Market Insights

The security analytics market was estimated at USD 14.13 billion in 2022 and is likely to grow at a CAGR of 16.15% during 2023-2028 to reach USD 34.84 billion in 2028.

Want to have a closer look at this report? Download a free sample here

Market Dynamics

Introduction

Security analytics refers to the process of identifying, protecting, and troubleshooting potential security threats. It collects and analyzes data from various sources like network traffic, logs, and user activities using advanced analytics solutions such as machine learning, artificial intelligence, and behavioral analysis to provide valuable insights.

Security analytics aim to identify risks and provide vital and reliable information to organizations so that they can respond to security threats, reduce the risk of data breaches, and improve overall security conditions.

Market Drivers

The major factors driving the growth of the security analytics market are:

- Machine Learning and Artificial Intelligence for quick detection: Security analytics solutions have undergone a significant transformation from rule-based detection to higher and more advanced methodologies rooted in data science, including Machine Learning (ML) and Artificial Intelligence (AI). This is in response to growing data volumes, and a lack of skilled professionals. Effective threat management requires a combination of quick and reliable security analytics.

- Rising instances of cybercrime: Security breaches are increasing, due to which, organizations require strict solutions for end-to-end security. Security analytics offers endpoint security with user behavior, external threat alerts, etc. to help organizations improve their security. Hence, with the increased usage of technology and the rise in cybercrime rates, the adoption of security analytics solutions is expected to increase.

- Increasing awareness: Organizations are gradually realizing the importance of the security analytics market to give their businesses the ability to foresee any threat and take informed decisions. To serve these purposes, many companies are working towards better security systems. For instance, in May 2023, Amazon announced the general availability of Amazon Security Lake (ASL), which is a purpose-built security data lake that enables customers to aggregate, normalize, and store data. It is a fully managed security data lake service offered by Amazon Web Services. It can enhance security operations, change the economics of data storage, promote the adoption of open cybersecurity schema frameworks, facilitate detection engineering, enable new types of analytics, and serve as a foundation for AI models.

Want to know more about the market scope? Register Here

Key Players

Major players in the market are:

- IBM Corporation, Cisco Systems, Inc.

- Splunk, Inc.

- RSA Security LLC

- FireEye

- HP Enterprise Company

- McAfee LLC

- NortonLifeLock, Inc.

- LogRhythm, Inc.

- Huntsman Security

- Securonix, Inc.

- Gurucul

- Juniper Networks, Inc.

- Hillstone Networks Co Ltd

- Exabeam, Inc.

- Rapid7

- Alert Logic

- Forcepoint, Assuria Ltd, and

- Haystax Technology, Inc.

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Write to us at sales@stratviewresearch.com

Segments Analysis

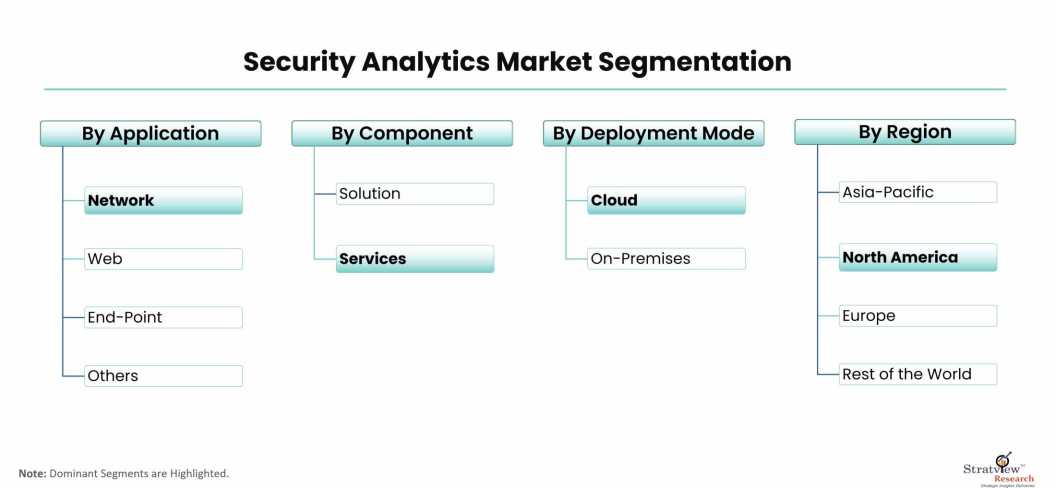

|

Segmentations

|

List of Sub-Segments

|

Segments with High Growth Opportunity

|

|

Application Type Analysis

|

Web Security Analytics, Network Security Analytics, End-point Security Analytics, Application Security Analytics, and Others

|

The network security analytics segment held the largest share of the market in 2022 and is expected to remain dominant during the forecast period.

|

|

Component Type Analysis

|

Solutions and Services [Professional Services and Managed Services]

|

The services segment is expected to grow at a higher rate, over the forecast period.

|

|

Deployment Mode Type Analysis

|

Cloud and On-Premises

|

The cloud segment is expected to grow at a higher rate, during the forecast period.

|

|

Regional Analysis

|

North America, Europe, Asia-Pacific, and Rest of the World

|

North America is estimated to be the largest market during the forecast period, with the USA and Canada being the major countries with lucrative growth opportunities.

|

By Application Type

Based on the application type, the market is segmented as web security analytics, network security analytics, end-point security analytics, application security analytics, and others. The network security analytics segment held the largest share of the market in 2022 and is expected to remain dominant during the forecast period. Network security analytics collect and analyze different types of network security event information and generate comprehensive security analytic solutions in order to secure the network from advanced threats.

By Component Type

Based on the component type, the market is segmented into solutions and services. The services segment is expected to grow at a higher rate, over the forecast period, owing to the increased rate of security-related instances, demanding organizations to adopt security analytic services in order to address the risks in the constantly evolving global threat landscape. Security vendors assist their customers by offering support for the efficient use and maintenance of security analytic solutions, which constitute the services segment, an integral part of the security analytics market.

By Deployment Mode Type

Based on the deployment mode type, the market is segmented as cloud and on-premises. The cloud segment is expected to grow at a higher rate, during the forecast period, driven by its advantages such as enabling cost savings by eliminating the need for an Information Technology (IT) staff to manage the software. Monitoring the security system can be done internally or it can be granted to the vendor. As this deployment mode requires low startup costs, it is being used by Small and Medium-Sized Enterprises (SMEs), offering web-based management and enterprise-class protection.

Another factor driving the market for cloud-based security analytic solutions is that it provides scalability and flexibility. The Software-as-a-Service (SaaS) model of deployment is generating demand for cloud-based security analytic solutions, further fueling the market growth.

Regional Insights

In terms of regions, North America is estimated to be the largest market during the forecast period, with the USA and Canada being the major countries with lucrative growth opportunities. This growth can be attributed to a large number of security breach incidents, leading to fast technological adoptions, and the presence of a number of leading players in North America. Cybersecurity has been identified by the government as the most serious economic and national security challenge in the region.

The region has experienced tremendous technological growth owing to the emergence of trends such as Bring Your Own Device (BYOD), the Internet of Things (IoT), and the Internet of Everything (IoE). This major trend has, in turn, led to a rise in next-generation threats, added complexities, and increased concerns and vulnerabilities for the existing technological infrastructure in the region. Europe and Asia-Pacific are also expected to offer substantial growth opportunities during the forecast period.

Want to know which region offers the best growth opportunities then? Register Here

Recent News & Developments

July 2022: CrowdStrike has introduced Falcon OverWatch Cloud Threat Hunting, an innovative cloud-based threat hunting service. This service empowers security teams to consistently detect and address advanced and covert threats originating from, and persisting within, cloud environments. It assists in pinpointing vulnerabilities that pose a threat to sensitive data, aiding onsite analysts in their mission.

JUNE 2022: Ensono Announces New Partnership with ATPCO to Achieve Operational Excellence and Commercial Savings- Ensono, a prominent technology consultant and managed service provider (MSP), has officially unveiled its strategic partnership with ATPCO, a pivotal platform within the global airline industry serving as the primary source for airline retailing and pricing data. In this collaboration, ATPCO has selected Ensono for its top-notch Mainframe-as-a-Service, disaster recovery, and private cloud solutions, enabling the attainment of superior operational performance. These services will grant ATPCO the utmost technical and commercial adaptability to align with both its current and future business requirements.

JULY 2021: LogRhythm Launches Automation Tools for Rapidly Complying with Qatar Cybersecurity Framework- LogRhythm, the driving force behind modern security operations centers (SOCs), has launched a novel automation module designed to assist organizations in swiftly aligning with Qatar's National Cybersecurity Framework. This module offers prebuilt content, facilitating the real-time detection of areas where compliance falls short through predefined searches and analytics that enable instant activity analysis. Demonstrating adherence to regulations becomes effortless with the use of preconfigured reports that can be scheduled or generated on demand.

JUNE 2021: Cisco Unveils New 5G Industrial Router Portfolio to Unite the IoT Edge- Cisco (NASDAQ: CSCO) has introduced an innovative lineup of Catalyst industrial routers, designed to amplify the influence of enterprise networks at the edge while ensuring the essential qualities of flexibility, security, and scalability crucial for the triumph of IoT initiatives. This portfolio, equipped with 5G capabilities, empowers organizations to conduct large-scale connected operations and offers a range of management tools tailored for both IT and operations teams. The integrated architecture fosters a seamless partnership between IT and operations, streamlining their implementations from the core enterprise to the edge.

APRIL 2021: Huntsman Security’s Enterprise SIEM V7.0 integrates Mitre ATT&CK® intelligence into SOC workflows with its live ATT&CK® heatmap- Huntsman Security has introduced the most recent version of its SIEM Cyber Security Analytics solution, available in both Enterprise and Managed Security Service Provider (MSSP) variants. Notably, this release incorporates an innovative live MITRE ATT&CK® heatmap. This enhancement allows security analysts to maintain real-time awareness of detected ATT&CK® techniques as they traverse a network. For the first time, analysts can actively engage with a dynamic ATT&CK® heatmap, empowering SOC teams to harness MITRE ATT&CK® intelligence for enhanced attack data visualization. This enables the swift and efficient identification of attack targets, origins, and the security vulnerabilities confronting their organization.

Research Methodology

- This strategic assessment report from Stratview Research provides a comprehensive analysis that reflects security analytics market realities and future market possibilities for the forecast period.

- The report segments and analyzes the market in the most detailed manner in order to provide a panoramic view of the market.

- The vital data/information provided in the report can play a crucial role for market participants as well as investors in the identification of the low-hanging fruits available in the market as well as to formulate growth strategies to expedite their growth process.

- This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools.

- More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data.

- We conducted more than 15 detailed primary interviews with market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Report Features

This report provides market intelligence in the most comprehensive way. The report structure has been kept such that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market. The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

- COVID-19 impact and its recovery curve

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors.

Market Segmentation

This report studies the market covering a period of 12 years of trend and forecast. The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The security analytics market is segmented into the following categories:

By Application Type

- Web Security Analytics

- Network Security Analytics

- End-Point Security Analytics

- Application Security Analytics

- Others

By Component Type

By Deployment Mode Type

By Organization Size Type

- Small and Medium-Sized Enterprises (SMEs)

- Large Enterprises

By Industry Vertical Type

- Government and Defense

- Banking, Financial Services, and Insurance

- Consumer Goods and Retail

- IT and Telecom

- Healthcare

- Energy and Utilities

- Manufacturing

- Others

By Region

- North America (Country Analysis: the USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, the UK, Russia, Spain, and the Rest of Europe)

- Asia-Pacific (Country Analysis: China, Japan, India, South Korea, and the Rest of Asia-Pacific)

- Rest of the World (Sub-Region Analysis: Latin America, the Middle East, and Others)

Know more about various segments of this report. Click Here

Report Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

- Detailed profiling of additional market players (up to 3 players)

- SWOT analysis of key players (up to 3 players)

Market Segmentation

- Current market segmentation of any one of the application types and by component type.

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Product portfolio, geographical reach, regional presence, and strategic alliances.

Custom Research: Stratview Research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to sales@stratviewresearch.com.