Market Insights

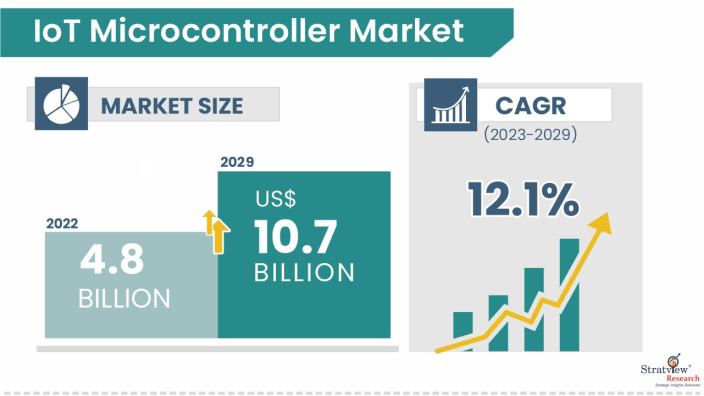

The IoT microcontroller market was estimated at USD 4.8 billion in 2022 and is likely to grow at a healthy CAGR of 12.1% during 2023-2029 to reach USD 10.7 billion in 2029.

Want to know more about the market scope? Register Here

Market Dynamics

Introduction

A microcontroller is the brain of an IoT device that defines the roles and functions of the IoT product. Microcontrollers are small, self-reliant computers that hold a single integrated circuit or microchip. IoT in microcontrollers allows connectivity and control of all the things that could be linked to the internet.

IoT microcontrollers are planned to perform special functions and can be combined with most other devices that range from warehouse inventory items, industrial equipment, and wearables devices, to home appliances, and others. IoT microcontrollers are used in a wide range of systems and devices. Devices often use multiple microcontrollers integrated within them to handle their tasks.

Market Drivers

The necessity of cost-efficient smart wireless sensor networks and the continually improving internet connection in developed nations are considered the market's most important drivers. Additional factors enhancing the market expansion entail the rising number of IoT connections and enhanced requirement for low-power, high-performance, energy-efficient connected products.

Also, it is forecasted that the usage of IoT will have a major impact on the market soon, given that this market is still relatively young. Applications like industrial automation, smart appliances, smart grids, and smart cities are currently utilizing IoT and it is expected that the IoT market will grow rapidly in the coming years. In addition, the emergence of fitness apps as well as enhancement in the consciousness of physical fitness in emerging markets particularly India, China, and Japan are also fueling the usage of wearable technology and consequently the market size during the forecast period.

The IoT microcontroller market is expected to experience growth due to features such as the increase in the number of IoT connections both at consumer and enterprise levels, requirements for energy, low power, and high-performance connected microcontrollers. Also, the prevailing transition from System-in-Package (SiP) to embedded Non-Volatile Memory (eNVM) solutions especially in industrial automation, smart transportation, and smart utilities will continue to drive the market. At the same time, there are no fixed norms in many sectors, and IoT device optimization and safety concerns may negatively affect its market in the future.

COVID-19 Impact

The market growth may be hindered due to several factors, including the high energy consumption of microcontrollers and security concerns with IoT devices. The COVID-19 pandemic also harmed the industrial sector, affecting the production of microcontrollers and microprocessors.

Although production has resumed, the shortage of semiconductors is expected to persist until 2023, and the fluctuating prices of MCUs and component shortages may also slow down market growth. Manufacturers may face challenges in balancing supply and demand due to the suspension of production facilities and the temporary closure of international borders during the pandemic.

Segments Analysis

|

Segmentations

|

List of Sub-Segments

|

Dominant and Fastest-Growing Segments

|

|

Product Type

|

8 Bit, 16 Bit, 32 Bit

|

The 32-bit MCU segment dominates the market and the 8-bit MCU segment is expected to grow at a faster rate during the forecast period.

|

|

Application Type

|

Industrial Automation, Smart Homes, Consumer Electronics

|

The smart homes segment is projected to grow at the highest CAGR during the forecast period.

|

|

Region Analysis

|

North America, Europe, Asia-Pacific, and the Rest of the World

|

Asia-Pacific is the largest market and is expected to grow at the highest CAGR during the forecast period.

|

By Product Type

“The 32-bit MCU segment dominates the market and 8-bit MCU segment is expected to grow at a faster rate.”

The IoT microcontroller market is segmented into 8-bit, 16-bit, and 32-bit based on product. In 2022, the 32-bit MCU segment dominated the market and is projected to register the highest CAGR from 2022 to 2029 due to its compatibility with IoT applications. It can handle multiple peripherals efficiently, is widely used in industrial applications like building and factory automation, and is also cost-effective.

The 8-bit MCUs segment is expected to grow at a CAGR above 11% during the forecast period, driven by its use in low-power applications such as smart wearables and connected devices. The growing popularity of fitness wearables among millennials, particularly for tracking their health and fitness performance, is expected to drive demand for the segment. This trend is driven by the growing concern about lifestyle disorders like obesity.

By Application Type

“The smart homes segment is projected to grow at a CAGR above 13% during the forecast period.”

