis: China, India, Australia, South Korea, and the Rest of Asia-Pacific)

- Rest of the World (Country Analysis: Saudi Arabia, Brazil, and Others)

Report Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

- Detailed profiling of additional market players (up to three players)

- SWOT analysis of key players (up to three players)

Competitive Benchmarking

- Benchmarking of key players on the following parameters: product portfolio, geographical reach, regional presence, and strategic alliances.

Custom Research: Stratview research offers custom research services across the sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected].

Recent Developments

- In December 2022, OMRON launches an automation center in Singapore for logistics to support the adoption of the Robotics Middleware Framework in the logistics sector.

- In November 2022, Dematic simplified Dianflex SRL's logistics processes with AutoStore Solution, making its picking operations more flexible, improving picking times, reducing warehouse space used, and reducing errors.

- In May 2022, ABB launched the ‘ABB Robotic Depalletizer’, for handling complex depalletizing tasks in the logistics, healthcare, e-commerce, and consumer packaged goods industries.

- In March 2022, Toyota Industries Corporation signed an agreement with Viastore, a Germany-based logistics system integrator, to acquire the company to enhance its Logistics Solutions business.