Market Dynamics

Introduction

Textile chemicals are specialty chemicals that are used in different processes and treatments including dyeing, bleaching, coating, pre-treatment, printing, etc. in the production of a wide range of textiles. These chemicals enhance the appearance and durability of textiles providing properties such as fire retardancy, water resistance, anti-bacterial properties, etc. Textile chemicals undergo stringent regulation to guarantee their safety and environmental impact.

COVID-19 IMPACT

The global textile chemicals market was badly hit by the pandemic in the year 2020. Many textile chemicals-producing countries stopped production due to lockdowns and restrictions. This led to supply chain disruption in the textile chemicals market.

Market Drivers

The major factors driving the growth of the textiles chemicals market are:

- Expanding textile industry – The growth of the global textile chemicals market is closely linked to the overall growth of the textile industry. Across sectors like home furnishings, healthcare, etc., the demand for textiles is rapidly growing, and with this, there is a parallel rise in the demand for textile chemicals too.

- Rising demand for technical textiles – The demand for technical textiles, which are used in sectors including automotive, construction, sports, etc. is growing significantly. These textiles require specialized chemicals to impart properties like durability, resistance to chemicals and temperature, etc. With this, the demand for textile chemicals is also rising substantially, as these chemicals play a massive role in pre-defining textile properties.

- Rising sustainability demands and environmental policies – Due to stringent environmental regulations, most textile and chemical manufacturers are shifting their focus towards green chemicals. In April 2023, Erca Group – an Italian chemical company that is already known for supplying textile chemical auxiliaries by replacing petrochemicals with vegetable oil, announced that it will spin out a new business unit by 2024 to provide a wide range of new ‘green’ chemical solutions. Hence, green textile chemical is going to boost global textile chemicals in the coming years.

Want to have a closer look at this market report? Register Here

Segment Analysis

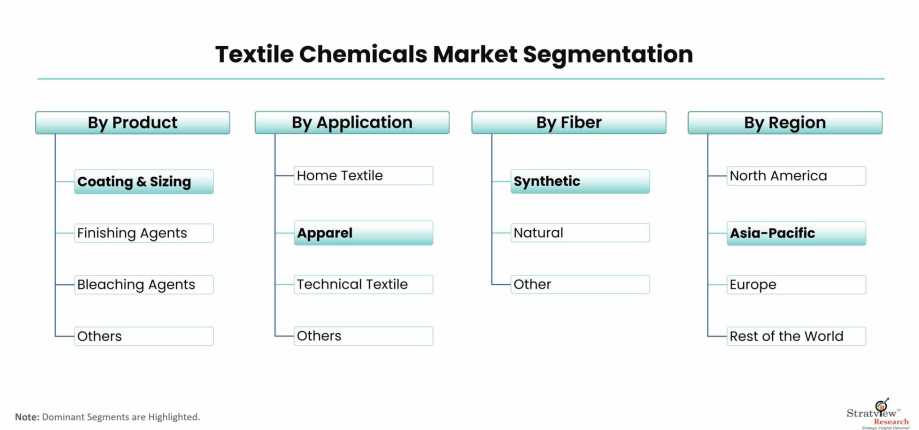

|

Segmentations

|

List of Sub-Segments

|

Segments with High Growth Opportunity

|

|

Product Type Analysis

|

Coating & Sizing Agents, Colorant & Auxiliaries, Finishing Agents, Surfactants, Desizing Agents, Bleaching Agents, and Others

|

The coating & sizing agents segment accounted for the largest market share of more than 50% in 2022.

|

|

Application Type Analysis

|

Apparel [Sportswear, Intimates, and Outerwear], Home Textile [Bed Linens, Carpet, Curtains, and Others], Technical Textile, and Others

|

The apparel segment accounted for the largest market share of more than 45% in 2022.

|

|

Fiber Type Analysis

|

Natural [Cotton, Wool, and Others] and Synthetic [Polyester, Polyamide, Viscose, and Others)

|

The synthetic segment is expected to maintain its dominance during the forecast period.

|

|

Regional Analysis

|

North America, Europe, Asia-Pacific, and Rest of the World

|

Asia-Pacific held the highest market share of more than 55% in 2022.

|

By Product Type

Based on the product type, the textile chemicals market is segmented as coating & sizing agents, colorants & auxiliaries, finishing agents, surfactants, desizing agents, bleaching agents, and others. The coating & sizing agents segment accounted for the largest market share of more than 50% in 2022. As coating & sizing agents enhance the strength and abrasion resistance of yarns, they are widely used in the pretreatment stage of the textile processing chain, which is a major factor driving the growth of the segment.

By Application Type

Based on the application type, the market is segmented as apparel, home textile, technical textile, and others. The apparel segment accounted for the largest market share of more than 45% in 2022. Increasing population and disposable income are paving the path toward unprecedented growth, bolstering the demand for apparel.

By Fiber Type

Based on the fiber type, the market is segmented as natural and synthetic. The synthetic segment is expected to maintain its dominance during the forecast period owing to its better performance with lower production cost characteristics.

Regional Insights

In terms of regions, Asia-Pacific held the highest market share of more than 55% in 2022. Large population, cheap labor, rapid industrialization, and robust textile manufacturing base are the factors likely to increase the demand for textile chemicals in the region.

Asia Pacific is considered the global hub for textile production with countries like China, Bangladesh, Indonesia, India, etc. accommodating several leading textile manufacturers.

China owns the world’s largest textile industry both in terms of production and export. Recent data from China’s Ministry of Industry and Information Technology reveals steady growth in the first three quarters of 2022. Major textile industries in China recorded a 3.1% year-over-year rise in the combined operating revenue reaching CNY 3.86 trillion (USD 570 billion) in that period.

According to IBEF, the Indian textile and apparel industry is projected to reach USD 190 billion by 2025-2026. In 2022, India’s textile and apparel exports surged a remarkable 41% year-on-year amounting to USD 44.4 billion.

With initiatives like Integrated Textile Parks, Technology Upgradation Fund Scheme, etc. by the Indian government, the nation’s textile industry is undergoing a significant transformation. The country is likely to attract USD 120- USD 160 billion worth of foreign direct investments by 2025 leveraging its diverse range of natural and synthetic fibers and yarns.

Know the high-growth countries in this report. Click Here

Report Features

This report provides market intelligence in the most comprehensive way. The report structure has been kept such that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market. The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

- COVID-19 impact and its recovery curve

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors.

Market Segmentation

This report studies the market covering a period of 12 years of trend and forecast. The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The textile chemicals market is segmented into the following categories:

By Product Type

- Coating & Sizing Agents

- Colorant & Auxiliaries

- Finishing Agents

- Desizing Agent

- Surfactants

- Desizing Agents

- Bleaching Agents

- Others

By Application Type

- Apparel

- Home Textile

- Technical Textile

- Others

By Fiber Type

By Region

- North America (Country Analysis: the USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, the UK, Russia, Spain, and the Rest of Europe)

- Asia-Pacific (Country Analysis: China, Japan, India, South Korea, and the Rest of Asia-Pacific)

- Rest of the World (Sub-Region Analysis: Latin America, The Middle East, and Others)

Want to know the most attractive market segments? Register Here

Report Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

- Detailed profiling of additional market players (up to 3 players)

- SWOT analysis of key players (up to 3 players)

Market Segmentation

- Current market segmentation of any one of the product types by application type.

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Product portfolio, geographical reach, regional presence, and strategic alliances.

Custom Research: Stratview Research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to sales@stratviewresearch.com.