Market Insights

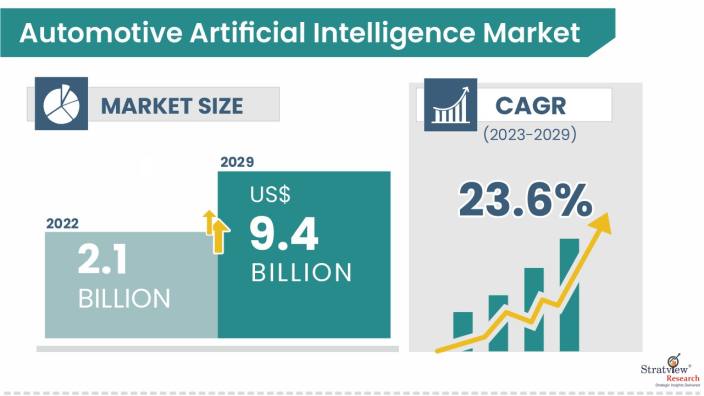

The automotive artificial intelligence market was estimated at USD 2.1 billion in 2022 and is likely to grow at a CAGR of 23.6% during 2023-2029 to reach USD 9.4 billion in 2029.

Want to get a free sample? Register Here

Market Dynamics

Introduction

Automotive Artificial Intelligence (AI) refers to the integration of advanced machine learning and computational algorithms within vehicles to enhance their functionality, safety, and autonomous capabilities. AI in the automotive industry enables vehicles to process and interpret real-time data from various sensors, cameras, and radar systems, empowering them to make intelligent decisions and adapt to changing driving conditions. This technology plays a crucial role in autonomous vehicles, allowing them to navigate, recognize obstacles, and make split-second decisions to ensure safe and efficient transportation.

Automotive AI also contributes to features like voice recognition, natural language processing, and predictive maintenance, enhancing the overall driving experience and paving the way for the future of smart, self-driving automobiles.

|

Automotive Artificial Intelligence Market Scope

|

|

Market Size in 2029

|

USD 2.1 Billion

|

|

Market Size in 2022

|

USD 9.4 Billion

|

|

Market Growth (2023-2029)

|

23.6%

|

|

Forecast Period

|

2023-2029

|

|

Base Year of Study

|

2022

|

|

Trend Period

|

2017-2021

|

Market Drivers

Rising Demand for Autonomous Vehicles

The automotive AI market is being propelled by the increasing adoption of self-driven vehicles, with different sources’ forecasts projecting Level 3 autonomous cars (self-driven) to account for up to 10% of global new vehicle sales by 2030. This growth is mainly due to AI advancements and integration that enhance user experience through real-time decision-making, adaptive learning systems, and more.

Rising EV Adoption

EV adoption is rapidly accelerating globally. The global EV production is projected to surge from 29 million units in 2023 to ~78 million units in 2031. AI-driven systems optimize vehicle battery performance, energy management, and EV infrastructure, addressing key challenges like battery life and charging efficiency. With the growing demand for EVs, the global demand for automotive AI will ultimately boost the automotive AI market globally.

Automotive Artificial Intelligence Market Challenges

Technical hurdles and cybersecurity concerns

Developing AI-integrated automotive requires sophisticated algorithms and high-performance computing capabilities further necessitating technical complexity which becomes a challenge for several manufacturers. Furthermore, the use of AI potentially increases the risk of cyberattacks. This creates a significant security concern hampering the sales and production of the automotive AI market.

Ethical and Regulatory Considerations

Ethical and regulatory implications are critical areas of concern when it comes to automotive. The use of AI in self-driving cars raises questions related to liability and accountability in case of any accidents. As the automotive industry continues to grapple with these considerations, it is crucial to develop robust frameworks and regulations that prioritize safety and ethical standards.

Automotive Artificial Intelligence Market Opportunities

Improved efficiency and cost reduction

AI-powered automotives can facilitate predictive maintenance, allowing users to check initial issues before they become costly problems. Reduced repair cost and maintenance encourage people to opt for AI automotives all over the world.

Enhanced Safety Features

AI systems can analyze real-time data from sensors and cameras to detect potential hazards and take appropriate action. This feature can reduce the risk of accidents and injuries on the road. Furthermore, AI can also assist in the development of advanced driver-assistance systems (ADAS), such as traffic detection, collision avoidance, lane changing, and pedestrian detection, and enhance the safety of end users.

