Biomaterials Market Insights

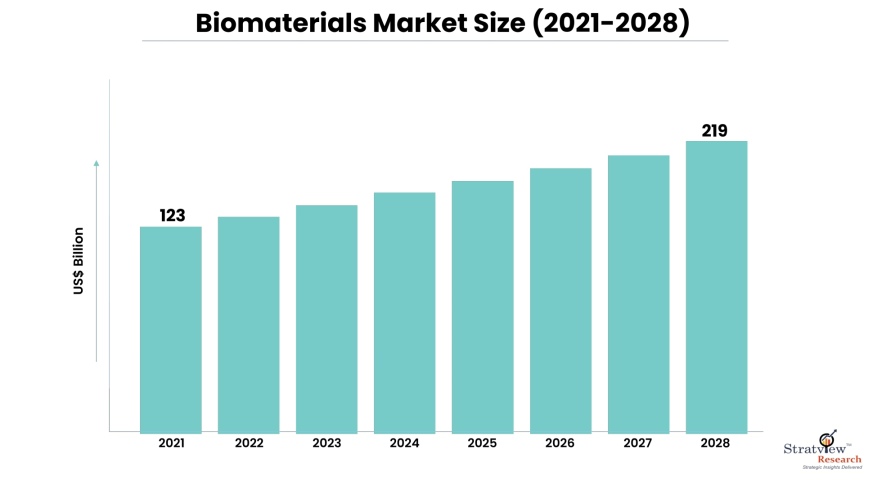

“The global biomaterials market was estimated at US$ 123 billion in 2021 and is expected to grow at a CAGR of 16.3% during 2022-2028 to reach US$ ~219 billion in 2028.”

Want to get a free sample? Register Here

Introduction

Biomaterials are substances engineered to interact with biological systems, serving various medical and healthcare applications. They can be natural or synthetic and are designed to mimic or enhance the functions of living tissues and organs. Biomaterials are used in implants, such as artificial joints and dental fixtures, as well as in drug delivery systems, tissue engineering, and diagnostic tools.

Biomaterials Market Growth & Innovations

The biomaterials market is experiencing rapid growth, driven by the increasing demand for advanced orthopedic implants, such as hip and knee replacements, and targeted drug delivery systems for cancer treatment. The rising prevalence of musculoskeletal disorders, including osteoarthritis and osteoporosis, coupled with advancements in smart biomaterials like piezoelectric scaffolds for bone regeneration, are key market drivers. Patients benefit from the adoption of biocompatible and biodegradable materials, which improve healing and reduce complications. Innovative technologies like 3D bioprinting and biosensors are revolutionizing regenerative medicine, enabling personalized treatments and faster recovery times. Companies are investing heavily in controlled-release drug implants and antimicrobial biomedical coatings to enhance efficacy and patient safety. With the aging global population and the growing demand for minimally invasive medical solutions, the biomaterials market is projected to expand significantly. Natural biomaterials derived from collagen and hyaluronic acid are gaining popularity due to their biocompatibility and reduced risk of adverse reactions, offering safer and more effective applications in tissue engineering and wound healing.

Biomaterials Market Segments' Analysis

|

Segmentations

|

List of Sub-Segments

|

Dominant and Fastest-Growing Segments

|

|

Product-Type Analysis

|

Metallic, Natural, Ceramics and Polymers

|

The polymers product category led the market in terms of revenue in 2021.

|

|

Application-Type Analysis

|

Cardiovascular, Orthopedics, Ophthalmology, Wound Healing, Neurology, Plastic Surgery, Dental and Others

|

The orthopedics application segment dominated the market in terms of revenue.

|

|

Regional Analysis

|

North America, Europe, Asia-Pacific, and Rest of the World

|

North America dominated the market and generated the greatest revenue share in 2021

|

Product Insights

“The polymers product category led the market in terms of revenue in 2021”.

The market is divided into metallic, natural, ceramics, and polymers. Due to the broad range of product applications, the polymers product category led the market in terms of revenue in 2021 and is predicted to maintain its dominance throughout the forecast period. The segment's revenue generation is also anticipated to speed up due to the widespread availability of biopolymers and advanced polymers for bio-resorbable tissue fixation and other orthopedic applications.

One of the pillars of tissue engineering is polymeric biomaterials. Continuous technological advancements in areas including micro-manufacturing, surface modification, drug delivery, nanotechnology, and high-throughput screening are crucial to expanding the use of polymeric materials in tissue engineering.

Application Insights

“The orthopedics application segment dominated the market in terms of revenue”.