The IoT microcontroller market is segmented into industrial automation, smart homes, consumer electronics, and others based on application. The smart homes segment, which includes home appliances, was valued at over USD 1 billion in 2022 and is projected to grow at a CAGR above 13% during the forecast period. The growth of this segment is driven by the increasing demand for safe, secure, and energy-efficient app-controlled smart devices such as HVAC and energy management, lighting, and infotainment systems.

The consumer electronics segment includes smartphones, wearables, and others. The COVID-19 pandemic led to a surge in remote work, which increased the demand for smart wearables like smartwatches and fitness trackers. The increasing focus on fitness and health among millennials is also expected to drive demand for wearables. Thus, the use of low-power MCUs with short-range wireless connectivity, particularly 8-bit integrated with protocols such as Bluetooth, KNX, Zigbee, and Wi-Fi, is expected to fuel the sales of IoT MCUs during the forecast period.

Regional Insights

“Asia-Pacific was the largest market for IoT microcontrollers and is expected to grow at a CAGR above 14% during the forecast period.”

The region is led by China, India, and Japan, which account for over 50% of the total market share. This can be attributed to the growing demand for smart wearables and supportive government spending on smart city initiatives. The recent RCEP trade agreement between China and ASEAN countries and rising disposable incomes in emerging economies such as Vietnam, Malaysia, and Indonesia are expected to lead to an increase in the affordability of smart home devices, driving market growth during the forecast period.

Europe held a revenue share of over 20% in 2022. The region has invested heavily in grid modernization, resulting in more than 50% of electricity meters being replaced by smart meters. Favorable government investments have particularly driven the installation of smart meters across countries such as France, Spain, and the U.K., contributing to market growth during the forecast period. These factors present opportunities for market players to increase profitability and boost the growth of the IoT microcontroller market over the forecast period.

Know the high-growth countries in this report. Register Here

Key Players

The market is highly populated with the presence of several local, regional, and global players. Most of the major players compete in some of the governing factors including price, product offerings, regional presence, etc.

The following are the key players in the IoT microcontroller market (arranged alphabetically):

- Broadcom

- Espressif Systems (Shanghai) Co., Ltd

- Holtek Semiconductor Inc.

- Infineon Technologies

- Microchip Technology Inc.

- Nuvoton Technology Corporation

- NXP Semiconductors

- Renesas Electronics Corporation

- Silicon Laboratories

- STMicroelectronics

- Texas Instruments Incorporated

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Write to us at [email protected]

Report Features

This report provides market intelligence in the most comprehensive way. The report structure has been kept such that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market. The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

- COVID-19 impact and its recovery curve

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors

Market Segmentation

This report studies the market, covering a period of 12 years of trends and forecasts. The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The IoT microcontroller market is segmented into the following categories:

By Product Type

By Type

- Industrial Automation

- Smart Homes

- Consumer Electronics

By Region

- North America (Country Analysis: the USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, the UK, Russia, Spain, and Rest of Europe)

- Asia-Pacific (Country Analysis: China, Japan, India, South Korea, and Rest of Asia-Pacific)

- Rest of the World (Sub-Region Analysis: Latin America, the Middle East, and Others)

Research Methodology

This strategic assessment report, from Stratview Research, provides a comprehensive analysis that reflects today’s IoT microcontroller market realities and future market possibilities for the forecast period of 2023 to 2029. After a continuous interest in our IoT microcontroller market report from the industry stakeholders, we have tried to further accentuate our research scope to the IoT microcontroller market to provide the most crystal-clear picture of the market. The report segments and analyses the market in the most detailed manner to provide a panoramic view of the market. The vital data/information provided in the report can play a crucial role for the market participants as well as investors in the identification of the low-hanging fruits available in the market as well as to formulate the growth strategies to expedite their growth process.

This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools. More than 1000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data. We conducted more than 15 detailed primary interviews with the market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

- Detailed profiling of additional market players (up to three players)

- SWOT analysis of key players (up to three players)

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Product portfolio, geographical reach, regional presence, and strategic alliances.

Custom Research: Stratview Research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected].

Recent Developments

-

In November 2022, Texas Instruments launched new Matter-enabled software development kits for Wi-Fi and Thread SimpleLink wireless MCUs that streamline adoption of the Matter protocol in various IoT applications.

-

In October 2022, Infineon Technologies launched a new IoT sensors platform, called XENSIV connected sensor kit.

-

In September 2022, Fabless semiconductor manufacturer Silicon Laboratories opened a new R&D unit in Hyderabad, India, with plans to triple its headcount in the country over the next few years.

-

In June 2022, Microsoft collaborated with STMicroelectronics to develop a comprehensive microcontroller-based device security platform.

-

In June 2022, Microchip Technology Inc. launched the AVR-IoT Cellular Mini Development Board based on the AVR128DB48 8-bit MCU. This solution provides a robust platform to build sensor and actuator nodes on 5G narrowband IoT networks.

-

In September 2021, MicroEJ and NXP Semiconductors collaborated to deliver ultra-low power optimization on the i.MX RT500 Crossover MCUs for wearables.