Market Insights

The precision guided munition market was estimated at USD 33.1 billion in 2021 and is likely to grow at a CAGR of 5.85% during 2022-2028 to reach USD 49.11 billion in 2028.

_63766.webp)

Want to know more about the market scope? Register Here

Market Dynamics

The COVID-19 outbreak has presented the military sector with a number of difficulties. Even though the business wasn't significantly impacted, the COVID-19 epidemic led to several economic issues. The worldwide military sector has suffered since the outbreak's start. The military sector has been slightly damaged by the drying up of private funding, the reduction in global defence spending in 2020, and the suspension of scheduled contracts. Therefore, the testing of certain missile defence equipment has been postponed as a result of the research and development activities linked to precision guided bombs. Additionally, many businesses are anticipated to see a drop in output as a result of the COVID-19-caused slowdown in the supply chain for precision guided bombs. therefore having an effect on market expansion.

The US defence forces enjoy a tactical combat edge over any foe in any weather because to the unrivalled performance of US weapon systems. The US Department of Defense (DoD) has requested USD 247.3 billion for acquisition funding for Fiscal Year (FY) 2020, which includes funding from the Base budget and the Overseas Contingency Operations (OCO) fund, totaling USD 143.1 billion for procurement and USD 104.3 billion for research, development, test, and evaluation (RDT&E).

For the National Defense Strategy's military force objective to be implemented, the spending in the budget proposal represents a balanced portfolio approach. The Major Defense Acquisition Programs (MDAPs), which are acquisition programs that exceed a cost cap set by the Under Secretary of Defense for Acquisition and Sustainment, are funded with USD 83.9 billion of the USD 247.3 billion requested.

The majority of nations adhere to the Law of Armed Conflicts (LOAC) and make an effort to reduce collateral damage, which includes the unintentional destruction of civilian property and civilian casualties (CIVCAS). The accuracy of a weapon is indicated by the Circular Error Probability (CEP). Low CEP precision-guided weapons are essential for reducing collateral damage and civilian fatalities. Regardless of the goal, whether it is a low-intensity conflict operation like counter-insurgency and counterterrorism or a high-intensity conventional conflict, causalities produce major ramifications in terms of public opinion and legislation. Precision-guided munitions aid in improved decision-making and decrease collateral damage in today's increasingly digitalized society, reducing casualties in the aftermath. Additionally, because targets on battlefields are scattered, mobile, and agile, precision-guided missiles successfully destroy threats.

From traditional border-to-border fighting to more urban-focused conflict, warfare has changed in character. Precision attacks are now crucial because they enable indirect fire in difficult terrain, where low-angle fire is necessary to eliminate targets. One of the key elements driving the need for precision-guided weapons is the growing use of satellite networks, navigational aids, and drones to eliminate high-value and far-off targets.

The state-owned defense organisations are subject to a number of federal and legislative laws and regulations, including the Foreign Corrupt Practices Act, exchange restrictions, and import-export control regimes. Manufacturers of munitions are often barred from exporting their goods, which reduces their ability to reach global markets. This makes it difficult for munitions producers to reach global markets. The issue of technology and weapon transfer was made worse when terrorist groups gained access to a variety of cutting-edge weapons, including anti-tank guided guns and high-tech land mines. The transfer of technologies and weaponry to other nations is now strictly regulated as a result of this. The market for precision guided munition growth is constrained by this constraint.

Several investments and guidelines in the industry have been directed in recent years, which would boost the overall market. Some of them are:

- High-tech new-generation missile development poses a serious risk to important sites and assets like military ships and air bases. High-speed cruise missiles and nuclear-capable ballistic missiles are a couple of these recent innovations. Many nations are working on very sophisticated weapons that can overcome sophisticated air defence systems like the Patriot Advanced Capability-3 (PAC-3), the S-400, and the Medium Extended Air Defense System (MEADS). Hypersonic missiles have been produced by nations like India, China, and Russia and are challenging for missile defence systems to intercept. The BrahMos missile, which was jointly produced by India and Russia, is challenging for earlier missile defence systems to intercept. Due to these advances, new-generation high-speed air defence electronic warfare systems are now necessary. While governments throughout the globe concentrate on developing stealth aircraft, they simultaneously make significant investments in cutting-edge surveillance systems to counter stealth technology. The need for different technologies connected to precision guided munition is anticipated to increase due to the ongoing development of new generation precision guided air and missile defence systems. These include, among others, GPS, INS, laser, and radar.

Market Drivers

The global precision guided munition market is forecast to witness constant growth during the forecast period due to rising defense budgets across the world along with a need for advanced precision guided munition to safeguard the country’s border against modern combat. Also, rising instances of conflicts and terrorism are expected to boost market demand. Furthermore, governments across the world, along with top defense manufacturers, are currently focusing on modernizing their existing military resources.

Want to have a closer look at this market report? Click Here

Segments Analysis

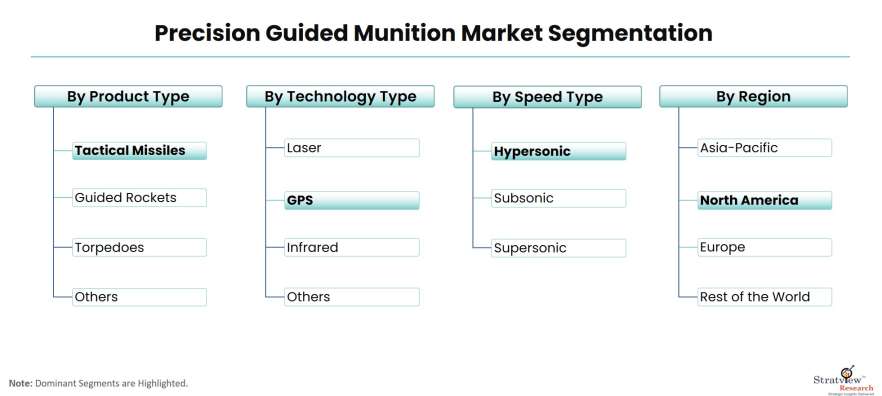

By Product Type

The precision-guided munition market has been split into guided ammunition, tactical missiles, torpedoes, guided rockets, and loitering munitions. Tactical missiles find use in shorter range and are capable of carrying a range of warheads that can be employed for various purposes. Tactical missiles are versatile and can be fired in various angles, modes, and from various platforms. The tactical missiles are armed with precision guidance technologies that assist them to hit the target with accuracy.

- Ongoing advances in the guided systems technology in rockets are expected to increase its demand in the market over the next few years.

- The loitering munition segment is anticipated to grow at the fastest rate owing to its distinctive feature of loitering around the target and hitting at a precise location.

- Further, guided ammunition, including bullets, bombs, artillery shells and mortars is anticipated to grow moderately in the coming years owing to a weak adoption of the technology in the defence systems.

By Technology Type

The GPS segment hold the largest share of the market in 2021, followed by the laser segment. The laser guidance for war weapons is likely to be replaced by GPS technology in the coming years due to its ability to detect the exact location of moving targets. The infrared segment is expected to grow at the fastest rate during the forecast period owing to the lower cost and precise location detection capabilities.

By Speed Type

The precision guided munition industry has been segmented into subsonic, supersonic, and hypersonic. Hypersonic munitions are armed with a propulsion system enabling it to achieve a speed of Mach 5 or higher. Currently, hypersonic weapons are in the development stage and are projected to be commercialized in the coming years.

Regional Insights

- North America held the highest demand share in 2021 and will continue to lead the market in the foreseeable future. The U.S. generated highest revenue in the region.

- The sharp increase in the U.S. defence budget is expected to increase demand for precision-guided Munitions in the country.

- Major companies such as Lockheed Martin, Northrop Grumman Corporation, Raytheon Technologies, Boeing, and General Dynamics Corporation are based out of the US.

- These manufacturers are currently focused on investing in R&D of advanced precision technology employed in the missile defence system.

- Further, with significant military modernization efforts taking place in countries across the Asia Pacific region, the demand for precision-guided munitions is expected to grow in the near future.

_86340.webp)

Know the high-growth countries in this report. Register Here

Key Players

The market comprises of a number of players that manufactures and supply Precision Guided Munitions to armed forces and local law enforcement agencies. Besides the global players, a few local manufacturers are also entering the market space with new product line, particularly in Asia-Pacific region owing to an increased focus on indigenous manufacturing in countries such as India and China.

There is stiff competition in the precision guided munition market. The growth of the companies is directly dependent on the industry conditions and government support. These companies differentiate their Precision Guided Munition offerings on the basis of their quality and their penetration in the target and emerging markets. Also, there have been some major development strategies adopted by key players in the industry in recent years, which significantly influenced the competitive dynamics. For example:

- In 2021, Boeing was awarded a contract by the US Department of Defense for JADM munition for the US Navy.

- In 2020, The Air Force Life Cycle Management Center (AFLCMC) awarded a USD 239.1 million modification contract for 6 lots of StromBreaker to Raytheon Technologies’ RTX Missiles and Defense unit.

- In 2019, BAE Systems was awarded a contract worth USD 2.68 billion by the US Navy for the indefinite-delivery and quantity purchase of APKWS laser-guided bombs.

- In February 2019, BAE Systems inked a contract with the U.S. Navy worth USD 114.5 million to enhance the guided-missile destroyer, USS Bulkeley (DDG 84) in its Norfolk shipyard.

- In January 2019, a 2100 F-Model missiles contract was awarded to Javelin, a joint venture company of Lockheed Martin and Raytheon.

The following are the major players in the precision guided munition market:

- Lockheed Martin

- Atlas Elektronik

- Raytheon

- Thales Group

- BAE Systems

- Northrop Grumman

- General Dynamics

- Elbit Systems

- Boeing Company

- Aselsan A.S.

- Israel Aerospace Industries

- Rheinmetall

- Leonardo S.P.A

- Kongsberg

- SAAB AB

- Rafael Advance Defense Systems Ltd.

- Bharat Dynamics Ltd.

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Write to us at sales@stratviewresearch.com

Research Methodology

This strategic assessment report, from Stratview Research, provides a comprehensive analysis that reflects today’s precision guided munition market realities and future market possibilities for the forecast period of 2022 to 2028. After a continuous interest in our precision guided munition market report from the industry stakeholders, we have tried to further accentuate our research scope to the precision guided munition market to provide the most crystal-clear picture of the market. The report segments and analyses the market in the most detailed manner to provide a panoramic view of the market. The vital data/information provided in the report can play a crucial role for the market participants as well as investors in the identification of the low-hanging fruits available in the market as well as to formulate the growth strategies to expedite their growth process.

This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools. More than 1000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data. We conducted more than 15 detailed primary interviews with the market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Report Features

This report provides market intelligence in the most comprehensive way. The report structure has been kept such that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market. The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

- COVID-19 impact and its recovery curve

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors.

Market Segmentation

This report studies the market, covering a period of 12 years of trend and forecast. The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The precision guided munition market is segmented into the following categories:

By Product Type

- Tactical Missiles

- Guided Rockets

- Guided Ammunition

- Torpedoes and Loitering Munition

By Technology Type

- Infrared

- Laser

- GPS

- Radar Homing

- Anti-Radiation and Inertial Navigation System

By Mode of Operation Type

- Autonomous

- Semi-Autonomous

By Launch Platform Type

By Speed Type

- Subsonic

- Supersonic

- Ultrasonic

By Region

- North America (Country Analysis: the USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, the UK, Russia, Spain, and Rest of Europe)

- Asia-Pacific (Country Analysis: China, Japan, India, South Korea, and Rest of Asia-Pacific)

- Rest of the World (Sub-Region Analysis: Latin America, the Middle East, and Others)

Click here to learn the market segmentation details.

Report Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

- Detailed profiling of additional market players (up to three players)

- SWOT analysis of key players (up to three players)

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Product portfolio, geographical reach, regional presence, and strategic alliances

Custom Research: Stratview Research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to sales@stratviewresearch.com.