Market Insights

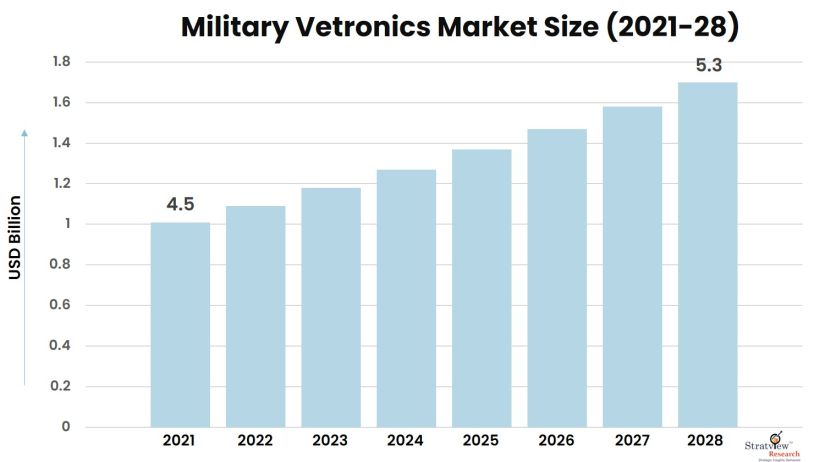

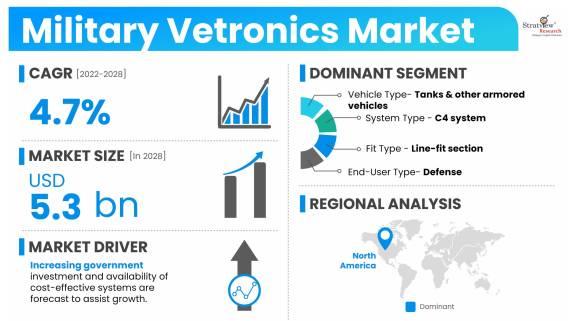

The military vetronics market was estimated at USD 4.5 billion in 2021 and is likely to grow at a CAGR of 4.7% during 2022-2028 to reach USD 5.3 billion in 2028.

Want to know more about the market scope? Register Here

Market Dynamics

Introduction

Vetronics is a portmanteau of the words ‘vehicles’ and ‘electronics’ that is used to describe electronics and communications used in military and homeland security vehicles for effective operations. Vetronics systems are responsible for handling and controlling many critical operations such as inter-vehicle communication, mobility systems, and self-protection. These systems are installed in military vehicles such as light-protected armor, battle tanks, and infantry fighting vehicles.

Impact Of Covid-19

The onset of Covid-19 had a severe impact on the manufacturing & supply side-side value chain of vetronics. Owing to the lack of preparedness exposed by the COVID-19 pandemic, the military and defense sectors suffered drastically. With a temporary halt in production and declined financial performance of industry players, the global vetronics market saw a decline between 2020 and 2021.

Market Drivers

Key manufacturers of military vetronics are currently focused on developing innovative solutions with enhanced performance while reducing design and operating costs. One of the key focus areas for manufacturers has been integrating solutions that provide real-time data. The adoption of such an advanced combat system that can be integrated into military vehicles with minimal investment is expected to boost market growth in the future.

The electronics market is expected to grow at a rapid rate during the forecast period owing to the growing demand for electronics with increased situational awareness in the war zone, rise in network-centric warfare, and shift towards COTS-enabled SWaP specifications among others. Further, increasing arms acquisition budgets of governments across the world along with a growing demand for UAVs and drones for surveillance and other commercial purposes are expected to boost demand for military vetronics in the near future. Other key factors such as increasing government investment and availability of cost-effective systems are forecast to assist growth. However, subsequent delays in procurement of vetronics from manufacturers, high power consumption, and tough military guidelines are expected to hinder market growth by 2028.

Want to have a closer look at this market report? Register Here

Key Players

The following are the key players in the military vetronics market:

- BAE Systems PLC

- Curtiss-Wright Corporation

- General Electric Company

- General Dynamics Corporation

- Kongsberg Gruppen ASA

- Lockheed Martin Corporation

- Thales Group

- Oshkosh Corporation

- Raytheon Technologies Corporation

- SAAB A.B.

There is stiff competition in the military vetronics market. The growth of the companies is directly dependent on the industry conditions and government support. These companies differentiate their offerings on the basis of their quality and their penetration in the target and emerging markets. Also, players operating in the global military vetronics market are currently undertaking custom contracts as per the client needs which in turn is helping them improve their existing market share. For example:

- In December 2019, the Danish Ministry of Defense Acquisition & Logistics Organization (DALO) agreed worth US$ 29.5 million with Kongsberg to integrate its Protector Remote Weapon Station (RWS) with Piranha V 8x8 vehicle.

- In June 2021, Raytheon successfully won a contract worth US$ 8.8 Million from DARPA for the agency’s FENCE program

- In November 2021, the U.S. army awarded a US$ 591 Million contract to Oshkosh Defense LLC for supplying around 868 JLTV trailers, 1,699 JLTV trucks and associated kits and parts to the Lithuania government as part of the U.S.-Lithuania Defense Co-operation Strategic roadmap

- In May 2022, a joint venture between Lockheed Martin and Raytheon Technologies was awarded two contract worth US$ 309 Million by the U.S. army for its anti-tank Javelin missiles.

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Write to us at [email protected]

Segment Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High Growth Opportunity

|

|

Vehicle Type Analysis

|

Tanks & Other Armored Vehicles, Light Protected Vehicles, Unmanned Ground Vehicles, Amphibious Vehicles, and Special Purpose Vehicles

|

Tanks & other armored vehicles segment was the largest segment in 2021.

|

|

System Type Analysis

|

Control & Communication (C3) System, Navigation System, C4 System, Power System, and Others

|

C4 system segment is projected to show significant growth over the forecast period.

|

|

Fit Type Analysis

|

Line Fit and Retrofit

|

Line-fit section held the lion’s share of the market in 2021.

|

|

End-User Type Analysis

|

Defense and Homeland Security

|

Defense segment dominated the market demand in 2021.

|

|

Regional Analysis

|

North America, Europe, Asia-Pacific, and Rest of the World

|

The market is dominated by North America in terms of demand during the forecast period

|

By Vehicle Type

"Tanks & other armored vehicles segment was the largest segment in 2021"

Based on vehicle type, tanks & other armored vehicles segment was the largest segment in 2021 owing to the increased procurement of battle tanks and other armored vehicles by countries around the world with a purpose of strengthening their military prowess. Further, the unmanned ground vehicles segment is expected to grow at the fastest growth rate during the forecast period owing to the introduction of artificial intelligence, robotics, and other advanced technologies that boost the operational efficiency of these vehicles.

By System Type

"C4 system segment is projected to show significant growth over the forecast period"

Based on system, the market is divided into control & communication (C3) system, navigation system, C4 system, power system and others. The C4 system segment is projected to show significant growth over the forecast period owing to the flexibility it provide to the combat vehicles for expanding and reconfiguring component in the field. The systems helps in reducing costs, risks and time associated with vehicle disassembly.

By Fit Type

"Line-fit section held the lion’s share of the market in 2021"

Based on fit, the military vetronics market is segmented into line-fit and retrofit. The line-fit section held the lion’s share of the market in 2021, while the retrofit fragment is projected to show fastest growth during the forecast period. Vetronics retrofits and updates costs much lesser than obtaining a new reinforced vehicle.

By End-User Type

"Defense segment dominated the market demand in 2021"

Based on end-user, the military vetronics market is segmented into defense and homeland security. The defense segment dominated the market demand in 2021, while the homeland security segment is expected to grow at an impressive growth rate during the forecast period.

Regional Analysis

"The market is dominated by North America in terms of demand during the forecast period"

Region-wise, the market is dominated by North America in terms of demand. This is attributed to an increased defense expenditure by the U.S. government for procurement of advanced vehicles as well as growing investments in upgradation of existing U.S. military vehicle fleet. The presence of top players such as L3Harris Technologies, Inc., Lockheed Martin Corp., General Dynamics Corp. and Raytheon Technologies Corp., will further boost market growth. Asia-Pacific is expected to witness exponential growth during the forecast period owing to the rising terrorist threats and cross-border conflicts across countries in Asia-Pacific. Further, governments across the region are focused on increasing investment on defense operations. For instance, in June 2020, Indian Ministry of Defense, under the Make in India program, announced procurement of 156 BMP 2 infantry vehicles for the army.

Know the high-growth countries in this report. Register Here

Recent Developments

There have been several investments in the defense industry directed at military vetronics in recent years, which would boost the overall market. Some of them are:

- The U.S. Army awarded a contract to TAE Aerospace, Inc. to refurbish the oil pump assemblies and electromechanical fuel system assemblies of AGT 1500 M1 tanks in April 2020

- In July 2020, the U.S. Army Combat Capabilities Development Command’s C5ISR Center launched the army’s C4ISR/Electronic Warfare Modular Open Suite of Standards initiative that integrates a wide range of functions and capabilities into a single system for the military vetronics

- In May 2019, the USAF made a deal with commercial satellite operators to build a hybrid architecture that shall enable the armed forces to switch between military and commercial networks while reducing the chances of cyber-attack

Research Methodology

- This strategic assessment report, from Stratview Research, provides a comprehensive analysis that reflects today’s military vetronics market realities and future market possibilities for the forecast period.

- The report segments and analyzes the market in the most detailed manner to provide a panoramic view of the market.

- The vital data/information provided in the report can play a crucial role for market participants as well as investors in the identification of the low-hanging fruits available in the market as well as to formulate growth strategies to expedite their growth process.

- This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools.

- More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data.

- We conducted more than 15 detailed primary interviews with market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Report Feature

This report provides market intelligence in the most comprehensive way. The report structure has been kept such that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market. The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

- COVID-19 impact and its recovery curve

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors.

Market Segmentation

This report studies the market covering 12 years of trend and forecast. The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market

The military vetronics market is segmented into the following categories

By Vehicle Type

- Tanks & Other Armored Vehicles

- Light Protected Vehicles

- Unmanned Ground Vehicles

- Amphibious Vehicles

- Special Purpose Vehicles

By System Type

- Control & Communication (C3) System

- Navigation System

- C4 System

- Power System

- Others

By End-User Type

- Defense

- Homeland Security

By Fit Type

By Region

- North America (Country Analysis: The USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, The UK, Russia, and the Rest of Europe)

- Asia-Pacific (Country Analysis: China, India, Australia, South Korea, and the Rest of Asia-Pacific)

- Rest of the World (Country Analysis: Saudi Arabia, Brazil, and Others)

_89566.webp)

Click Here, to learn the market segmentation details.

Customization Option

With this detailed report, Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

- Detailed profiling of additional market players (up to three players)

- SWOT analysis of key players (up to three players)

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Product portfolio, geographical reach, regional presence, and strategic alliances.

Custom Research:

Stratview research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected].