Market Insights

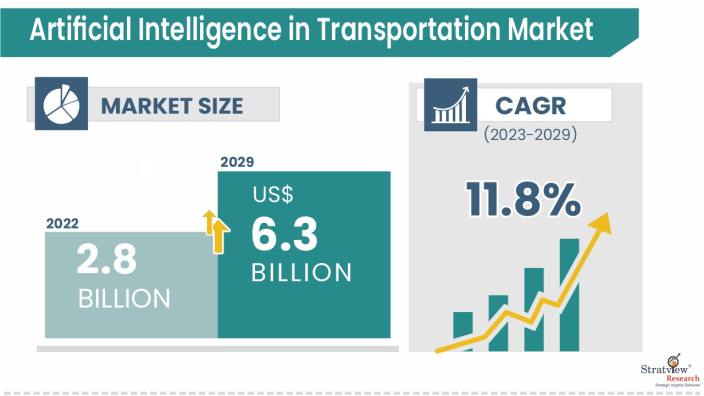

The artificial intelligence in transportation market was estimated at USD 2.8 billion in 2022 and is likely to grow at a CAGR of 11.8% during 2023-2029 to reach USD 6.3 billion in 2029.

Want to know more about the market scope? Register Here

Market Dynamics

Introduction

Artificial Intelligence (AI) in transportation refers to the integration of advanced technologies, algorithms, and machine learning systems to enhance various aspects of the transportation sector. AI applications in transportation include traffic management, route optimization, predictive maintenance, autonomous vehicles, and smart logistics. Through real-time data analysis, AI helps optimize traffic flow, reduce congestion, and improve overall efficiency.

Additionally, AI contributes to improved safety, energy efficiency, operational efficiency, reduced costs, and sustainability in transportation systems, making it a key driver of innovation in the modernization and transformation of the transportation industry.

Market Drivers

The growth of the artificial intelligence in transportation market is being fueled by the advancement of autonomous vehicles. Major vehicle original equipment manufacturers (OEM) are making significant investments to optimize self-driving technology, particularly in the automotive industry. Consequently, the integration of autonomous vehicles with intelligent features is anticipated to drive market growth on a global scale.

The rising need for traffic management solutions is also propelling market growth. Robust traffic management systems that incorporate cameras and sensors embedded in the road rely heavily on AI technology. These systems generate vast amounts of traffic-related data, which are then analyzed using AI systems to gain insights into traffic patterns. The increasing emphasis on improving traffic management in developed and developing countries is anticipated to further drive market growth in the foreseeable future.

AI is also being utilized to improve logistics operations and to reduce transportation costs. Through the implementation of better traffic management solutions, optimal routes can be identified for last-mile operations, leading to decreased freight costs. Major e-commerce companies like Alibaba and Amazon are making significant investments in AI technology to enhance the efficiency of their delivery processes and gain a competitive edge in the e-commerce market.

In Tokyo, autonomous taxis are already in operation, and their manufacturers claim that the technology will decrease taxi service costs. This reduction in costs could potentially increase the availability of public transportation in remote areas. Additionally, the logistics industry in the US is adopting autonomous trucks to reap the many benefits they offer. Globally, 70% of goods are transported via trucks, according to a recent study.

In contrast, cloud-based AI systems require expensive bandwidth to power the system, leading to high operating costs. Additionally, AI is a new and rapidly developing technology solution that requires specialized training and skills, which can also increase the cost of implementation and operation.

The development and maintenance of the network of individual processors, relays, and other components that make up AI-operated machines also require a significant amount of energy, further contributing to the high cost of operation. These challenges can adversely affect the growth of AI in the transportation market. These significant challenges result in a high operating cost of AI when used in transportation.

The machines operated by AI consist of a network of individual processors, relays, and other components that require regular maintenance and replacement, as well as a substantial amount of energy to operate. These challenges negatively impact the growth of artificial intelligence in the transportation market.

Segments Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High Growth Opportunity

|

|

Application Type Analysis

|

Autonomous Trucks, HMI in Trucks, Semi-autonomous Trucks

|

Autonomous trucks held the largest market share globally in 2022.

|

|

Offering Type Analysis

|

Hardware, Software

|

The software segment held a larger market share in the market.

|

|

Machine Learning Technology Type Analysis

|

Deep Learning, Computer Vision, Context Awareness, Natural Language Processing

|

The deep learning segment held the highest revenue share contribution to the market compared to other regions.

|

|

Regional Analysis

|

North America, Europe, Asia-Pacific, and Rest of the World

|

North American region held the largest share of the market.

|

By Application Type

The market is categorized by application into Autonomous Trucks, HMI in Trucks, and Semi-Autonomous Trucks. Among these, Autonomous Trucks held the largest market share globally in 2022. This is primarily due to the growing development in the trucking industry, which is increasing the demand for autonomous trucks.

Furthermore, the logistics industry's growth in the US for the transportation of goods is driving the need for autonomous trucks. The deployment of autonomous trucks is also expected to result in a reduction of maintenance and administrative expenses by about 45%. By 2029, HMI is projected to have a larger market share of the market. This growth is mainly attributed to its higher penetration of HMI in trucks compared to advanced driver-assistance systems (ADAS).

By Offering Type

Artificial Intelligence in transportation market is also categorized based on offering, with segments including Hardware and Software. In 2022, the software segment held a larger market share in the market. This is mainly due to the growing use of software as a service platform (such as Microsoft Azure) in human-machine interface (HMI) applications.

By Learning Technology Type

The market has been further segmented by learning technology into deep learning, context awareness, computer vision, and Natural Language Processing. In 2022, the deep learning segment held the highest revenue share contribution to the market compared to other regions.

Deep learning algorithms play a crucial role in exploring the complex interactions of highways, roads, traffic, crashes, and environmental elements. They also have significant potential in managing day-to-day traffic and collecting traffic data.

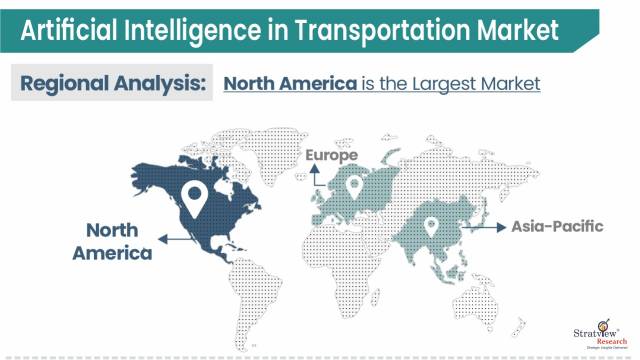

Regional Analysis

The North American region held the largest share of the market, followed by Europe and Asia-Pacific in 2022. The use of automated cars and the integration of self-driving vehicles onto US roadways are major factors accelerating the growth of the market in North America. The transportation and logistics industry in the US is also driving the adoption of AI-based self-driving trucks for reduced operational costs, further boosting the market growth.

Asia-Pacific is projected to grow at the highest compound annual growth rate (CAGR) during the forecast period. This is mainly due to the high sales of trucks in the region and the increasing adoption of Artificial Intelligence in transportation in developing countries like Japan and China.

Japan is expected to be the fastest-growing country in the market during the forecast period. With the growing truck market in Japan, companies are finding new revenue streams by integrating AI-enabled features in trucks, which is further supporting the growth of AI in the transportation market in the Asia-Pacific region.

Know the high-growth countries in this report. Register Here

Key Players

The major players operating in the global market are:

- Alphabet

- Bosch

- Continental

- Daimler

- Intel

- Magna

- Man

- Microsoft

- Nauto

- NVIDIA

- Paccar

- Peloton

- Scania

- Valeo

- Volvo

- Xevo

- ZF

- Zonar

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Write to us at [email protected]

Research Methodology

This strategic assessment report, from Stratview Research, provides a comprehensive analysis that reflects today’s artificial intelligence in transportation market realities and future market possibilities for the forecast period of 2023 to 2029. After a continuous interest in our artificial intelligence in transportation market report from the industry stakeholders, we have tried to further accentuate our research scope to the artificial intelligence in transportation market to provide the most crystal-clear picture of the market. The report segments and analyses the market in the most detailed manner to provide a panoramic view of the market. The vital data/information provided in the report can play a crucial role for the market participants as well as investors in the identification of the low-hanging fruits available in the market as well as to formulate the growth strategies to expedite their growth process.

This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools. More than 1000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data. We conducted more than 15 detailed primary interviews with the market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Report Features

This report provides market intelligence in the most comprehensive way. The report structure has been kept such that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market. The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

- COVID-19 impact and its recovery curve

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors

Market Segmentation

This report studies the market, covering a period of 12 years of trends and forecasts. The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The artificial intelligence in transportation market is segmented into the following categories:

By Application Type

- Autonomous Trucks

- HMI in Trucks

- Semi-autonomous Trucks

By Offering Type

By Application Type

- Deep Learning

- Computer Vision

- Context Awareness

- Natural Language Processing

By Process Type

- Signal Recognition

- Object Recognition

- Data Mining

By Region

- North America (Country Analysis: the USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, the UK, Russia, Spain, and Rest of Europe)

- Asia-Pacific (Country Analysis: China, Japan, India, South Korea, and Rest of Asia-Pacific)

- Rest of the World (Sub-Region Analysis: Latin America, the Middle East, and Others)

Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

- Detailed profiling of additional market players (up to 3 players).

- SWOT analysis of key players (up to 3 players).

Market Segmentation

- Current market segmentation of any one of the offering types by application type.

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Product portfolio, geographical reach, regional presence, and strategic alliances.

Custom Research: Stratview Research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected].

Recent Market News & Developments

-

In February 2023, Mercedes-Benz and Google partnered to create a next-generation navigation experience.

-

In January 2023, Germany's Continental and US-based AI chip firm Ambarella entered a partnership to make software and hardware systems for autonomous driving.

-

In October 2022, Seeing Machines Limited, an advanced computer vision technology company that designs AI-powered operator monitoring systems to improve transport safety, signed a collaboration agreement with Magna International to pursue driver and occupant monitoring system business aimed at the vehicle's interior rearview mirror.