Market Insights

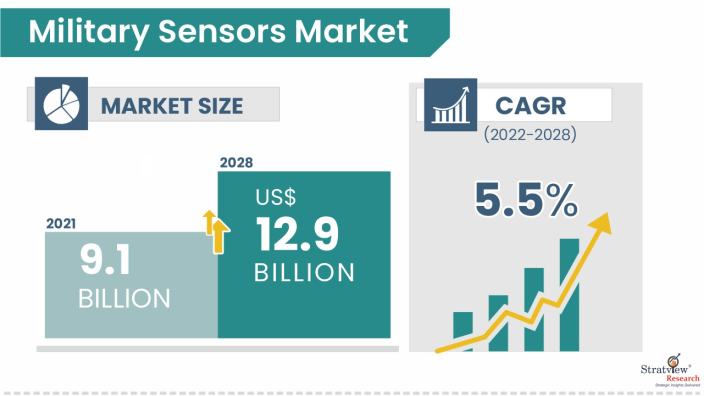

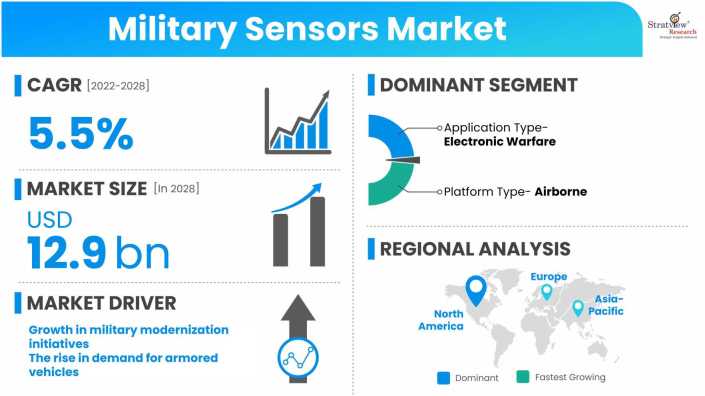

The military sensors market was estimated at USD 9.1 billion in 2021 and is likely to grow at a CAGR of 5.5% during 2022-2028 to reach USD 12.9 billion in 2028.

Want to know more about the market scope? Register Here

Market Dynamics

Military sensors' long-term market drivers are still robust, and prior to the pandemic, the market had begun to show indications of recovery from the significant market price reset. With the COVID-19 epidemic ravaging the globe, many sectors are struggling to survive. Different governments and sensor-related firms are responding differently to the new circumstance. Certain product releases are proceeding while others are not; some testing is being postponed while others are continuing; some businesses are still open while others have closed.

Because militaries throughout the world are buying more defensive systems, the market for military sensors is expanding significantly. A weapon, an aircraft, or an electronic device's military sensors are a subsystem that detects changes in its surroundings or scans them to acquire data. The data is subsequently sent to another electronic system, often a computer processor, for processing and data analysis. In a wide range of systems for navigation, weapon control, active guiding, target tracking, and environmental awareness, military sensors are utilized in missiles, battles, airplanes, and radars. Fog, smoke, and dust can also be detected using sensors like electro-optical ones.

The drivers driving the worldwide military sensors market include:

- The growth in military modernization initiatives

- The rise in demand for armored vehicles

- The rise in the usage of unmanned vehicles like UAVs

The market expansion might be hampered by regulations governing the development and transfer of weapons systems or related technologies. In contrast, the growth of the Internet of Things (IoT), micro-electrochemical systems (miniature mechanical & electronics integrated devices), and artificial intelligence (AI) provide new routes in the sector.

Want to have a closer look at this market report? Click Here

Several investments/guidelines in the industry have been directed in recent years, which would boost the overall market. Some of them are:

- Defense organizations are concentrating on unmanned vehicles to save operating costs and improve operability in challenging environments. Lockheed Martin has received a 12,300,000 USD contract from the US Defense Advanced Research Projects Agency (DARPA) to create an autonomous underwater vehicle with extended range, long endurance, and payload capability (UUV). Additionally, unmanned vehicles (UVs) or drones use cutting-edge sensors including light detection and ranging (LiDAR) sensors, capacitive fuel level sensors, and ultrasonic fuel flow sensors. As a result, the global market for military sensors will be driven by the development of cutting-edge sensors for unmanned vehicles and the rising demand for drones.

Covid-19 Impact

Due to labor scarcity, the government's lockdown campaign to stop the spread of COVID-19 has had an effect on the manufacturers of military sensors. Due to COVID-19's disruption of the supply chain, sensor producers are experiencing a shortage of components required for the development and production of military sensors. Due to travel limitations enforced by the government to manage the COVID-19 epidemic, defence contractors who depend on an international workforce are currently experiencing operational problems. Defense organizations are required to postpone ongoing initiatives as well as R&D in order to abide by the shutdown order issued by authorities.

North American supply chains and logistics have been disrupted as a result of the COVID-19 epidemic. Approximately 80% of manufacturers anticipate that the pandemic would have a negative financial impact on their companies, according to a poll released by the National Association of Manufacturers (NAM) in March 2020. Some significant businesses in the area have shut down their offices and are considering firing their staff. The US manufacturing industry, which employs around 13 million people, is also anticipated to be negatively impacted by the pandemic for two main reasons: first, many industrial jobs are onsite, which limits the possibility of working remotely. Second, as the economy has slowed, there has been a decline in demand for industrial goods both domestically and internationally.

Segments Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High Growth Opportunity

|

|

Application Type Analysis

|

Combat Operations, Target Recognition, Electronic Warfare, Communication & Navigation, Command & Control, Surveillance & Monitoring, and Intelligence & Reconnaissance

|

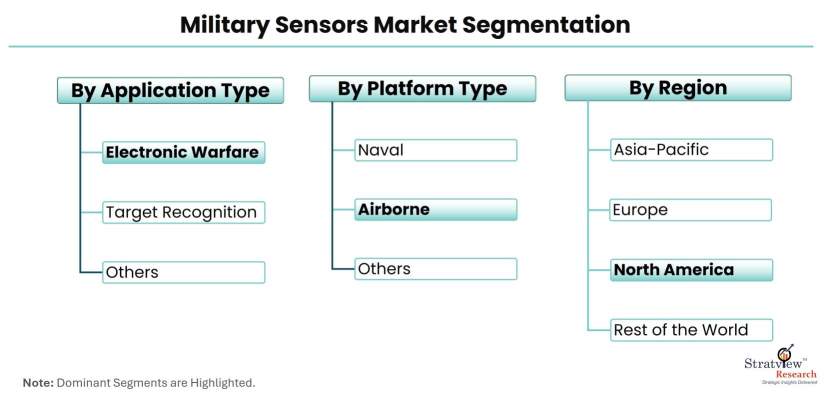

The electronic warfare segment of the military sensors market will be driven by significant technological advancements and the integration of sensors and electronics in military equipment, which are leading to a shift toward multi-layered defense systems

|

|

Platform Type Analysis

|

Space, Munition, Land, Naval, and Airborne

|

The defense industry's expanding use of airborne sensors is fueling the market for military sensors' airborne segment expansion.

|

|

Regional Analysis

|

North America, Europe, Asia-Pacific, and Rest of the World

|

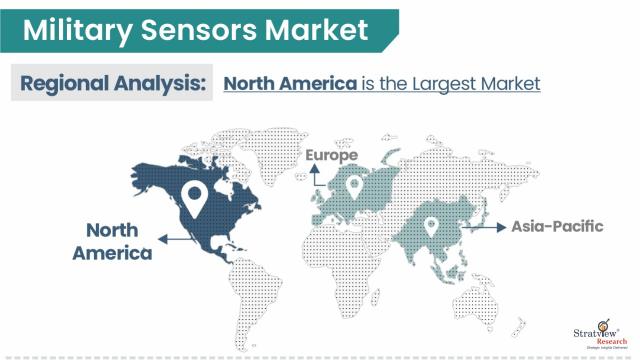

North America has had rapid expansion in the market for military sensors over the past ten years, and it is anticipated that it will maintain its leadership position during the forecast period.

|

By Application Type

During the forecast period, it is anticipated that the electronic warfare segment of the military sensors market will be driven by significant technological advancements and the integration of sensors and electronics in military equipment, which are leading to a shift toward multi-layered defense systems. In addition to these elements, the growing usage of UAV systems and the demand for communication jamming and ground surveillance present potential for the electronic warfare sector. To start low-rate initial manufacturing of an electronic warfare system for F-15s that would shield pilots from cutting-edge threats arriving over the electromagnetic spectrum, BAE Systems won a USD 58 million contract in March 2021. The range of work covered by the contract includes multispectral sensors, countermeasures, signal processing, microelectronics, algorithms for self-defense, situational awareness, and geolocation.