Segments' Analysis

|

Segmentations

|

List of Sub-Segments

|

Dominant and Fastest-Growing Segments

|

|

Application Type

|

Human–Machine Interface (HMI), Semi-Autonomous Driving, Autonomous Driving, Identity Authentication, Driver Monitoring, Autonomous Driving Processor Chips

|

The human-machine interface (HMI) application segment accounts for the largest share of the market during the forecast period.

|

|

Technology Type

|

Deep Learning, Machine Learning, Computer Vision, Context-Aware Computing, Natural Language Processing

|

The machine learning segment dominates the market during the forecast period.

|

|

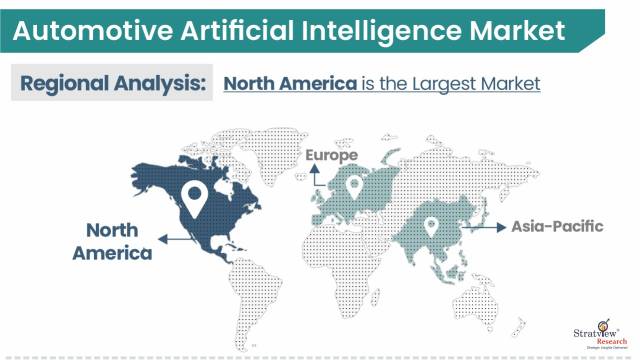

Region Analysis

|

North America, Europe, Asia-Pacific, and the Rest of the World

|

North America is projected to hold the largest portion of the market during the forecast period.

|

Application Insights

“The human-machine interface (HMI) application segment accounts for the largest share of the automotive artificial intelligence market during the forecast period.”

HMI allows drivers and passengers to interact with the vehicle by delivering convenience, information, and entertainment seamlessly. Key components of HMI include electromechanical devices such as keypads, pointing devices, indicators, and alarms.

The infotainment category comprises advanced features such as speech recognition, eye tracking, monitoring driving behavior, gesture recognition, and a database of natural languages. OEMs are integrating advanced HMI solutions to provide a unique and innovative user experience and differentiate their brand image. The intelligent car concept is evolving rapidly, with features such as self-braking, advanced cruise control, and self-parking becoming increasingly common. These developments will create numerous opportunities for automotive HMI systems.

Developed countries where people prefer to travel long distances in their vehicles and where infrastructure is improving are also driving the demand for advanced HMI systems.

Technology Insights

“Machine learning accounts for the second largest share of the automotive artificial intelligence market during the forecast period.”

By using machine learning, vehicles are equipped with the capability to examine and understand diverse driving scenarios, resulting in fewer accidents and enhanced safety and efficiency. Through this technology, precise models can be created to provide direction for future actions while also quickly detecting patterns at a previously unprecedented scale.

The machine learning field encompasses several different technologies, such as supervised learning, unsupervised learning, deep learning, and reinforcement learning. Within the automotive industry, where datasets are extensive, varied, and often evolving, machine-learning approaches are especially effective in powering systems with novel insights.

Regional Insights

“North America is projected to hold the largest portion of the automotive artificial intelligence market during the forecast period.”

The moderate expansion of automotive artificial intelligence in this region is attributed to the swift advancement of autonomous vehicle technology, coupled with stringent government regulations on road safety. Additionally, the presence of numerous major technological firms within the region helps the early introduction and widespread adoption of technologies, including automotive artificial intelligence.

Government incentives and funding serve as crucial drivers in the development of this technology. The automotive industry in the US is highly advanced, with industry leaders such as Ford Motor Company, General Motors, and Fiat-Chrysler Automotive continually updating their product portfolios. Vehicles in the US come equipped with sophisticated features such as adaptive cruise control, lane departure warning systems, voice recognition, gesture recognition, and blind spot detection.

Want to get a free sample? Register Here

Key Players

The market is highly populated with the presence of several local, regional, and global players. Most of the major players compete in some of the governing factors including price, product offerings, regional presence, etc.

The following are the key players in the automotive artificial intelligence market (arranged alphabetically):

-

Alphabet Inc.

-

Audi AG

-

Bayerische Motoren Werke AG

-

Daimler AG

-

Didi Chuxing

-

Ford Motor Company

-

General Motors Company

-

Harman International Industries, Inc.

-

Honda Motor Co Ltd.

-

Hyundai Motor Co., Ltd

-

Intel Corporation

-

International Business Machines Corporation

-

Micron Technology

-

Microsoft Corporation

-

NVIDIA Corporation

-

Qualcomm Inc.

-

Tesla, Inc.

-

Toyota Motor Corporation

-

Uber Technologies, Inc

-

Volvo Cars

-

Xilinx, Inc.

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Write to us at [email protected]

Recent Developments

Key Innovations

-

NVIDIA DRIVE Thor Platform (January 2024): NVIDIA introduced the DRIVE Thor, a centralized AI computer platform integrating autonomous driving, parking, driver monitoring, and AI cockpit functionalities. Adopted by manufacturers like Great Wall Motor, Zeekr, and Xiaomi EV, it enhances real-time decision-making for self-driving systems.

-

Waymo’s Autonomous Ride-Hailing: By 2024, Waymo’s fully autonomous ride-hailing service completed over 200,000 paid rides per week in cities like San Francisco and Los Angeles, leveraging AI for navigation and safety. In May 2024, Wayve (UK) secured USD 1 billion to develop next-generation AI-powered self-driving vehicles.

-

General Motors and NVIDIA Collaboration (March 2025): GM expanded its partnership with NVIDIA, adopting the Omniverse and Cosmos platforms to integrate AI into autonomous vehicles, robots, and factories. This collaboration leverages NVIDIA’s full-stack autonomous vehicle development suite for enhanced navigation and decision-making.

-

Tesla’s Full Self-Driving (FSD) Advancements: Tesla’s FSD Version 12 was deployed on 1.8 million vehicles by mid-2024, with plans for unsupervised FSD rollout in Austin by June 2025. FSD v14 incorporates map-enhanced AI for robotaxi services, using auto-regressive transformers to fuse vision-based data.

Research Methodology

This strategic assessment report, from Stratview Research, provides a comprehensive analysis that reflects today’s automotive artificial intelligence market realities and future market possibilities for the forecast period of 2023 to 2029. After a continuous interest in our automotive artificial intelligence market report from the industry stakeholders, we have tried to further accentuate our research scope to the automotive artificial intelligence market to provide the most crystal-clear picture of the market. The report segments and analyses the market in the most detailed manner to provide a panoramic view of the market. The vital data/information provided in the report can play a crucial role for the market participants as well as investors in the identification of the low-hanging fruits available in the market as well as to formulate the growth strategies to expedite their growth process.

This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools. More than 1000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data. We conducted more than 15 detailed primary interviews with the market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Report Features

This report provides market intelligence in the most comprehensive way. The report structure has been kept such that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market. The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

- COVID-19 impact and its recovery curve

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors

Market Segmentation

This report studies the market, covering a period of 12 years of trends and forecasts. The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The automotive artificial intelligence market is segmented into the following categories:

By Component Type

- Microprocessors

- Graphics Processing Unit (GPU)

- Field Programmable Gate Array (FPGA)

- Memory and Storage Systems

- Image Sensors

- Biometric Scanners

By Offering Type

By Technology Type

- Deep Learning

- Machine Learning

- Computer Vision

- Context-Aware Computing

- Natural Language Processing

By Process Type

- Signal Recognition

- Image Recognition

- Data Mining

By Application Type

- Human–Machine Interface (HMI)

- Semi-Autonomous Driving

- Autonomous Driving,

- Identity Authentication

- Driver Monitoring

- Autonomous Driving Processor Chips

By Region

- North America (Country Analysis: the USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, the UK, Russia, Spain, and Rest of Europe)

- Asia-Pacific (Country Analysis: China, Japan, India, South Korea, and Rest of Asia-Pacific)

- Rest of the World (Sub-Region Analysis: Latin America, the Middle East, and Others)

Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

- Detailed profiling of additional market players (up to 3 players)

- SWOT analysis of key players (up to 3 players)

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Product portfolio, geographical reach, regional presence, and strategic alliances.

Custom Research: Stratview Research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected].