Attractive Opportunities

Global Demand Analysis & Sales Opportunities in Body Armor Market

-

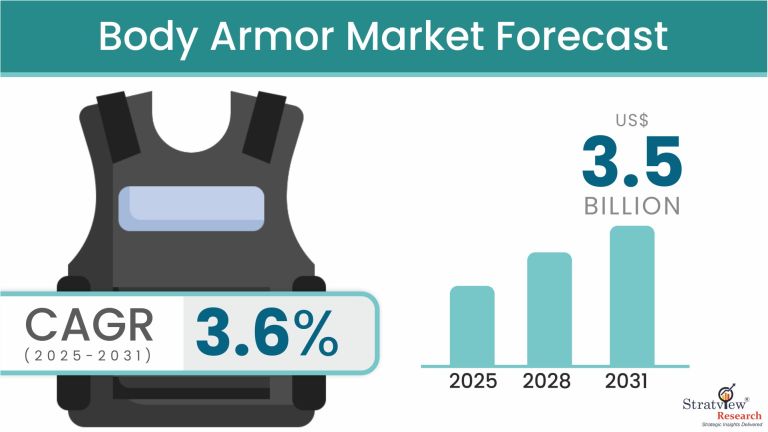

The annual demand for body armor was USD 2.8 billion in 2024 and is expected to reach USD 2.9 billion in 2025, up 3.6% than the value in 2024.

-

During the forecast period (2025-2031), the body armor market is expected to grow at a CAGR of 3.6%. The annual demand will reach USD 3.5 billion in 2031.

-

During 2025-2031, the body armor industry is expected to generate a cumulative sales opportunity of USD 22.5 billion.

Want to get a free sample? Register Here

High-Growth Market Segments:

-

North America is expected to be the dominant region during the forecast period.

-

By armor type, Hard body armor is estimated to be the dominant segment during the forecast period.

-

By product type, Ballistic-resistant armor is likely to be the dominant segment during the forecast period.

-

By material type, UHMWPE is expected to be the most preferred material in the market over the forecasted years.

-

By level of protection type, Level IIIA + SP/KR/SP-KR is anticipated to witness the highest demand during the forecast period.

-

By end-user type, Homeland security is likely to generate the largest market demand as well as to witness the fastest growth during the forecast period.

-

By mode of operation type, Overt operation is estimated to be the dominant category in the market.

Market Statistics

Have a look at the sales opportunities presented by the body armor market in terms of growth and market forecast.

|

Body Armor Market Data & Statistics

|

|

|

Market Statistics

|

Value (in USD Billion)

|

Market Growth (%)

|

|

Annual Market Size in 2024

|

USD 2.8 billion

|

-

|

|

Annual Market Size in 2025

|

USD 2.9 billion

|

YoY Growth in 2025: 3.6%

|

|

Annual Market Size in 2031

|

USD 3.5 billion

|

CAGR 2025-2031: 3.6%

|

|

Cumulative Sales Opportunity during 2025-2031

|

USD 22.5 billion

|

-

|

|

Top 10 Countries’ Market Share in 2024

|

USD 2.2 billion +

|

> 80%

|

|

Top 10 Company’s Market Share in 2024

|

USD 1.4 billion to USD 2.0 billion

|

50% - 70%

|

Market Dynamics

Introduction:

Body armor is basically of two types: soft armor and hard armor. Soft body armor consists of flexible panels made up of synthetic fiber materials like aramid and polyethylene, typically designed to protect against handgun ammunition, and is primarily worn by law enforcement officials while carrying out regular paramilitary operations. On the other hand, hard body armor is made up of hard, ballistic-resistant panels and plates, and is intended to provide additional protection as compared to soft armor. Typically, hard body armor is thicker and heavier than soft body armor, as it is a combination of a hard armor plate with a soft armor panel. These two types of body armor are designed to effectively absorb and fend off physical assaults and ballistic ammunition.

Armor was historically made of metals and alloys. These armors, which were typically constructed of steel, were cumbersome, clumsy, and useless. Heavy metals resulted in an increase in the armor's weight, which made it difficult to carriage for an extended period. However, there has been a shift from the conventional metallic heavy body armor to extremely lightweight and comfortable body armor over the years, which is developed using Ultra High Molecular Weight Polyethylene (UHMWPE) materials. With defense expenditure and law enforcement budgets rising in both developed and developing countries, a sizeable amount is being inevitably allocated to the procurement of advanced body armor, which aids in fending off threats to the physical safety of the personnel.

Market Drivers:

The body armor market is driven by a host of factors, some of which are noted below:

-

Increase in terrorism, mass shootings, and gun violence across the globe.

-

Law enforcement officers and military personnel have come to rely heavily on body armor in order to ensure their protection and survival during anti-terrorist military operations.

-

Cross-border conflicts and geopolitical tensions are on the rise around the world.

-

The Russia-Ukraine crisis serves as a recent example. Such factors propel the development and sales of body armor products globally.

Segments' Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High-Growth Opportunity

|

|

Armor-Type Analysis

|

Soft Body Armor and Hard Body Armor

|

Hard body armor is estimated to be the dominant armor type during the forecast period.

|

|

Product-Type Analysis

|

Ballistic-Resistant Armor, Stab-Resistant Armor, Combined Resistant Armor, and ICW Armor

|

Ballistic-resistant armor is likely to be the dominant product type during the forecast period.

|

|

Material-Type Analysis

|

UHMWPE, Aramid, Ceramic, and Other Materials

|

UHMWPE is expected to be the most preferred material in the market over the forecasted years.

|

|

Level of Protection-Type Analysis

|

Level IIA, Level II, Level IIIA, Level III, Level IV, SP1/KR1, SP2/KR2, SP3/KR3, Level IIA + SP/KR/SP-KR, Level II + SP/KR/SP-KR, Level IIIA + SP/KR/SP-KR, Level III+ Level IIIA/II, and Level IV + Level IIIA/II

|

Level IIIA + SP/KR/SP-KR is anticipated to witness the highest demand by the level of protection type during the forecast period.

|

|

End-User-Type Analysis

|

Military, Homeland Security, and Commercial

|

Homeland security is likely to generate the largest market demand as well as to witness the fastest growth during the forecast period.

|

|

Mode of Operation-Type Analysis

|

Covert and Overt

|

Overt operation is estimated to be the dominant category in the market.

|

|

Region Analysis

|

North America, Asia-Pacific, Europe, and the Rest of the World

|

North America is expected to be the dominant market.

|

Armor Insights

“Hard body armor is estimated to be the dominant armor type during the forecast period.”

-

Based on armor type, the body armor market is segmented into soft body armor and hard body armor.

-

Hard body armor dominates, due to its superior ballistic protection capabilities, widespread adoption by military and law enforcement, and continuous technological advancements in materials like ceramics and polyethylene. These advancements make the armor stronger while also making it lighter.

Product Insights

“Ballistic-resistant armor is expected to remain dominant in the market during the forecast period.”

-

Based on product type, the body armor market is segmented into ballistic-resistant armor, stab-resistant armor, combined resistant armor, and ICW Armor.

-

Ballistic-resistant armor is likely to stay the top choice in the body armor market because there's always a need for strong protection against new and changing threats. With ongoing improvements in materials and how they're made, along with increasing security concerns in many industries, this type of armor remains in high demand.

Material Insights

“UHMWPE is expected to be the most preferred material in the market, over the forecasted years.”

-

Based on material type, the body armor market is segmented into UHMWPE, Aramid, Ceramic, and Other Materials.

-

UHMWPE is expected to stay a popular choice for body armor because it’s incredibly strong yet lightweight. Its ability to resist bullets and last a long time makes it great at absorbing and spreading out the energy from projectiles, all while being easy to wear and tough enough for long-term use.

Level of Protection Insights

“Level IIIA + SP/KR/SP-KR is anticipated to witness the highest demand by the level of protection type.”

Based on the level of protection type the body armor market is segmented into Level IIA, Level II, Level IIIA, Level III, Level IV, SP1/KR1, SP2/KR2, SP3/KR3, Level IIA + SP/KR/SP-KR, Level II + SP/KR/SP-KR, Level IIIA + SP/KR/SP-KR, Level III+ Level IIIA/II, and Level IV + Level IIIA/II. Level IIIA + SP/KR/SP-KR body armor is expected to see the most demand and grow the fastest because it provides strong protection against a wide range of threats, like powerful rifle rounds and common handgun bullets. These types of armor are becoming more important in both military and law enforcement situations.

End-User Insights

“Level IIIA + SP/KR/SP-KR is anticipated to witness the highest demand by the level of protection type.”

-

Based on the level of protection type the body armor market is segmented into Level IIA, Level II, Level IIIA, Level III, Level IV, SP1/KR1, SP2/KR2, SP3/KR3, Level IIA + SP/KR/SP-KR, Level II + SP/KR/SP-KR, Level IIIA + SP/KR/SP-KR, Level III+ Level IIIA/II, and Level IV + Level IIIA/II.

-

Level IIIA + SP/KR/SP-KR body armor is expected to see the most demand and grow the fastest because it provides strong protection against a wide range of threats, like powerful rifle rounds and common handgun bullets. These types of armor are becoming more important in both military and law enforcement situations.

Mode of Operation Insights

“Overt operation is estimated to be the dominant category in the market.”

-

Based on the mode of operation type the body armor market is segmented into covert and overt.

-

Overt body armor is expected to lead the market because it offers better protection against serious threats, like heavy gunfire and sharp objects. It's also ideal for high-risk jobs, like military and law enforcement, where being visible and having customizable features are really important.

Regional Insights

“North America is expected to retain its dominance in the market during the forecast period.”

-

North America is expected to dominate the body armor market for several important reasons. First, there’s an ongoing need for stronger protection due to rising concerns about terrorism, mass shootings, and an increase in violent crime. These security threats have pushed governments, law enforcement agencies, and military forces to prioritize personal safety and invest in better protective gear.

-

In addition, the region's military and law enforcement agencies consistently upgrade their equipment, which drives demand for advanced body armor that can protect against a wider range of threats, from gunfire to sharp objects. The North American market also benefits from significant technological advancements, with new materials and design innovations making body armor more effective and lighter, which further boosts its appeal.

-

Moreover, North America has a well-established manufacturing base and strong supply chains that allow for the quick development and production of these technologies. This combination of high demand, continuous innovation, and strong local manufacturing capabilities makes North America the leading and fastest-growing market in the body armor industry.

Competitive Landscape

The market is fragmented, with over 50 players. Most of the major players compete in some of the governing factors, including price, service offerings, regional presence, etc. The following are the key players in the body armor market. Some of the major players provide a complete range of services.

Here is the list of the Top Players (Based on Dominance)

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Write to us at sales@stratviewresearch.com

Recent Developments/M&As:

-

Schultze SPAC's Proposed Merger with Point Blank Enterprises (2023): In 2023, Schultze Special Purpose Acquisition Corp. II, a special purpose acquisition company (SPAC), entered into discussions to merge with Point Blank Enterprises Inc., a manufacturer of body armor. This merger aimed to enhance Point Blank's capabilities and market reach in the body armor industry.

Report Features

This report provides market intelligence most comprehensively. The report structure has been kept so that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market.

The following are the key features of the report:

-

Market structure: Overview, industry life cycle analysis, supply chain analysis.

-

Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

-

Market trend and forecast analysis.

-

Market segment trend and forecast.

-

Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

-

COVID-19 impact and its recovery curve.

-

Attractive market segments and associated growth opportunities.

-

Emerging trends.

-

Strategic growth opportunities for the existing and new players.

-

Key success factors.

|

Market Study Period

|

2019-2031

|

|

Base Year

|

2024

|

|

Forecast Period

|

2025-2031

|

|

Trend Period

|

2019-2023

|

|

Number of Tables & Figures

|

>100

|

|

Number of Segments Analysed

|

7 (Armor Type, Product Type, Material Type, Level of Protection Type, End-User Type, Mode of Operation Type, and Region)

|

|

Number of Regions Analysed

|

4 (North America, Europe, Asia-Pacific, Rest of the World)

|

|

Countries Analysed

|

15 (The USA, Canada, Mexico, Germany, France, Italy, The UK, China, Japan, India, Brazil, Saudi Arabia, Rest of Europe, Rest of APAC, and Rest of the World)

|

|

Free Customization Offered

|

10%

|

|

After Sales Support

|

Unlimited

|

|

Report Presentation

|

Complimentary

|

|

Market Dataset

|

Complimentary

|

|

Further Deep Dive & Consulting Services

|

10% Discount

|

Market Segmentation

The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The body armor market is segmented into the following categories:

Body Armor Market, by Armor Type

-

Hard Body Armor

-

Soft Body Armor

Body Armor Market, by Product Type

Body Armor Market, by Material Type

-

UHMWPE

-

Aramid

-

Ceramic

-

Others

Body Armor Market, by Level of Protection Type

-

Level IIA

-

Level II

-

Level IIIA

-

Level III

-

Level IV

-

SP1/KR1

-

SP2/KR2

-

SP3/KR3

-

Level IIA + SP/KR/SP-KR

-

Level II + SP/KR/SP-KR

-

Level IIIA + SP/KR/SP-KR

-

Level III+ Level IIIA/II

-

Level IV+ Level IIIA/II

Body Armor Market, by End-User Type

-

Military

-

Homeland Security

-

Commercial

Body Armor Market, by Mode of Operation Type

-

Covert Operation

-

Overt Operation

Body Armor Market, by Region

-

North America (Country Analysis: the USA, Canada, and Mexico)

-

Europe (Country Analysis: Germany, France, the UK, Russia, Spain, and the Rest of Europe)

-

Asia-Pacific (Country Analysis: China, Japan, India, South Korea, and the Rest of Asia-Pacific)

-

Rest of the World (Sub-Region Analysis: Latin America, the Middle East, and Others)

Research Methodology

-

This strategic assessment report from Stratview Research provides a comprehensive analysis that reflects today’s body armor market realities and future market possibilities for the forecast period.

-

The report segments and analyzes the market in the most detailed manner to provide a panoramic view of the market.

-

The vital data/information provided in the report can play a crucial role for market participants and investors in identifying the low-hanging fruits available in the market and formulating growth strategies to expedite their growth process.

-

This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools.

-

More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data.

-

We conducted more than 15 detailed primary interviews with market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respected clients:

Company Profiling

Competitive Benchmarking

-

Benchmarking of key players on the following parameters: Service portfolio, geographical reach, regional presence, and strategic alliances

Custom Research: Stratview Research offers custom research services across industries. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to sales@stratviewresearch.com