Market Dynamics

Introduction

Polyphthalamide (PPA) is well known for its exceptional performance at high temperatures and remarkable mechanical properties. The PPA prepreg is formed by pre-impregnating carbon/glass fiber with PPA resin and it is used in applications that require extremely light-weight materials.

Although PPA prepreg has critical attributes such as higher heat resistance and lower moisture absorption, these high-performance UD tapes have very limited applications and have a higher cost.

Market Drivers

The PPA prepreg market is still in the developmental phase and most of the companies have their PPA prepreg product in the R&D stage presently. The growing EV production would likely propel the demand for PPA prepreg, as it can be an ideal choice to produce EV battery enclosures. Furthermore, there is a good market opportunity for PPA prepreg in under-the-hood automotive applications with a simple structure.

Recent Developments

The market is currently at the introductory stage with the presence of a few global players, which are currently working on the R&D of PPA prepreg. Many companies backed off from the market after commercializing the product, as there wasn’t any significant market demand. In 2019, Solvay and Marelli Holdings Co., Ltd. developed a steering knuckle prototype using PPA prepregs and compounds.

Segment Analysis

|

Segmentations

|

List of Sub-Segments

|

Dominant and Fastest-Growing Segments

|

|

Form-Type Analysis

|

UD Prepreg and Fabric Prepreg

|

UD prepreg remains the most preferred form category and will continue maintaining its dominance in the years to come.

|

|

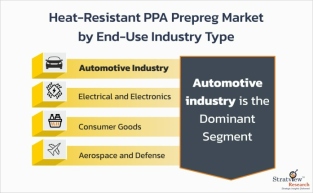

End-Use Industry-Type Analysis

|

Automotive, Electrical and Electronics, Consumer Goods, Energy Storage, Aerospace and Defense, and Others

|

The automotive industry is likely to be the major demand generator of PPA prepreg and is also likely to experience the highest growth in the coming years.

|

|

Reinforcement-Type Analysis

|

Carbon Fiber Prepreg and Glass Fiber Prepreg

|

Glass fiber prepreg is expected to be the dominant and faster-growing reinforcement type over the next ten years.

|

|

Process-Type Analysis

|

Prepreg Layup, Additive Manufacturing, and Others

|

Prepreg layup is estimated to remain the most widely used process type for making parts using prepreg.

|

|

Resin-Type Analysis

|

PA4T, PA9T, and Others

|

PA4T is likely to be the dominant and fastest-growing resin type during 2023-2032.

|

|

Regional Analysis

|

North America, Europe, Asia-Pacific, and the Rest of the World

|

Europe is expected to be the largest market over the next ten years, whereas Asia-Pacific is likely to grow at the highest during the same period.

|

By Form Type

"UD prepreg is estimated to remain the most preferred form type in the market during the forecast period".

The market is segmented into UD prepreg and fabric prepreg. UD prepreg is estimated to remain the most preferred form type in the market during the forecast period. Currently, all three companies are engaged in the development of UD tapes only. With a gradual rise in the demand for PPA prepreg, it is also anticipated that there will be a demand for fabric PPA prepregs in the long run.

By End-Use Industry Type

"The automotive industry is likely to dominate the market during the forecast period".

The market is segmented into automotive, electrical & electronics, consumer goods, energy storage, aerospace and defense, and others. Among the end-use industry types, the automotive industry is likely to dominate the market during the forecast period.

Currently, all the developments related to PPA prepreg are mainly targeted at the automotive industry. However, it is anticipated that energy storage tanks and electrical & electronics would be the next target applications for PPA prepreg in the coming years.

Want to get more details about the segmentations? Register Here

By Fiber Type

"The glass fiber is expected to remain the widely used fiber type in the market during the forecast period".

The market is segmented into carbon prepreg and glass prepreg. Between fiber types, glass fiber is expected to remain the widely used fiber type in the market during the forecast period.

Glass fiber mainly competes in highly cost-sensitive industries such as automotive and it is also preferred for electrical & electronics, and consumer goods applications. On the other hand, carbon fiber is primarily preferred for aerospace & defense applications and is likely to rapidly gain market share in the coming years.

By Resin Type

"PA4T is likely to be the preferred resin type in the market during the forecast period".

The market is classified as PA4T, PA9T, and others. PA4T is likely to be the preferred resin type in the market during the forecast period, owing to its critical advantages, such as high melting point, excellent noise, vibration, and harshness (NVH) properties, along with extreme stiffness and strength.

Regional Analysis

"Europe is expected to be the largest market over the next ten years, whereas Asia-Pacific is likely to grow at the highest during the same period".

In terms of region, Europe is expected to be the largest market for heat-resistant PPA prepregs during the forecast period, following a similar trend of thermoplastic prepreg.

This region is home to all three PPA prepreg manufacturers. On the contrary, the Asia-Pacific region is likely to witness the fastest market growth during the forecast period, mainly driven by the automotive industry in Japan and China.

Want to know which region offers the best growth opportunities? Register Here

Report Features

This report provides market intelligence in the most comprehensive way. The report structure has been kept such that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market. The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

- COVID-19 impact and its recovery curve

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors.

Market Segmentation

This report studies the market, covering 12 years of trend and forecast. The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The Heat-Resistant PPA Prepreg Market is segmented into the following categories:

By Form Type

- UD Prepreg

- Fabric Prepreg

By End-Use Industry Type

- Automotive [Exterior, Interior, and Under-the-Hood]

- Electrical & Electronics

- Consumer Goods

- Energy Storage

- Aerospace & Defense

- Others

By Fiber Type

- Carbon Fiber Prepreg

- Glass Fiber Prepreg

By Process Type

- Prepreg Layup

- Additive Manufacturing

- Others

By Resin Type

- PA4T Prepreg

- PA9T Prepreg

- Others

By Region

- North America (Country Analysis: The USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, The UK, Russia, and the Rest of Europe)

- Asia-Pacific (Country Analysis: China, India, Australia, South Korea, and the Rest of Asia-Pacific)

- Rest of the World (Country Analysis: Saudi Arabia, Brazil, and Others)

Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

- Detailed profiling of additional market players (up to three players)

- SWOT analysis of key players (up to three players)

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Product portfolio, geographical reach, regional presence, and strategic alliances

Custom Research: Stratview Research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected]