Market Insights

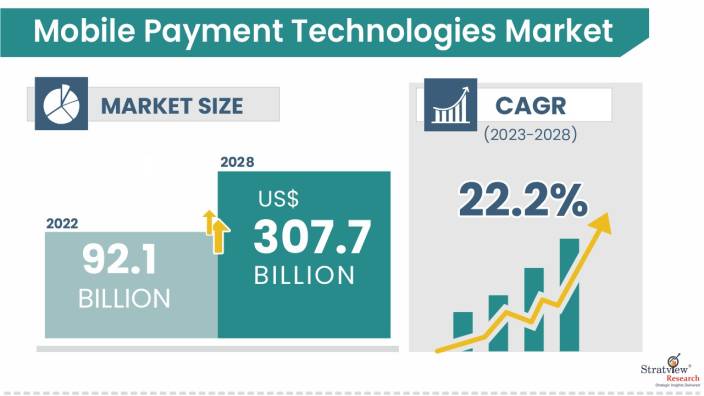

The mobile payment technologies market was estimated at USD 92.1 billion in 2022 and is likely to grow at a CAGR of 22.2% during 2023-2028 to reach USD 307.7 billion in 2028.

Want to know more about the market scope? Register Here

Market Dynamics

Introduction

Mobile payment refers to the use of a portable electronic device, such as a smartphone, tablet, or cell phone, as a payment medium. Consumers can use mobile payment technology to make immediate payments for goods and services. The concept of using mobile payment technologies stems from the desire to avoid the use of currency, coins, plastic, and paper media such as checks, cash, bank transactions, and debit/credit cards. Because of the increasing adoption of smartphones and tablets in emerging economies, the market for mobile payment technologies is currently expanding at a faster rate.

Market Drivers

The mobile payment technologies market is driven by a host of factors, some of which are noted below:

-

With the rapidly expanding global economy, mobile phones (particularly smartphones) have become an indispensable commodity for individuals.

-

Similarly, for many people, the internet has become an integral part of their daily lives.

-

This has increased the global penetration of smartphones and internet users, fueling the growth of the mobile payment market.

-

Many governments are also encouraging banks to build infrastructure to enable safe and secure mobile payments in rural areas, creating enormous opportunities for vendors.

Challenges:

- Security Concerns: Providing comprehensive security measures to secure user data and prevent fraud is one of the most significant problems for mobile payment technologies. As mobile payments become more popular, so does the potential for cyber-attacks.

- Standardization and Interoperability: With so many mobile payment platforms and technologies available, standardization and interoperability are critical to ensuring a smooth and seamless user experience across multiple payment systems.

- Regulatory Hurdles: The mobile payment business is governed by a complicated web of legislation and compliance standards, which can vary greatly between nations. Adapting to numerous regulatory environments can be difficult for providers who operate in multiple jurisdictions.

- Customer Trust and Adoption: Convincing users to use mobile payment technologies necessitates creating trust in the platform’s security and dependability. Some users may be unwilling to abandon established payment methods.

- Infrastructure Limitations: In some areas, particularly in underdeveloped nations, a lack of technological infrastructure and access to stable internet connections can stymie the widespread adoption of mobile payment solutions.

- Competition and Market Saturation: The mobile payment market is fiercely competitive, with both established businesses and newcomers striving for market share. This degree of rivalry could result in market saturation and possible consolidation.

- Data Privacy Concerns: As mobile payment providers collect massive volumes of user data, sustaining customer trust requires assuring data privacy and compliance with data protection requirements.

Opportunities:

- Increased Smartphone Adoption: As smartphone penetration continues to climb around the world, so does the potential client base for mobile payment technology. Easy availability of the internet and mobile drives the payment technologies market.

- Contactless Payments: As a result of the convenience and hygiene benefits of contactless payments, develops an opportunity for mobile payment providers. These transactions are made possible by the incorporation of Near Field Communication (NFC) technology in smartphones.

- Integration with IoT Devices: The Internet of Things (IoT) is booming, and incorporating mobile payment capabilities into IoT devices opens up new possibilities for secure and seamless transactions in a variety of industries, including smart homes, wearables, and connected autos.

- P2P Payments: Peer-to-peer payment services are becoming increasingly popular, particularly among younger generations. To gain a greater market share, mobile payment providers can pursue additional upgrades and innovations in this field.

- E-commerce Growth: The ongoing rise of e-commerce presents an opportunity for mobile payment solutions to support faster and more straightforward transactions, decreasing checkout friction for online buyers.

- Unbanked and Underbanked Populations: By offering access to digital financial transactions, mobile payment technology helps bridge the financial services gap for unbanked and underbanked populations, particularly in developing nations.

COVID-19 Impact

The coronavirus COVID-19 has had a significant impact on the economy and humans. It has significantly altered the channels and modes of transaction used by consumers and merchants. People are becoming more cautious about using cash while shopping in public places.

This has resulted in an unexpected surge in demand for contactless payment methods such as mobile wallets, NFC, QR codes, and others. The World Health Organization (WHO) recommended that consumers around the world use contactless payment methods in March 2020. As a result, the mobile-based payment mode is expected to grow rapidly during and after the pandemic.

