Market Insights

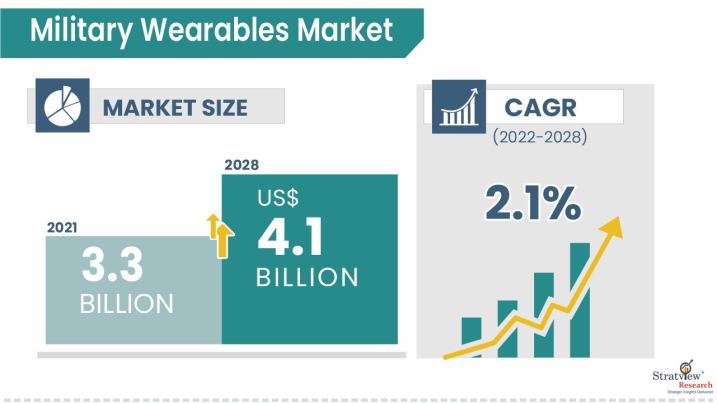

The military wearables market was estimated at USD 3.3 billion in 2021 and is likely to grow at a CAGR of 2.1% during 2022-2028 to reach USD 4.1 billion in 2028.

Want to know more about the market scope? Register Here

Market Dynamics

Introduction

The gear that troops use while on operations or in military drills is known as military wearables. Global soldier casualties have decreased thanks to technology. Military wearables come in various forms, including headgear, eyeglasses, bodywear, and others. Military wearables enable total situational awareness, improve communication between troops and military stations, and monitor soldiers' physical health while on operations.

One of its additional advantages is the capacity of military wearables to resist difficult climatic conditions, such as high temperatures, inside water, and others. Numerous nations are making investments in very effective military wearables. For instance, the U.S. army and Lockheed Martin agreed on a 7.5 million USD deal in November 2019 to improve exoskeletons.

Market Drivers

The market for military wearables is expanding due to causes such as rising asymmetric warfare, purported geopolitical crises, and plans for troop modernization. However, it is anticipated that the market development would be hampered by emerging economies purchasing conventional combat equipment rather than cutting-edge military wearables. On the other hand, the exoskeleton, smart textiles, power and energy management, and communication and computing present opportunities for the market for military wearables to expand in the future.

Defense agencies' priority has been ensuring the safety of their troops, particularly in light of the ongoing conflicts in places like Yemen, Syria, and Iraq. Military wearables keep tabs on the soldiers' movements and give the military office real-time situational knowledge, which enhances the soldiers' teamwork. Military wearables also help with troop training. Military wearables will thus continue to be in demand due to the increased necessity for army coordination and training.

Emergency economies are increasingly characterized by financial instability, a severe obstacle to market expansion. Due to high inflation and low GDP, developing nations like South Africa, Sudan, and the Philippines, among others, are compelled to spend less money on cutting-edge military technology and more money on traditional weapons systems. Due to rising economic concerns, these countries have dramatically reduced their defence investment and expenditure. This prevents many countries' defense ministries from making investments to improve the capabilities of their army systems, which is restricting the growth of the market for military equipment.

Most countries now lack clarity on their fighting needs due to the rapidly evolving nature of the battle. The expected performance of technologies and their availability are also at odds with one another. The current system-based efforts for upgrading soldiers are hampered by this lack of technological preparation from continuing forward as planned.

Additionally, the ambiguity surrounding the long-term military requirements of many countries and the incapacity of technology to deliver to expectations. Governments like India, South Korea, and Brazil have chosen the incremental approach, which modernizes military wearables in stages, to ensure sustained procurements and avoid protracted delays. These governments have recognized the challenges faced by the soldier modernization program pioneers.

Several investments/guidelines in the industry have been directed in recent years, which would boost the overall market. Some of them are:

- Global producers of military wearables are always working to offer a variety of cutting-edge technology in the fields of communication and intelligence to support troops' tactical and rapid combat actions. To solve shortcomings in lethality, mobility, survivability, sustainability, and C4I, companies developing contemporary military wearables place a heavy focus on developing integrated modular military wearables. Defense agencies from several countries are developing and manufacturing better or even ballistic materials. Modern technologies are helpful when injured soldiers are unable to send a message for assistance. Smart clothing responds to these circumstances by identifying the issues and sending the relevant information using radio communication devices

Recent Developments

There is stiff competition in the military wearables market. The growth of the companies is directly dependent on industry conditions and government support. These companies differentiate their military wearables based on their quality and penetration in the target and emerging markets. Also, some major mergers and acquisitions in the industry recently have significantly influenced the competitive dynamics. For example:

- In 2022, the European Air Force's Airbus A330-200 MRTT aircraft will get DRICM (Direct infrared Countermeasures) and EW (Electronic Warfare) equipment from Elbit Systems.

- In 2022, the U.S. Marine Corps received a contract from Elbit Systems Ltd. of America for squad binocular night vision goggles systems for USD 49 million.

- In 2022, under the Combat Net Radio (CNR) Modernization Program, Thales was granted the contract to provide the U. S. Army with cutting-edge tactical radio. This contract was given as part of the company's effort to replace its antiquated single-channel ground and aerial radio system (SINCGARS), valued at USD 6 billion.