By Platform Type

The defense industry's expanding use of airborne sensors is fueling the market for military sensors' airborne segment expansion. The widespread use of UAVs is one of the factors driving the military sensors market for air-based systems. UAVs are being purchased by nations all around the world to boost surveillance. Various nations are also expanding their fleets of fighter aircraft or modernizing their current fighter fleets with cutting-edge sensor technology, which will significantly contribute to the market growth for airborne military sensors. The need for airborne military sensors will be driven by the quick development of geopolitical dynamics throughout the world, along with rising terrorist threats, procurement plans of growing countries, modernizations, and political instability in a few locations.

Regional Insights

North America has had rapid expansion in the market for military sensors over the past ten years, and it is anticipated that it will maintain its leadership position during the forecast period. Some of the factors anticipated to propel the growth of the military sensors market in this region include significant expenditures in R&D activities for the development of new military power solutions by major companies and the rising need for lightweight and energy-efficient sensors. Due to easy access to numerous cutting-edge technologies and significant investments being made by manufacturers in the US for the development of better health monitoring and warfare sensors, the US is anticipated to lead the growth of the North American military sensors market during the forecast period. In the area, there have been a number of breakthroughs in the field of military sensors.

Know the high-growth countries in this report. Register Here

Key Players

There is stiff competition in the military sensors market. The growth of the companies is directly dependent on industry conditions and government support. These companies differentiate their military sensors based on their quality and penetration in the target and emerging markets. Also, some major mergers and acquisitions in the industry recently have significantly influenced the competitive dynamics. For example:

- Honeywell International was given a cost-plus-fixed-fee modification contract to integrate the Advanced Battle Management Systems (ABMS) with a variety of sensors and sensing modalities.

- Inertial Navigation Kits, which employ motion and rotation sensors to continually determine through dead reckoning the location, the orientation, and the velocity of a moving object without the need for external references, were purchased by the US Army from Honeywell International for USD 7.7 million.

- For DARPA's Blackjack satellite constellation, Raytheon created the autonomous mission management sensor system known as the Pit Boss. In order to offer constant worldwide coverage for several applications, such as missile warning, it will network sensors.

The overall competitive landscape has been affected due to these mergers and acquisitions. The following are the major players in the military sensors market:

- TE Connectivity Ltd

- Raytheon Company

- Thales Group

- KONGSBERG GRUPPEN ASA

- Honeywell International Inc.

- Lockheed Martin Corporation

- General Electric Company

- BAE Systems plc

- Ultra Electronics

- Aerosonic LLC (Transdigm Group)

- Viooa Imaging Technology Inc.

- Imperx Inc.

- Microflown Avisa BV

- Vectornav Technologies LLC

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Write to us at sales@stratviewresearch.com

Research Methodology

This strategic assessment report, from Stratview Research, provides a comprehensive analysis that reflects today’s military sensors market realities and future market possibilities for the forecast period of 2022 to 2028. After a continuous interest in our military sensors market report from the industry stakeholders, we have tried to further accentuate our research scope to the military sensors market to provide the most crystal-clear picture of the market. The report segments and analyses the market in the most detailed manner to provide a panoramic view of the market. The vital data/information provided in the report can play a crucial role for the market participants as well as investors in the identification of the low-hanging fruits available in the market as well as to formulate the growth strategies to expedite their growth process.

This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools. More than 1000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data. We conducted more than 15 detailed primary interviews with the market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Report Features

This report provides market intelligence in the most comprehensive way. The report structure has been kept such that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market. The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

- COVID-19 impact and its recovery curve

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors

Market Segmentation

This report studies the market, covering a period of 12 years of trends and forecasts. The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The military sensors market is segmented into the following categories:

By Platform Type

- Space

- Munition

- Land

- Naval

- Airborne

By Component Type

- Software

- Hardware

- Cybersecurity Solutions

By Application Type

- Combat Operations

- Target Recognition

- Electronic Warfare

- Communication & Navigation

- Command & Control

- Surveillance & Monitoring

- Intelligence & Reconnaissance

By Region

- North America (Country Analysis: the USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, the UK, Russia, Spain, and Rest of Europe)

- Asia-Pacific (Country Analysis: China, Japan, India, South Korea, and Rest of Asia-Pacific)

- Rest of the World (Sub-Region Analysis: Latin America, the Middle East, and Others)

Click Here, to learn the market segmentation details.

Report Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

- Detailed profiling of additional market players (up to three players)

- SWOT analysis of key players (up to three players)

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Product portfolio, geographical reach, regional presence, and strategic alliances.

Custom Research: Stratview research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to sales@stratviewresearch.com.