Segment Analysis

|

Segmentations

|

List of Sub-Segments

|

Dominant and Fastest-Growing Segments

|

|

Solutions Type

|

Point-of-sale (PoS), In-store payments, Remote payments

|

The remote payments segment dominates the market during the forecast period.

|

|

Applications Type

|

Retail & E-Commerce, Healthcare, BFSI, Enterprise

|

E-commerce dominates the market during the forecast period.

|

|

Region Analysis

|

North America, Europe, Asia-Pacific, and the Rest of the World

|

Asia-Pacific accounted for the largest market share and is expected to grow at a healthy CAGR during the forecast period.

|

By Solutions Type

“Remote payments segment dominates the market during the forecast period.”

The market has been classified into Point-of-sale (PoS), In-store payments & Remote payments. Under these Remote payments segment held a significant market share in 2022 and is estimated to remain dominant during the forecast period.

Due to COVID-19, the demand for remote payments increased, as remote payments require no direct contact while making payments. Various companies are releasing remote payment apps to enable users to pay remotely.

By Application Type

“E-commerce dominates the market during the forecast period.”

The market has been classified into Retail & E-Commerce, Healthcare, BFSI, and Enterprise. E-commerce accounted for the largest share of the market in 2022 and is expected to grow at a robust CAGR during the forecast period.

With an increasing number of mobile devices and high-speed cellular networks around the world, the e-commerce industry is booming.

Regional Insights

“Asia-Pacific accounted for the largest market share in 2022 and is expected to grow at a healthy CAGR during the forecast period.”

The Asia-Pacific region is becoming increasingly popular for the adoption of electronic payment models. Countries such as India, Japan, China, and Australia are creating a stable environment for the growth of the mobile payment technologies market.

-

In India, the recent demonetization act has raised public awareness of alternative payment methods to cash (which is a major medium of transaction all over the Asia-Pacific).

-

According to Visa Inc., the company sold over 20 million contactless cards in India in 2018.

-

According to the company, contactless payments and QR transactions account for more than 25% of all Visa transactions in India.

Know the high-growth countries in this report. Register Here

Key Players

The market is highly populated with the presence of several local, regional, and global players. Most of the major players compete in some of the governing factors, including price, product offerings, regional presence, etc.

The following are the key players in the mobile payment technologies market (arranged alphabetically).

- American Express

- Ant Financial Service Group

- Apple Inc.

- AT & T Inc.

- Bharti Airtel Ltd.

- Fortumo

- Google Inc.

- Mastercard International

- Microsoft Corporation

- Paypal Inc.

- Vodafone Ltd

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Write to us at sales@stratviewresearch.com

Report Features

This report provides market intelligence in the most comprehensive way. The report structure has been kept such that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market. The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

- COVID-19 impact and its recovery curve

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors

Market Segmentation

This report studies the market, covering a period of 12 years of trends and forecasts. The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The mobile payment technologies market is segmented into the following categories:

By Solutions Type

- Point-of-sale (PoS)

- In-store payments

- Remote payments

By Remote Payment Type

- Internet payments

- SMS payments

- Direct carrier billing

- Mobile banking

By Application Type

- Retail & E-Commerce

- Healthcare

- BFSI

- Enterprise

By In-store Payments Solutions Type

- Mobile wallets

- Quick response (QR) code payments

By Region

- North America (Country Analysis: the USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, the UK, Russia, Spain, and Rest of Europe)

- Asia-Pacific (Country Analysis: China, Japan, India, South Korea, and Rest of Asia-Pacific)

- Rest of the World (Sub-Region Analysis: Latin America, the Middle East, and Others)

Research Methodology

This strategic assessment report, from Stratview Research, provides a comprehensive analysis that reflects today’s mobile payment technologies market realities and future market possibilities for the forecast period of 2023 to 2028. After a continuous interest in our mobile payment technologies market report from the industry stakeholders, we have tried to further accentuate our research scope to the mobile payment technologies market to provide the most crystal-clear picture of the market. The report segments and analyses the market in the most detailed manner to provide a panoramic view of the market. The vital data/information provided in the report can play a crucial role for the market participants as well as investors in the identification of the low-hanging fruits available in the market as well as to formulate the growth strategies to expedite their growth process.

This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools. More than 1000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data. We conducted more than 15 detailed primary interviews with the market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Customization Option

With this detailed report, Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

- Detailed profiling of additional market players (up to three players)

- SWOT analysis of key players (up to three players)

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Product portfolio, geographical reach, regional presence, and strategic alliances

Custom Research: Stratview Research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to sales@stratviewresearch.com

Recent Developments

In February 2022, Apple announced that they are planning to launch Tap to Pay on iPhone. This new feature will help in empowering businesses in using their mobile phones to accept payment through Apple Pay and other contact-free payment methods using the iPhone and iOS app.

In March 2022, Visa announced that it will be acquiring Tink, an open banking platform that allows financial businesses and fintech companies to build services and products and transact money. This merger of Tink and Visa is expected to provide better management of financial services, financial data, and money to clients.