COVID-19 Impact

The proclaimed lockdowns and governmental limitations on public gatherings have slowed the production rate of military wearables businesses worldwide. Canceling training activities like Pitch Black 2020, Milan 2020, and others owing to the COVID-19 pandemic may affect the purchase of military wearables.

After COVID-19, the need for military wearables will significantly increase as combat training will resume. Due to the COVID-19 epidemic, governments' expenditure is shifting toward economic recovery, which might cause manufacturers to receive fewer orders for military wearables.

Segments Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High Growth Opportunity

|

|

Wearable Type Analysis

|

Headwear, Eyewear, Wristwear, Hearables, and Bodywear

|

The headwear sector is anticipated to dominate the military wearables market during the forecast period.

|

|

Regional Analysis

|

North America, Europe, Asia-Pacific, and the Rest of the World

|

North America is expected to maintain its supremacy in the market, while the Asia Pacific is projected to witness the fastest growth during the forecast period.

|

By Wearable Type

“The headwear sector is projected to dominate the military wearables market during the forecast period.”

The market is segmented into headwear, eyewear, wristwear, hearables, and bodywear. The headwear sector is anticipated to dominate the military wearables market during the forecast period. The wearables market is driven by a significant demand for headgear incorporating cutting-edge technology, including augmented reality (AR) and virtual reality (VR).

A fire control computer, an integrated camera, and a display with improved low-light performance are all features of contemporary military wearables. For instance, Surface Optics Corporation created a multispectral 3D camera technology that collects the data necessary to produce entire multispectral cubes with each focus plane exposure.

By Technology Type

The market is segmented into communication & computing, network and connectivity management, navigation, vision & surveillance, exoskeleton, monitoring, power, and energy source.

Regional Insights

“North America is expected to maintain its supremacy in the market, while Asia Pacific is projected to witness the fastest growth during the forecast period."

The market is broken down geographically into areas like North America, Europe, Asia-Pacific, and the Rest of the World (RoW). In terms of regions, North America is likely to maintain its supremacy in the military wearables market throughout the forecast period. In terms of market share for portable military sensors in 2020, North America is expected to continue to lead the sector. The growth of military platform data security is predicted to fuel the need for portable military sensors in the coming years due to the increased requirement for better military modernization efforts and large investments to monitor and develop the military's health.

Concurrently, the Asia Pacific is expected to witness the fastest growth in the military wearables market during the forecast period. Most nations in the area aim to make infantry soldiers more deadly, resilient, and mobile while also transforming them into independent fighting units. The expansion of the military wearables market in the area is also driven by increased defence spending and expenditures in upgrading various law enforcement organizations in these nations.

Know the high-growth countries in this report. Register Here

Key Players

The following are the key players in the military wearables market (arranged alphabetically)

- ASELSAN A.

- BAE Systems

- Bionic Power Inc.

- Elbit Systems Ltd.

- General Dynamics Corporation

- Interactive Wear AG

- L3Harris Technologies Inc

- Leonardo S.P.A.

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Rheinmetall AG

- Saab AB

- Safran

- TE Connectivity Ltd.

- TT Electronics Plc

- Teledyne Flir Llc

- Thales Group

- Ultra-Electronics

- Viasat Inc.

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Write to us at [email protected].

Report Features

This report provides market intelligence in the most comprehensive way. The report structure has been kept such that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market. The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

- COVID-19 impact and its recovery curve

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors

Market Segmentation

This report studies the market, covering a period of 12 years of trends and forecasts. The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The military wearables market is segmented into the following categories:

By Technology Type

- Communication & Computing

- Network and Connectivity Management

- Navigation,

- Vision & Surveillance

- Exoskeleton

- Monitoring

- Power & Energy Source

By Application Type

- Heart Monitor

- Performance Monitor

By Wearable Type

- Headwear

- Eyewear

- Wristwear

- Hearables

- Bodywear

By End-Use Type

By Region

- North America (Country Analysis: the USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, the UK, Russia, Spain, and Rest of Europe)

- Asia-Pacific (Country Analysis: China, Japan, India, South Korea, and Rest of Asia-Pacific)

- Rest of the World (Sub-Region Analysis: Latin America, the Middle East, and Others)

Research Methodology

This strategic assessment report, from Stratview Research, provides a comprehensive analysis that reflects today’s military wearables market realities and future market possibilities for the forecast period of 2022 to 2028. After a continuous interest in our military wearables market report from the industry stakeholders, we have tried to further accentuate our research scope to the military wearables market to provide the most crystal-clear picture of the market. The report segments and analyses the market in the most detailed manner to provide a panoramic view of the market. The vital data/information provided in the report can play a crucial role for the market participants as well as investors in the identification of the low-hanging fruits available in the market as well as to formulate the growth strategies to expedite their growth process.

This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools. More than 1000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data. We conducted more than 15 detailed primary interviews with the market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

- Detailed profiling of additional market players (up to three players)

- SWOT analysis of key players (up to three players)

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Product portfolio, geographical reach, regional presence, and strategic alliances.

Custom Research:

Stratview Research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected].