Market Insights

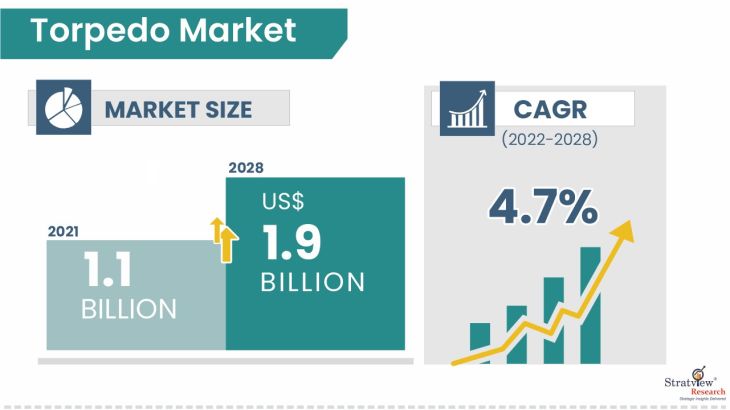

The torpedo market was estimated at USS 1.1 billion in 2021 and is likely to grow at a CAGR of 4.7% during 2022-2028 to reach USD 1.9 billion in 2028.

Want to know more about the market scope? Register Here

Market Dynamics

Introduction

An explosive warhead is attached to a self-propelled weapon called a torpedo, intended to explode as it meets the target or closes by. Heavyweight and lightweight torpedoes are the two market segments for torpedoes, respectively, depending on weight.

The sector of lightweight torpedoes includes those that weigh less than 500 kg, whereas the segment of heavyweight torpedoes includes those that weigh more than 500 kg.

Market Drivers

Major economies are involved in trade and cold wars for their interest and disinterest, positively impacting market growth. For instance, the US was in a trade war with China, which shattered in 1949 as part of the Chinese mainland, the delivery of technology that would allow Taiwan to produce its advanced weapons.

The defense industry's growth directly impacts the Torpedo market's growth. The high demand from the navy is closely attributed to the growth. The increasing number of territorial conflicts worldwide will show positive market growth during the assessment period.

The globe is seeing a lot of navy modernization efforts since maritime security is one of the most important defense units. Various ships, aircraft, wire-guided torpedoes, and wake-homing torpedoes are all part of China's navy modernization effort, including improvements in maintenance & logistics, personnel education, and training.

China's navy modernization efforts are intended to improve capabilities for handling any unfortunate series of events or for gaining more control over China's near-seas region, protecting China's commercial sea lines of communication (SLOCs), particularly those connecting China to the Persian Gulf, posing a threat to the U.S.'s influence in the Western Pacific, and reaffirming China's status as a major world power. Consequently, this will fuel the expansion of the worldwide torpedo market throughout the anticipated time.

Several investments in the defense industry have been directed at Torpedo in recent years, which would boost the overall market. Some of them are:

- Overall funding for the US Department of the Navy was sought at USD$211.7 billion, which is a 1.8% increase above the FY21 proposal. However, the Navy's share of that is just USD$163.9 billion, or 0.6%, higher than in FY21.

- India is now continuing to invest in its naval forces. Last month, the Union Minister of State for Defence announced that expected orders for surface ships and submarines with torpedos from 2020 to 2030 by the Indian Navy would be worth $51 billion.

- According to the Department for Promotion of Industry and Internal Trade (DPIIT), from April 2020 – June 2021, the Foreign Direct Investment (FDI) equity flow in the Indian Defense sector was valued at $10.15 million.

Recent Developments

There is stiff competition in the Torpedo market. The growth of the companies is directly dependent on industry conditions and government support. These companies differentiate Torpedo based on their quality and penetration in the target and emerging markets. Also, some major mergers and acquisitions in the industry recently have significantly influenced the competitive dynamics. For example:

- In October 2021, the Indian Defence Ministry signed a contract (worth INR 423 crore (USD 56.38 million)) with the US government to procure MK 54 torpedo and expendables such as chaff and flares for P-8I anti-submarine warfare aircraft of the Indian Navy.

- In October 2021, Thales Australia won a contract from the Australian Department of Defence to provide the Royal Australian Navy’s (RAN) MU90 lightweight torpedo that is worth of around $14.5 million.

- In March 2019, General Dynamics Corp’s subsidiary, Electric Boat, received UDS$ 2 billion in contract modification by the U.S. Navy for long-term supply for the main propulsion unit and ship service turbine-generator efforts. Electrical and mechanical components of the system.

Covid-19 Impact

Nearly all industrial sectors have been proven to be negatively impacted by COVID-19. COVID-19's impacts on the defense sector were minimal compared to other market industries. However, there was even a little decline in growth rate because of the temporary shutdown or halt in industrial facilities brought on by the lockdown effect.

Due to significant financial losses brought on by the epidemic, the world is currently experiencing an economic crisis, which has restricted investment in the defense industry.

The government has backed investments in defense equipment to protect the military and the populace. This aspect has accelerated the expansion of the torpedo market size, and it is anticipated that this growth will continue significantly to meet the stated CAGR.

Segments Analysis

|

Segmentations

|

List of Sub-Segments

|

Dominant and Fastest-Growing Segments

|

|

Operation-Type Analysis

|

Autonomous and Guided

|

The autonomous category has emerged as the leading segment in the market.

|

|

Launch Platform-Type Analysis

|

Aerial and Naval

|

The naval sector has held the largest share in recent years.

|

|

Propulsion-Type Analysis

|

Thermal Powered and Electric Powered

|

Electric-powered torpedoes have dominated the market for naval combat operations in recent years.

|

|

Category-Type Analysis

|

Light Weight and Heavy Weight

|

The heavyweight category has accounted for the largest market share for torpedoes.

|

|

Regional Analysis

|

North America, Europe, Asia-Pacific, and Rest of the World

|

North America is likely to maintain its supremacy in the market throughout the forecast period.

|

By Operation Type

“The autonomous category has emerged as the leading segment in the torpedo market”.

The market is segmented into two types of operation namely autonomous and guided. Due to numerous qualities like rapid speed and high capacity, which are useful in warfare, the autonomous category has accounted for the biggest torpedo market share between the two. Therefore, the autonomous category is expected to see the highest growth rate throughout the projection period.

By Launch Platform Type

“The naval sector has held the largest share in recent years”.

The market is segmented into aerial and naval platforms. Aerial platforms include helicopters and airplanes, while naval platforms include ships and submarines capable of torpedoes with significant weight. Consequently, the naval sector has seen the highest share in recent years.

By Propulsion Type

“Electric-powered torpedoes have dominated the market for naval combat operations in recent years”.

The market is divided into two categories: thermal-powered and electric-driven propulsion. Due to the increased lethality and effectiveness of electric-powered torpedoes in naval combat operations, the market for these has dominated in recent years.

By Category Type

“The heavyweight category has accounted for the largest market share for torpedoes”.

The torpedo market is further divided into heavyweight and lightweight torpedoes. Lethal warheads can be added to the highly weighted torpedoes, increasing damage. As a result, in recent years, the heavily weighted category has represented the biggest market share for torpedoes.

Regional Insights

“North America will dominate the market, with Asia Pacific experiencing the fastest growth during the forecast period”.

The market is broken down geographically into areas like North America, Europe, Asia-Pacific, and the Rest of the World (RoW). In terms of regions, North America is likely to maintain its supremacy in the Torpedo market throughout the forecast period. During the anticipated term, it is anticipated to have the quickest growth.

Regions like the US are speeding the growth of the torpedo market in the North American area due to the rise in investment in missile and rocket systems to develop the naval warfare system. Due to the need for military equipment for diverse military activities in navy and air force missions, the remaining regions, including Europe and the Asia Pacific, continue to develop steadily.

Concurrently, Asia Pacific is expected to witness the fastest growth in the global Torpedo market during the forecast period. The key factor responsible for the swift growth is the increased demand for torpedos by the navy. The increased defense and individual spending on security in countries such as China and India inject huge growth prospectus for the Torpedo market in the Asia Pacific region.

Know the high-growth countries in this report. Register Here

Key Players

The following are the key players in the torpedo market (arranged alphabetically)

- ASELSAN AS

- BAE Systems PLC

- Bharat Dynamics Limited

- JSC Tactical Missiles Corporation

- Leonardo SpA

- Lockheed Martin Corporation

- Mitsubishi Heavy Industries Ltd

- Naval Group

- Northrop Grumman Corporation

- Raytheon Technologies Corporation

- Saab AB

- ThyssenKrupp AG

The overall competitive landscape has been affected due to these mergers and acquisitions.

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Write to us at sales@stratviewresearch.com

Report Features

This report provides market intelligence in the most comprehensive way. The report structure has been kept such that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market. The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

- COVID-19 impact and its recovery curve

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors

Market Segmentation

This report studies the market, covering a period of 12 years of trends and forecasts. The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The torpedo market is segmented into the following categories:

By Operation Type

By Launch Platform Type

By Propulsion Type

- Thermal Powered

- Electric Powered

By Category Type

- Light Weight

- Heavy Weight

By Region

- North America (Country Analysis: the USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, the UK, Russia, Spain, and Rest of Europe)

- Asia-Pacific (Country Analysis: China, Japan, India, South Korea, and Rest of Asia-Pacific)

- Rest of the World (Sub-Region Analysis: Latin America, the Middle East, and Others)

Research Methodology

This strategic assessment report, from Stratview Research, provides a comprehensive analysis that reflects today’s torpedo market realities and future market possibilities for the forecast period of 2022 to 2028. After a continuous interest in our torpedo market report from the industry stakeholders, we have tried to further accentuate our research scope to the torpedo market to provide the most crystal-clear picture of the market. The report segments and analyses the market in the most detailed manner to provide a panoramic view of the market. The vital data/information provided in the report can play a crucial role for the market participants as well as investors in the identification of the low-hanging fruits available in the market as well as to formulate the growth strategies to expedite their growth process.

This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools. More than 1000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data. We conducted more than 15 detailed primary interviews with the market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

- Detailed profiling of additional market players (up to three players)

- SWOT analysis of key players (up to three players)

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Product portfolio, geographical reach, regional presence, and strategic alliances.

Custom Research:

Stratview Research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to sales@stratviewresearch.com.