Market Insights

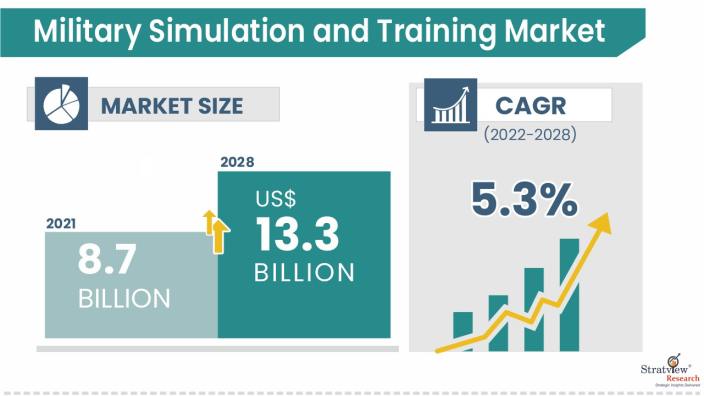

The military simulation and training market was estimated at USD 8.7 billion in 2021 and is likely to grow at a CAGR of 5.3% during 2022-2028 to reach USD 13.3 billion in 2028.

Want to know more about the market scope? Register Here

Market Dynamics

Introduction

Military simulation and training involve the use of advanced technologies to replicate realistic combat scenarios, allowing military personnel to practice and enhance their skills in a controlled environment. Utilizing virtual reality, computer simulations, and other sophisticated tools, these programs enable soldiers to simulate diverse situations, from battlefield tactics to vehicle operations, without actual combat risks. This immersive training fosters strategic thinking, teamwork, and decision-making skills, preparing military forces for a wide range of potential challenges. The goal is to enhance readiness, reduce casualties, and ensure effective responses in real-world situations through experiential learning in a simulated setting.

Market Drivers

Global demand for military simulation and training is anticipated to be driven by rising defence spending and new technological advancements to boost military capabilities and efficiency. Rising geopolitical tensions between the various countries and global strengthening initiatives are driving defence investment in these areas. This, in turn, is driving designers and makers of high-tech, high-resolution military simulators to create more of them for use in the training of defence personnel.

A real-time scenario may be portrayed using realistic digital scenarios, and military simulation can be utilized to teach aspiring troops. One of the key elements influencing the market expansion is projected to be the rising investments in simulation software. Additionally, the industry is driven by defense ministries of various nations reforming and changing their military in novel ways.

The armed forces of several nations worldwide are rapidly using military simulation and virtual training. Because they are built using Commercial-off-the-Shelf (COTS) components, they assist in lowering training expenses. The simulators have a minimal cost of development. These elements are crucial for the military's substantial advancements in simulation-based training systems.

The military simulation and virtual training industry is expected to increase due to the rising need for equipment modifications on already purchased items and orders for new, cutting-edge equipment. For instance, Augmented Reality (AR) visual systems were created by Bohemia Interactive Simulation for Textron, Inc. These systems provide a synthetically created visual picture and facilitate a trainee's interactions with the actual world utilizing VR/AR technology.

It is anticipated that developing portable simulation systems, such as vehicle, flight, and combat simulation, would provide solutions that may be customized to meet unique demands and objectives. These technologies can enhance the methods for applications relating to aerial, terrestrial, and marine platforms providing warriors with strategic experience. Soldiers' ability and general comprehension are improved via simulation training. These systems enable the armed services to improve their proficiency in handling sophisticated missile systems and intricate electronic military apparatus, which is expected to drive market expansion.

Because it takes so long to create a reproduction of any proven aircraft, product development in the simulator industry is a drawn-out process. Additionally, OEM certification is needed before flight simulator developers may create a duplicate of an aircraft, which extends the time and expense of development. Additionally, producers need to provide clients with items that are versatile and adaptive to their demands while also enabling them to deal with the ever-changing environment of pilot training. Providing the necessary simulators on time is difficult since they must also adhere to safety and regulatory management constraints.

Covid-19 Impact

Due to travel limitations, the COVID-19 epidemic has had a detrimental influence on the global military simulation and training market, and it is predicted that this will continue through 2020. The broader economy has been harmed, and contributors like market players are creating smart cost-saving initiatives. Regulatory and legislative changes, reliance on labor, working capital management, and liquidity and solvency management are the main risk considerations for market participants in military simulation and training. During the pandemic, most development facilities for military simulation and training have been shut down due to travel restrictions, a lack of labor, and disruptions in the supply chain.

Several investments/guidelines in the industry have been directed in recent years, which would boost the overall market. Some of them are:

- The need for simulators and the demand for autonomous systems in commercial and defence applications are anticipated to rise. Highly advanced unmanned simulators, irrespective of hardware configurations, have been developed by AEgis Technologies Group (US) and Havelsan Inc. (US) to replicate any UAS with any sensor operator and payload suite. These simulators can build a simulated battlefield in real-time, facilitating initial training, fundamental payload, and flight operations, mission rehearsals, and mission planning. However, they must be affordable, able to simulate flight dynamics precisely, have an error-tolerant control system architecture, and provide interoperable multi-vehicle simulation.

Segments Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High Growth Opportunity

|

|

Application Type Analysis

|

Army, Aviation, Naval

|

The aviation industry is anticipated to have a greater market share.

|

|

Regional Analysis

|

North America, Europe, Asia-Pacific, and Rest of the World

|

North America is likely to maintain its supremacy in the military simulation and training market throughout the forecast period.

|

By Type

The market is segmented into live, virtual, and constructive.

By Technology Type

The market is divided into 5G, robotic process automation, big data analytics, Artificial Intelligence, Internet of Things, 3D Printing, cloud computing & master data management, digital twin, blockchain, and AR & VR.

By Application Type

The market is segmented into army, naval, and aviation. In the anticipated year, the aviation industry is anticipated to have a greater market share. This is mostly because airplanes are more sophisticated and risky than other end users. For instance, a single error made by the pilots of a military aircraft during takeoff or landing might result in the loss of complex military equipment, the loss of life on board, and risk to the mission. This complexity compelled the military authorities to adopt simulator-based training for pilots.

Regional Analysis

In terms of regions, North America is likely to maintain its supremacy in the military simulation and training market throughout the forecast period. The main causes driving the need for new ship commanders and crew are the increased orders from the US and Canada to replace the outdated navy fleet with new ones and the increased export of products. Additionally, this results in a rise in demand for military training programs. Between 2019 and 2038, North America is expected to need more than 193,000 aviation technicians and maintenance personnel, according to Boeing Technician Outlook 2019. During the projection period, it is predicted that this will increase demand for maintenance staff training throughout the area. The market is also anticipated to be driven by the presence of well-known producers and integrators of this Military Simulation and Training, such as Lockheed Martin (US), Northrop Grumman (US), and L3Harris Technologies, Inc. (US), and Raytheon Technologies (US).

Concurrently, the military simulation and training market in the Asia Pacific is anticipated to expand at the highest CAGR during the forecast period. China and India, for example, have expanded their military spending, encouraging the purchase of this technology. The regional demand is also anticipated to be boosted by an emphasis on providing forces with best-in-class training that is both affordable and efficient. A few notable initiatives are the Helicopter Aircrew Training System (HATS) program and the Sea 1000 future submarine simulators by Australia, the J15 flight simulators and J-13 flight simulators by China, the Rafale simulators and fifth-generation aircraft simulators by India, and others.

Know the high-growth countries in this report. Register Here

Key Players

There is stiff competition in the military simulation and training market. The growth of the companies is directly dependent on industry conditions and government support. These companies differentiate their military simulation and training based on their quality and penetration in the target and emerging markets. Also, some major mergers and acquisitions in the industry recently have significantly influenced the competitive dynamics. For example:

- In October 2021, Le Luc, Fritzlar, Pau, Phalsbourg, Rheinmetall, and Thales delivered 20 modern Tiger simulators as well as repair and maintenance assistance. The crews may train using the most recent configuration of the operational aircraft to the 12 cockpit procedure trainers and 8 full-mission simulators.

The overall competitive landscape has been affected due to these mergers and acquisitions. The following are the major players in the military simulation and training market:

- BAE Systems

- Bohemia Interactive Simulations

- Cubic Corporation

- CAE, Inc.

- Lockheed Martin Corporation

- L3 Link Training & Simulation

- Israel Aerospace Industries Ltd.

- Northrop Grumman Corporation

- Meggitt PLC

- Raytheon Technologies

- Rheinmetall AG

- Rockwell Collins Inc.

- SAAB AB

- Textron Inc.

- Thales Group

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Write to us at [email protected]

Research Methodology

This strategic assessment report, from Stratview Research, provides a comprehensive analysis that reflects today’s military simulation and training market realities and future market possibilities for the forecast period of 2022 to 2028. After a continuous interest in our military simulation and training market report from the industry stakeholders, we have tried to further accentuate our research scope to the military simulation and training market to provide the most crystal-clear picture of the market. The report segments and analyses the market in the most detailed manner to provide a panoramic view of the market. The vital data/information provided in the report can play a crucial role for the market participants as well as investors in the identification of the low-hanging fruits available in the market as well as to formulate the growth strategies to expedite their growth process.

This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools. More than 1000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data. We conducted more than 15 detailed primary interviews with the market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Report Features

This report provides market intelligence in the most comprehensive way. The report structure has been kept such that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market. The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

- COVID-19 impact and its recovery curve

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors

Market Segmentation

This report studies the market, covering a period of 12 years of trends and forecasts. The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The military simulation and training market is segmented into the following categories:

By Application Type

By Type

- Live

- Virtual

- Constructive

By Platform Type

By Solution Type

- Hardware

- Software

- Services

By Technology Type

- Artificial Intelligence

- 3D Printing

- Internet of Things

- Big Data Analytics

- Robotic Process Automation

- Cloud Computing & Master Data Management

- Digital twin

- Blockchain

- AR & VR

- 5G

By Region

- North America (Country Analysis: the USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, the UK, Russia, Spain, and Rest of Europe)

- Asia-Pacific (Country Analysis: China, Japan, India, South Korea, and Rest of Asia-Pacific)

- Rest of the World (Sub-Region Analysis: Latin America, the Middle East, and Others)

Report Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

- Detailed profiling of additional market players (up to three players)

- SWOT analysis of key players (up to three players)

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Product portfolio, geographical reach, regional presence, and strategic alliances.

Custom Research: Stratview Research offers custom research services across the sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected].