Market Dynamics

Introduction

A clean room robot is a type of robotic system that is designed to operate in clean room environments, which are areas that are free of contaminants such as dust, bacteria, and other particulates. These robots are commonly used in industries such as electronics manufacturing, pharmaceuticals, and medical device production, where even small levels of contamination can compromise the quality of the products being produced.

Clean room robots are typically equipped with specialized components that prevent the release of particles and other contaminants, such as specially designed covers, filters, and seals. They are also designed to be easy to clean and maintain, minimizing the risk of contamination during operation.

One of the key benefits of clean room robots is their ability to improve the efficiency and quality of production in clean room environments. They can perform tasks with a high level of precision and consistency, reducing the risk of human error and improving product quality. As clean room technology continues to evolve, so too will the capabilities of clean room robots, making them an increasingly important part of the manufacturing process.

Market Drivers

Need to transfer goods and materials using material air locks (MAL) in differently graded areas

To maintain the cleanliness of the environment in clean rooms, it is necessary to transfer goods and materials between areas with varying levels of environmental control using a Material Air Lock (MAL). During this transfer process, it is important to clean the goods and materials with isopropyl alcohol (IPA) to avoid the transfer of impurities.

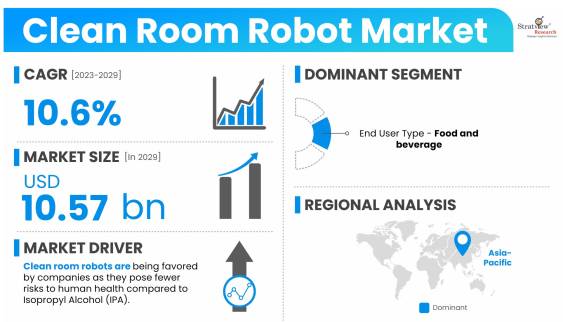

Clean room robots are being favored by companies as they pose fewer risks to human health compared to Isopropyl Alcohol (IPA). IPA, when inhaled or absorbed by humans, can result in severe consequences that may endanger life. It can impact the central nervous system, which regulates involuntary actions like breathing, heartbeat, and gag reflex. Furthermore, IPA is known to thin the blood, leading to a decrease in blood sugar levels, which could ultimately result in seizures. To ensure the safety of individuals, companies are opting for clean room robots.

In addition to posing a threat to human health, IPA has several other drawbacks. One of these is its inefficacy against non-polar contaminants. Moreover, IPA can absorb moisture from the surroundings, which can result in corrosion and electrical leakage on precision assemblies.

Exposure to air can lead to IPA absorbing moisture until it reaches an equilibrium value of 65% IPA to 35% water, which could be particularly problematic for plastic films used as anti-glare coatings on computer monitor screens, even with mild alcohol dilutions. To minimize the use of IPA and its associated issues, companies are adopting clean room environments and robots for production, as they reduce the need for IPA cleaning.

Restraint: High installation cost

The adoption of industrial clean room robots is limited by the high installation costs, particularly for small and medium-sized enterprises. The cost of industrial robots, including controllers and teach pendants, ranges from USD 50,000 to USD 80,000. Application-specific peripherals add an additional cost of USD 100,000 to USD 150,000 to the robot system.

Additionally, there are other expenses involved in setting up the robot. For example, the robot requires sturdy, purpose-built pedestals that can cost several thousand dollars. If the robot is not collaborative, a safety cage is necessary to protect workers, which also requires safety equipment like an emergency stop button and safety sensors.

Furthermore, additional costs are incurred in the customization of end effectors to suit the specific application, as they are not readily available. The use of more than one end effector also necessitates the acquisition of a tool changer, which can add nearly 30% to the initial cost of the robot. Additionally, the robot requires fixtures and contraptions to hold the parts on which it operates. These additional expenses further contribute to the overall cost of the system.

Moreover, the fixtures and contraptions utilized in the manufacturing process have to be tailored to meet specific requirements. The robot would also require vision systems and lighting to operate correctly. In the final phase, the robot needs to be programmed, and the selection of programmable logic controllers (PLCs) or embedded computers depends on the application.

Customers may not know how to integrate and set up robots with the aforementioned peripherals, which leads them to hire integration companies. However, the cost of hiring these companies is twice the total cost of all the parts involved. The high cost of adopting robots, along with the associated peripherals and services, makes it difficult for small and medium-sized businesses to adopt this technology.

Want to have a closer look at this market report? Click Here

Segment Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High Growth Opportunity

|

|

End User Type Analysis

|

Aerospace, Electrical and Electronics, Plastics, Rubber, and Chemicals, Food and Beverages, Optics, Pharmaceuticals and Cosmetics

|

Food and beverage industry is projected to experience the highest compound annual growth rate (CAGR) during the forecast period.

|

|

Regional Analysis

|

North America, Europe, Asia-Pacific, and Rest of the World

|

Asia Pacific market is expected to experience the fastest compound annual growth rate (CAGR) during the forecast period.

|

By End User Type

"Food and beverage industry is projected to experience the highest compound annual growth rate (CAGR) during the forecast period"

During the forecast period, the food and beverage industry is projected to experience the highest compound annual growth rate (CAGR). This is because businesses are striving to prepare for future pandemics like COVID-19 by reducing contamination caused by humans. In the food and beverage industry, robots are primarily employed for primary packaging tasks, such as loading food products into their packaging.

Consequently, robots typically have a payload capacity of up to 10 Kg. SCARA (Selective Compliance Assembly Robot Arm) robots are being increasingly adopted for food processing purposes. Their low cost, small footprint, and high throughput rates make them an attractive option.

Regional Analysis

"Asia Pacific market is expected to experience the fastest compound annual growth rate (CAGR) during the forecast period"

The Asia Pacific market is expected to experience the fastest compound annual growth rate (CAGR) during the forecast period, primarily due to the presence of developing countries such as India and China, which have room for new manufacturing plant establishments and are not yet saturated in terms of development and demand. The pharmaceutical industry in countries such as China and Japan is witnessing a significant demand for clean room robots owing to the aging population.

Additionally, the availability of a cheap workforce has led to the development of a strong IT industry in the Asia Pacific region. For example, in January 2020, Nippon Telegraph and Telephone, a Japanese tech company, announced plans to invest a significant portion of its USD 7 billion global commitment in a data center business in India over the next few years, further boosting the demand for clean room robots in the optics industry.

Due to the large population in the region, the food and beverage industry is also thriving. As per the Population Reference Bureau, China had the largest population, followed by India, in 2022.

Know the high-growth countries in this report. Register Here