The market has been divided into cardiovascular, orthopedics, ophthalmology, wound healing, neurology, plastic surgery, dental, and others. The orthopedics application segment dominated the market in terms of revenue. One of the elements promoting the segment's expansion is the growing use of metallic biomaterials in orthopedic applications because of their strong load-bearing capacity.

Additionally, it is anticipated that ongoing efforts by industry players to introduce new orthopedic implants will boost revenue growth. For instance, DiFusion Inc. got FDA approval for its Xiphos-ZF spinal interbody device in November 2019.

This device is based on a different biomaterial called Zfuze, which is a mix of titanium and poly-ether-ether-ketone. The cytokine indicators that produce inflammation and are linked to the development of fibrous tissue are significantly decreased as a result of this novel biomaterial.

Regional Insights

“North America dominated the market and generated the greatest revenue share in 2021”.

The biomaterials market is broken down geographically into areas like North America, Europe, Asia-Pacific, and the Rest of the World (RoW). Due to measures implemented by numerous governmental and private organizations, North America dominated the market and generated the greatest revenue share in 2021.

The National Science Foundation and the National Institute of Standards and Technology are two of them; they offer information and support relating to the use of biomaterials in biological applications. This has led to a rise in the use of biomaterials in this area. The regional market share has also been influenced by additional elements like advantageous government policies and the existence of numerous significant market participants in this area.

Want to get a free sample? Register Here

Key Players

The following are the key players in the Biomaterials Market (arranged alphabetically)

- BASF SE

- Berkeley Advanced Biomaterials

- Carpenter Technology Corporation

- Collagen Matrix, Inc.

- CoorsTek Inc.

- Corbion

- Covalon Technologies Ltd.

- Dentsply Sirona

- Evonik Industries AG

- Invibio Ltd.

- Johnson & Johnson

- Medtronic plc

- Stryker

- Zimmer Biomet Holdings, Inc.

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Write to us at [email protected]

Recent Developments of Biomaterials Market

Important businesses are investing heavily to grow their presence and keep a competitive edge. They are also implementing techniques including contracts, collaborations, and collaborative models to improve their product catalog. Key vendors are also leaning toward creating more novel goods to broaden their selection of biomaterials. For example,

- In April 2022, to meet the unique requirements and demand for care in ambulatory surgery centers (ASCs) and office-based laboratories, Medtronic and GE Healthcare established a partnership (OBLs). As a result of this new agreement, customers will have access to a wide range of products, financial solutions, and excellent support.

- In March 2022, Evonik Industries officially introduced EUDRATEC Fasteric, a platform for oral drug delivery technology that goes straight over the released target and is utilized for enteric fortification and quick release in the upper smaller intestine. This product development reinforced Evonik's expansion while enhancing the biocompatibility, safety, and functionality of implantable goods utilized by medical device customers.

Report Features

This report provides market intelligence in the most comprehensive way. The report structure has been kept such that it offers maximum business value. It provides critical insights into the market dynamics and will enable strategic decision-making for the existing market players as well as those willing to enter the market.

What Deliverables Will You Get in this Report?

|

Key questions this report answers

|

Relevant contents in the report

|

|

How big is the sales opportunity?

|

In-depth Analysis of the Biomaterials Market

|

|

How lucrative is the future?

|

The market forecast and trend data and emerging trends

|

|

Which regions offer the best sales opportunities?

|

Global, regional, and country-level historical data and forecasts

|

|

Which are the most attractive market segments?

|

Market segment analysis and Forecast

|

|

Which are the top players and their market positioning?

|

Competitive landscape analysis, Market share analysis

|

|

How complex is the business environment?

|

Porter’s five forces analysis, PEST analysis, Life cycle analysis

|

|

What are the factors affecting the market?

|

Drivers & challenges

|

|

Will I get the information on my specific requirement?

|

10% free customization

|

Research Methodology

This strategic assessment report from Stratview Research provides a comprehensive analysis that reflects today’s biomaterials market realities and future market possibilities for the forecast period. The report segments and analyzes the market in the most detailed manner in order to provide a panoramic view of the market. The vital data/information provided in the report can play a crucial role for market participants as well as investors in the identification of the low-hanging fruits available in the market as well as to formulate the growth strategies to expedite their growth process.

This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools. More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data. We conducted more than 15 detailed primary interviews with market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

- Detailed profiling of additional market players (up to three players)

- SWOT analysis of key players (up to three players)

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Product portfolio, geographical reach, regional presence, and strategic alliances.

Custom Research:

Stratview Research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected].