Market Insights

“The global cured-in-place pipe (CIPP) market size was US$ 2.7 billion in 2023 and is likely to grow at an impressive CAGR of 4.9% in the long run to reach US$ 3.8 billion in 2030.”

Want to get a free sample? Register Here

Introduction

Cured-in-place pipe (CIPP) is a trenchless (or no-dig) rehabilitation process used to repair pipelines. It is a non-invasive, jointless, seamless, pipe-within-a-pipe, which is used for the rehabilitation of sewer pipes, industrial gas pipes, potable water pipes, and gravity pipes. It can be performed inside a pipe with a diameter range of 6" to 120". This trenchless pipe rehabilitation method causes minimal disruption to traffic, work productivity, and people at home. Municipalities or utilities install it by accessing piping systems from city manholes. CIPP liner manufacturing has to be compliant with various standards, regulated by ASTM and has to follow the emission norms of different regulatory bodies, such as OSHA regulation.

The CIPP technology was invented by Insituform Technologies, Inc. in 1971 with the first project in London, the UK. Since then, the market has been witnessing incessant growth in its penetration across the world. There is already a high penetration of CIPP technology in developed economies, especially the USA, Germany, and Japan. Currently, the penetration of CIPP technology is limited in developing economies, such as China and India; however, this study reveals that the adoption rate is briskly increasing in these markets in the wake of aging pipelines coupled with increased spending on infrastructure rehabilitation.

There are various trenchless technologies used for pipe rehabilitation such as CIPP, SIPP, pipe bursting, and slip lining. Among all, CIPP is the most widely used technology and alone accounts for a mammoth share of the trenchless pipe rehabilitation market.

The global CIPP market grew at a healthy rate over the past five years. The market also witnessed a marginal drop in its growth trajectory amid the pandemic in 2020. The resulting market loss is estimated to be aptly compensated by a swift growth in the sale of CIPP during 2020-2021 and beyond, filling all the voids generated due to the pandemic.

The major factors continuously fueling the growth of the CIPP market are as follows:

- Aging potable and sewage water structure.

- Increasing spending by municipalities on utilities and pipeline rehabilitation.

- Increasing awareness about the benefits of trenchless methods.

- High performance of CIPP over competing technologies.

Recent Market JVs and Acquisitions:

- In 2024: Vortex acquired Applied Felts Inc. and Planned Engineered Construction, Inc. (PEC), establishing a stronger than before position in the market with improved capabilities.

- In 2023:

- Granite’s Inliner, Murphy Pipeline Contractors, and Inland Pipe Rehabilitation merged to form one business entity, PURIS Corporation.

- Azura announced the acquisitions of four companies: Enviro Group, Infraspec Services, Inc., Standard Pipe Services, and C&L Water Solutions, Inc.

- In 2022:

- Inland Pipe Rehabilitation (IPR) (Now PURIS Corporation) completed the acquisition of Granite’s Inliner business, a leading company in heat and UV-cured CIPP technology. It will diversify and expand IPR’s capabilities and service offerings while growing its presence throughout North America.

- Aegion Corporation acquired En-Tech Corporation’s CIPP lining division, a leading provider of pipe maintenance and rehabilitation solutions across the Northeast since 1983.

- In 2021, New Mountain Capital, a New York-based private equity investment firm, completely acquired the shares of Aegion Corporation.

- In 2019, Granite Construction (Now PURIS Corporation) acquired certain assets and equipment related to Lametti & Sons, Inc.’s CIPP business to strengthen its position in the water and wastewater market.

Segments' Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High Growth Opportunity

|

|

Pipe Diameter-Type

|

<1-Foot Diameter, 1-2.5-Feet Diameter, 2.5-5-Feet Diameter, and >5-Feet Diameter.

|

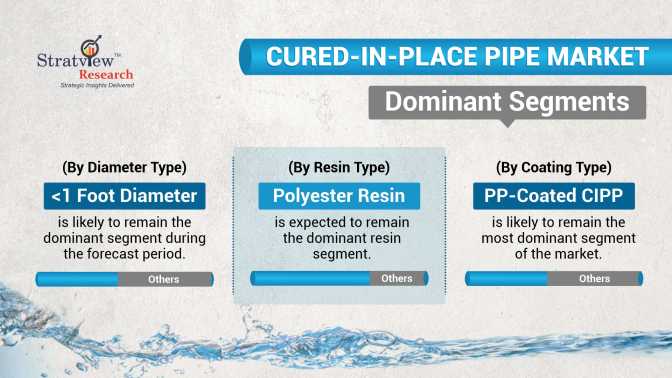

<1-foot diameter pipe is likely to remain the dominant segment during the forecast period.

|

|

Resin-Type

|

Polyester Resin-based CIPP, Vinyl Ester Resin-based CIPP, and Epoxy Resin-based CIPP.

|

Polyester is expected to remain the dominant resin type, whereas epoxy resin-based CIPP is expected to be the fastest-growing segment in the foreseen future.

|

|

Fabric-Type

|

Polyester Fabric-based CIPP, Glass Fabric-based CIPP, and Other CIPP.

|

Polyester is likely to remain the most dominant fabric type, whereas glass fabric is expected to be the fastest-growing segment during the forecast period.

|

|

Curing-Type

|

Hot Water-Cured CIPP, Steam-Cured CIPP, and UV-Cured CIPP.

|

Steam curing continues to rule the market, owing to its less curing time and stronger finished products.

|

|

Coating-Type

|

Polypropylene (PP)-Coated CIPP, Polyethylene (PE)-Coated CIPP, Polyurethane (PU)-Coated CIPP, Non-Coated CIPP, and Other Coatings CIPP.

|

PP-coated CIPP is likely to remain the most dominant coating type in the market.

|

|

Region

|

North America, Europe, Asia-Pacific, and Rest of the World.

|

North America is projected to remain the largest market, whereas Asia-Pacific is likely to grow at the fastest pace during the forecast period.

|

Diameter Trends

We have segmented the CIPP market based on pipe diameter as <1 Foot, 1-2.5 Feet, 2.5-5.0 Feet, and >5.0 Feet. <1-foot diameter pipe is likely to remain the largest and fastest-growing diameter type during the forecast period. The large demand for CIPP in the <1-foot diameter pipe is mainly attributed to the large installed base for sewer and potable water applications across regions. An 8” diameter pipe is a standard size and has been one of the largest used pipelines across the world.

Resin Trends

Based on the resin type, the market is classified as polyester resin-based CIPP, vinyl ester resin-based CIPP, and epoxy resin-based CIPP. Polyester resin-based CIPP is expected to remain the dominant resin, whereas epoxy resin-based CIPP is expected to be the fastest-growing resin in the foreseen future. Polyester resins-based CIPP are predominantly used in sewer and stormwater pipe rehabilitation, owing to their high flexural modulus, low tensile elongation, and good chemical resistance. Further, lower costs as compared to vinyl ester and epoxy resins elevate its demand. Epoxy resin does not have HAPs (hazardous air pollutants) or cause fewer VOCs (volatile organic compounds) emissions and is one of the eco-friendly choices for CIPP. Epoxy resin-based CIPP is mostly used for the rehabilitation of potable water pipelines as it’s the only resin that meets the NSF/ANSI 61 potable water requirements.

Want to get a free sample? Register Here

Fabric Trends

Based on the fabric type, the market is segmented into polyester fabric, glass fabric, and other fabrics. Polyester felt is likely to remain the most preferred fabric, whereas glass fabric is expected to be the fastest-growing fabric in the market during the forecast period. Polyester fabric exceeds the desired tensile strength and meets the ASTM D461 standard at a very competitive price compared to other fabrics. It is considered a superior fabric for optimum resin carriage coupled with high surface tension. Glass fabric is the preferred choice for CIPP where curing is done through UV. The main reason for using glass fabric liners with UV curing, instead of water or steam-cured felt liners, is that felt curing generates by-products that negatively affect the environment.

Curing Trends

Based on the curing type, the market is segmented into hot water curing, steam curing, and UV curing. Steam curing continues to rule the market with the largest share among all curing types. UV curing is anticipated to mark the highest growth during 2024-2030. Steam curing enables less curing time and results in stronger finished products. The overall curing time of the steam process is lower than that of the hot water curing time as the transfer of heat in the steam process is faster as compared to hot water. The setup of a steam cure system is also quicker than a hot water cure system, and it does not require large-scale water on the job site as in the case of hot water curing. UV liners do not need refrigeration; hence, they can be delivered directly to the job site in advance. They are 3 to 5 times stronger than conventional felt CIPP liners, contribute towards reducing emissions and are not temperature-sensitive.

Coating Trends

"PP-coated CIPP segment accounted for the largest market share."

Based on the coating type, the market is segmented into Polypropylene (PP)-Coated CIPP, Polyethylene (PE)-Coated CIPP, Polyurethane (PU)-Coated CIPP, Non-Coated CIPP, and Other Coatings CIPP. PP-coated CIPP is likely to remain the most dominant coating type in the market.

Regional Insights

“North America is expected to remain the largest market for CIPP during the forecast period.”

The USA is the largest market for CIPP in North America as well as in the world. Most of the pipeline construction in the region was constructed post-World War II and requires rehabilitation with CIPP, the most suitable method for pipe rehabilitation. Similarly, the Asia-Pacific region, which has a low penetration of trenchless technology presently, is likely to witness the fastest growth in the coming years, as the market is rapidly gaining momentum in the region.

Want to get a free sample? Register Here

Key Players

The market is moderately concentrated with the presence of over 50 players across the globe. Most of the major players compete in some of the governing factors, including price, service offerings, regional presence, etc. Developing thinner, stronger, and eco-friendly liners, executing mergers & acquisitions, and formation of contracts with installers and utilities are the key strategies adopted by the market players to gain a competitive edge in the market. Also, there have been some major mergers and acquisitions in the industry in recent years, which have had a substantial impact on the entire competitive landscape. The following are the key players in the cured-in-place pipe market:

Here is the list of the Top Players (Based on Dominance)

- Aegion Corporation (now known as Azuria Water Solutions)

- PURIS Corporation

- Per Aarsleff A/S

- SAK Construction

- RELINE UV Group

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Write to us at sales@stratviewresearch.com

Report Features

This report provides market intelligence in the most comprehensive way. The report structure has been kept such that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market.

What deliverables will you get in this report?

|

Key questions this report answers

|

Relevant contents in the report

|

|

How big is the sales opportunity?

|

In-depth analysis of the Cured-in-Place Pipe Market

|

|

How lucrative is the future?

|

Market forecast and trend data and emerging trends

|

|

Which regions offer the best sales opportunities?

|

Global, regional and country level historical data and forecasts

|

|

Which are the most attractive market segments?

|

Market segment analysis and forecast

|

|

Which are the top players and their market positioning?

|

Competitive landscape analysis, Market share analysis

|

|

How complex is the business environment?

|

Porter’s five forces analysis, PEST analysis, Life cycle analysis

|

|

What are the factors affecting the market?

|

Drivers & challenges

|

|

Will I get the information on my specific requirement?

|

10% free customization

|

The global CIPP market is segmented into the following categories:

By Pipe Diameter Type

- < 1-foot Diameter

- 1-2.5-Feet Diameter

- 2.5-5-Feet Diameter

- >5-Feet Diameter

By Resin Type

- Polyester Resin-Based CIPP

- Vinyl Ester Resin-Based CIPP

- Epoxy Resin-Based CIPP

By Fabric Type

- Polyester Fabric-Based CIPP

- Glass Fabric-Based CIPP

- Other Fabrics-Based CIPP

By Weaving Type

- Woven CIPP

- Non-Woven CIPP

- Other CIPP

By Curing Type

- Hot Water-Cured CIPP

- Steam-Cured CIPP

- UV-Cured CIPP

By Coating Type

- PP-Coated CIPP

- PE-Coated CIPP

- PU-Coated CIPP

- Non-Coated CIPP

- Other-Coated CIPP

By Region

- North America (Country Analysis: The USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, The UK, Spain, and Rest of Europe)

- Asia-Pacific (Country Analysis: Japan, China, Australia, Singapore, and Rest of Asia-Pacific)

- Rest of the World (Sub-Regional Analysis: Latin America, Middle East, and Others)

Research Methodology

This strategic assessment report from Stratview Research provides a comprehensive analysis that reflects today’s CIPP market realities and future market possibilities for the forecast period. The report segments and analyzes the market in the most detailed manner in order to provide a panoramic view of the market. The vital data/information provided in the report can play a crucial role for market participants as well as investors in the identification of the low-hanging fruits available in the market as well as to formulate growth strategies to expedite their growth process.

This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools. More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data. We conducted more than 15 detailed primary interviews with market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

- Detailed profiling of additional market players (up to three players)

- SWOT analysis of key players (up to three players)

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Service portfolio, geographical reach, regional presence, and strategic alliances

Custom Research: Stratview Research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to sales@stratviewresearch.com