Market Insights

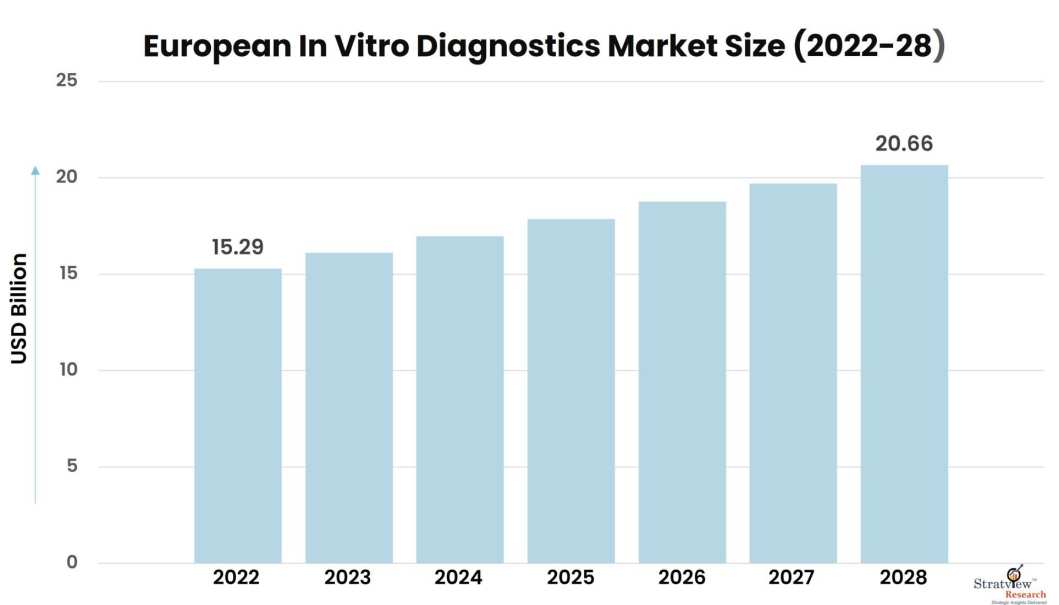

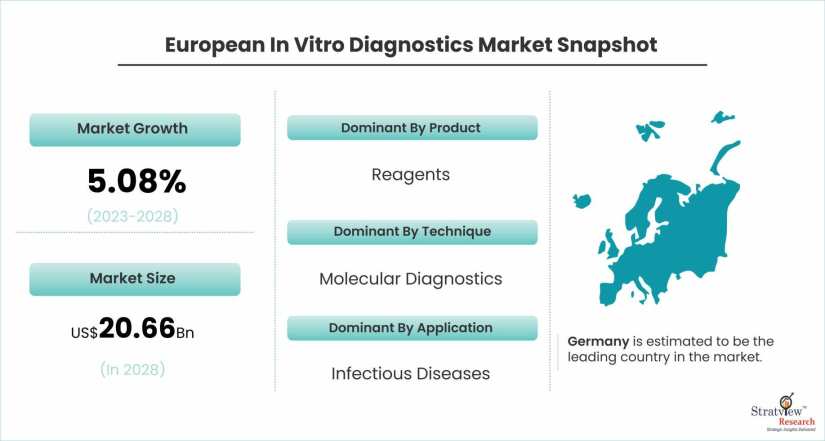

European in vitro diagnostics market was estimated at USD 15.29 billion in 2022 and is likely to grow at a CAGR of 5.08% during 2023-2028 to reach USD 20.66 billion in 2028.

Want to know more about the market scope? Download a free sample here

What are in vitro diagnostics?

In vitro diagnostics encompasses a wide range of tests done on blood or tissue samples from the human body. These tests are vital for detecting diseases or assessing other health conditions and can also be used to monitor patients’ overall health. By providing vital insights, in vitro diagnostic remains one of the significant components of healthcare, contributing to improved patient outcomes.

|

European In Vitro Diagnostics Market Highlights

|

|

Market Size in 2022

|

USD 15.29 billion

|

|

Market Size in 2028

|

USD 20.66 billion

|

|

Market Growth (2023-2028)

|

5.08% CAGR

|

|

Base Year of Study

|

2022

|

|

Trend Period

|

2017-2021

|

|

Forecast Period

|

2023-2028

|

Key Players

Some of the key players in the market are-

- Abbott Laboratories, Inc.

- Alere, Inc.

- Bio-Rad Laboratories, Inc.

- Cepheid, Inc.

- Hologic, Inc.

- OraSure Technologies

- Qiagen N.V.

- Quidel Corporation

- Roche Diagnostics

- Siemens Healthcare GmbH.

Market Dynamics

The market dynamics of the European in vitro diagnostics market are influenced by various factors that drive its growth. Here are some key growth factors-

- Rising chronic and infectious diseases – The prevalence of chronic diseases such as cancer, diabetes, and cardiovascular diseases in Europe is rising. The Organisation for Economic Co-operation and Development (OECD) states that cardiovascular diseases (CVD) are the leading cause of death in Europe, causing ~3.9 million deaths every year, which corresponds to 45% of all deaths. This rise is leading to an increased demand for in vitro diagnostics to diagnose or monitor these diseases.

- Growth in geriatric population – The European Union (Europe. eu) states that the median age of the EU's population is increasing. In 2022, more than one-fifth (21.1 %) of the EU population was aged 65 and over. It is projected that there will be close to half a million centenarians in the EU-27 by 2050. Greying of Europeans leads to high chances of chronic diseases, which require regular monitoring, and thus demand more in vitro diagnostics.

- Rise in the use of personalized medicines – Personalized medicine is the practice of tailoring medical treatment to the individual patient's genetic makeup. This is becoming increasingly important as scientists learn more about the genetic basis of diseases. in vitro diagnostics play a key role in personalized medicine by providing doctors with information about the patient's genetic makeup.

- Rising R&D expenditure to introduce new products – The surge in demand for in-vitro diagnostic tests has encouraged the market players to invest more in R&D and develop innovative products. For instance, in April 2023, bioMérieux – a French multinational biotechnology giant, and JMI Laboratories (JMI) announced a six-year partnership to undertake collaborative projects to enhance the effectiveness of quick microbiology diagnostics, crucial in the fight against antimicrobial resistance (AMR).

- Technological advancements – Continuous advancements in technology have improved the performance, accuracy, and efficiency of diagnostic tests. The introduction of innovative techniques, such as molecular diagnostics, point-of-care testing, and artificial intelligence has expanded the range of diagnostic capabilities and accelerated the adoption of in vitro diagnostic tests. For instance, in June 2023, news stated that the incorporation of AI technology in oncology-based in vitro diagnostic products is projected to revolutionize cancer diagnosis, enabling early detection, and improved patient outcomes.

Want to have a closer look at this market report? Click Here

Segment Analysis

By Product Type

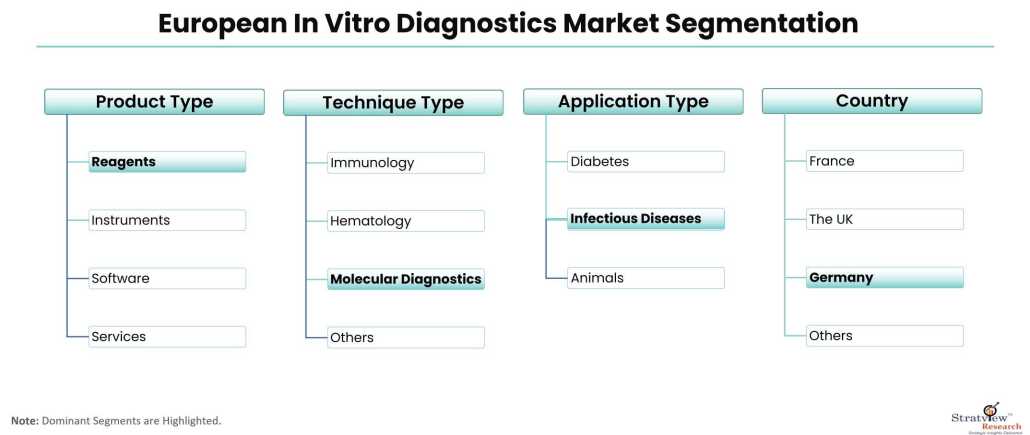

Based on the product type, the market is segmented as instruments, reagents, software, and services. The reagents segment is expected to hold the major share of the market during the forecast period owing to its high precision and accuracy in diagnosis. Furthermore, the Covid-19 pandemic has increased the demand for reagents. Also, an increase in the use of self-diagnosis tests and the number of R&D activities is expected to drive market growth during the forecast period.

By Technique Type

Based on the technique type, the market is segmented as immunology, hematology, clinical chemistry, molecular diagnostics, coagulation, microbiology, and others. The molecular diagnostics segment is anticipated to register high growth in the market owing to the increasing demand for molecular diagnosis in infectious diseases. Furthermore, the rapid rise in chronic diseases, as well as the increase in the number of genetic disorders, is expected to drive market growth during the forecast period.

By Application Type

Based on the application type, the market is segmented as infectious diseases, diabetes, oncology/cancer, cardiology, nephrology, autoimmune diseases, drug testing, and others. The infectious diseases application type segment is estimated to account for the major share of the market during the forecast period on account of the increasing number of infectious diseases such as HIV-AIDS, hepatitis, and Respiratory Syncytial Virus.

Country Insights

In terms of country, Germany is estimated to be the leading country in the market over the forecast period. The growth of the market is owing to the increasing prevalence of infectious diseases and the growing demand for rapid tests. Furthermore, the presence of various manufacturing companies is expected to fuel market growth over the forecast period. The UK is also expected to offer substantial growth opportunities during the forecast period.

Want to know which region offers the best growth opportunities then? Click Here

Market Segmentation

This report studies the market covering a period of 12 years of trend and forecast. The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The European in vitro diagnostics market is segmented into the following categories.

By Product Type

- Instruments

- Reagents

- Software

- Services

By Technique Type

- Immunology

- Hematology

- Clinical Chemistry

- Molecular Diagnostics

- Coagulation

- Microbiology

- Others

By Application Type

- Infectious Diseases

- Diabetes

- Oncology/Cancer

- Cardiology

- Nephrology

- Autoimmune Diseases

- Drug Testing

- Others

By End-User Type

- Hospitals

- Laboratory

- Home Care

- Others

By Country

- Germany (Trend and Forecast)

- France (Trend and Forecast)

- The UK (Trend and Forecast)

- Russia (Trend and Forecast)

- Spain (Trend and Forecast)

- Rest of Europe (Trend and Forecast)

Know more about various segments of this report. Register Here

Recent News & Developments

OCT 2022: QIAGEN gains CE-marking for in-vitro diagnostic kit and its automated testing platform NeuMoDx under new EU IVDR framework- QIAGEN N.V. (NYSE: QGEN; Frankfurt Prime Standard: QIA) has officially announced the certification of its leading in-vitro diagnostic (IVD) kit and its fully automated NeuMoDx platforms in accordance with the European Union's updated In-Vitro Diagnostic Medical Devices Regulation (IVDR), which replaced the previous IVDD regulations in May. Notably, the ipsogen JAK2 RGQ PCR Kit, designed for diagnosing myeloproliferative neoplasms (MPN), a specific type of blood cancer, has become QIAGEN's first IVD kit to receive the IVDR CE-marking, classifying it under Class C.

March 2022: Roche launches cobas 5800, a new molecular diagnostics system to expand access to testing and improve patient care- Roche (SIX: RO, ROG; OTCQX: RHHBY) has unveiled the introduction of the cobas® 5800 System, a novel molecular laboratory device, in countries where the CE mark is accepted.

FEB 2022: Vitro S.A. sells Cytognos to BD to prioritize the market launch of their new and disruptive Molecular Biology and Anatomic Pathology diagnostic platforms- Vitro S.A, a privately-owned firm based in Seville, Spain, has revealed the sale of Cytognos to Becton Dickinson and Company (BD). Cytognos is a dedicated provider of flow cytometry solutions catering to the diagnosis of blood cancer, the detection of minimal residual disease (MRD), and research related to immune monitoring in hematological diseases. Employees of Cytognos who are transitioning to BD as a part of this acquisition will contribute to preserving employment opportunities in the Salamanca region of Spain. The specific terms of the transaction have not been disclosed.

April 2021: Italian diagnostics group DiaSorin to buy Luminex for $1.8 billion- DiaSorin SpA, an Italian diagnostics group, announced on Sunday its intention to acquire Luminex Corp, a U.S.-based company, in an all-cash transaction valued at $1.8 billion. This strategic move is set to bolster DiaSorin's molecular diagnostics technology portfolio significantly. Under the terms of the deal, Luminex shareholders will receive $37 for each Luminex share, as confirmed by DiaSorin in a statement.

Research Methodology

This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools.

More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles have been leveraged to gather the data.

We conducted more than 10 detailed primary interviews with the market players across the value chain in all four regions and with industry experts to obtain both qualitative and quantitative insights.

Report Features

This report provides market intelligence in the most comprehensive way. The report structure has been kept such that it offers maximum business value. It provides critical insights into the market dynamics and will enable strategic decision-making for the existing market players as well as those willing to enter the market.

What Deliverables Will You Get in this Report?

|

Key questions this report answers

|

Relevant contents in the report

|

|

How big is the sales opportunity?

|

In-depth Analysis of the European In Vitro Diagnostics Market

|

|

How lucrative is the future?

|

Market forecast and trend data and emerging trends

|

|

Which regions offer the best sales opportunities?

|

Global, regional, and country-level historical data and forecasts

|

|

Which are the most attractive market segments?

|

Market segment analysis and Forecast

|

|

Which are the top players and their market positioning?

|

Competitive landscape analysis, Market share analysis

|

|

How complex is the business environment?

|

Porter’s five forces analysis, PEST analysis, Life cycle analysis

|

|

What are the factors affecting the market?

|

Drivers & challenges

|

|

Will I get the information on my specific requirement?

|

10% free customization

|

Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

- Detailed profiling of additional market players (up to 3 players)

- SWOT analysis of key players (up to 3 players)

Market Segmentation

- Current market segmentation by any one of the technique types by application type.

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Product portfolio, geographical reach, regional presence, and strategic alliances.

Custom Research: Stratview Research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected].