Market Insights

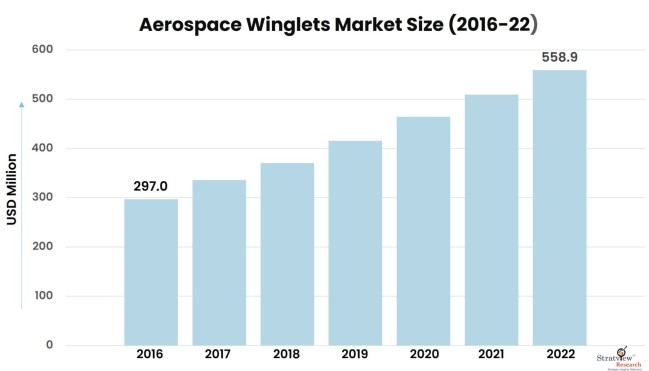

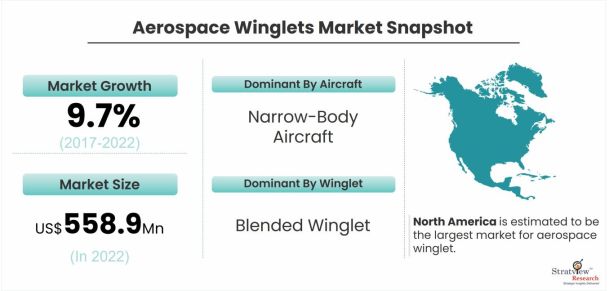

The aerospace winglets market was estimated at USD 297.0 million in 2016 and is likely to grow at a CAGR of 9.7% during 2017-2022 to reach USD 558.9 million in 2022.

Want to know more about the market scope? Register Here

Market Dynamics

Introduction

Winglets reduce wingtip vortices, the twin whirlwinds formed by the difference between the pressure on the upper surface of an aircraft's wing and that on the lower surface. High pressure on the lower surface creates a natural airflow that makes its way to the wingtip and curls upward around it. When flow around the wingtips streams out behind the airplane, a vortex is formed. This represents an energy loss and is strong enough to flip the aircraft. Overall, winglets are a proven way to reduce drag, enhance fuel efficiency, reduce CO2 and NOx emissions, and reduce community noise. Winglets can also be used to increase the payload or range capabilities of the aircraft, apart from reducing fuel consumption.

|

Aerospace Winglets Market Report Highlights

|

|

Market Size in 2016

|

USD 297.0 million

|

|

Market Size in 2022

|

USD 558.9 million

|

|

Market Growth (2017-2022)

|

9.7% CAGR

|

|

Base Year of Study

|

2016

|

|

Trend Period

|

2011-2015

|

|

Forecast Period

|

2017-2022

|

Market Drivers

The major factors driving the growth of the aerospace winglets market are-

- Increasing the production rate of commercial and regional aircraft.

- Certification of winglets as standard equipment in the variants of the best-selling aircraft, such as the B737 Max and A320neo family.

- The increasing adoption rate of winglets by airlines in both the new as well as retrofit installations.

- Winglet technology advancement.

- Increasing fleet size.

Want to have a closer look at this market report? Click Here

Key Players

The supply chain of this market comprises raw material manufacturers, winglet manufacturers, aerospace OEMs, and airline companies.

The raw material manufacturers are-

- Rio Tinto

- Toray Industries

- Hexcel

- The Gill Corporation

- Cytec.

The key aerospace OEMs are-

- Boeing

- Airbus

- Comac

- Bombardier

- Embraer

- Cessna

- Gulfstream.

The key winglet manufacturers are-

- FACC AG

- Korean Air Aerospace Division

- RUAG Aerostructures

- GKN Aerospace

- Winglet Technology LLC

- BLR Aerospace LLC.

New product development, collaboration with OEMs, and the formation of long-term contracts with OEMs are the key strategies adopted by the key players to gain a competitive edge in the market.

Segment Analysis

By Aircraft Type

The aerospace winglets market is segmented based on aircraft type as narrow-body aircraft, wide-body aircraft, very large aircraft, regional aircraft, and general aviation. Narrow-body aircraft is likely to remain the largest and fastest-growing segment of the market during the forecast period of 2017-2022. B737 and A320 along with their recently launched variants would remain the growth engines of the winglets market in the narrow-body aerospace industry over the next five years.

By Winglet Type

Based on winglet type, the global aerospace winglets market is segmented as blended winglets, sharklets, split scimitar winglets, raked wingtips, advanced technology winglets, wingtip fences, elliptical winglets, and others. Blended winglet dominates the aerospace winglets market, propelled by its certification in Boeing's best-selling aircraft program B737. Blended winglets offer a 3% to 5% increase in fuel efficiency as compared to aircraft without winglets. Advanced technology winglet is projected to witness the highest growth during the forecast period of 2017-2022.

Regional Insights

North America is projected to remain the largest market for winglets during the forecast period, driven by the presence of assembly plants of Boeing and Bombardier. The region is also the manufacturing capital of the aerospace industry with the presence of major composite part fabricators and raw material suppliers. Asia-Pacific is the fastest-growing winglets market over the next five years, driven by upcoming commercial and regional aircraft with winglets as an option and high commercial aircraft fleet size.

Know which region offers the best growth opportunities. Register Here

Research Methodology

- This strategic assessment report from Stratview Research provides a comprehensive analysis that reflects today’s aerospace winglets market realities and future market possibilities for the forecast period.

- The report segments and analyzes the market in the most detailed manner in order to provide a panoramic view of the market.

- The vital data/information provided in the report can play a crucial role for market participants as well as investors in the identification of the low-hanging fruits available in the market as well as to formulate growth strategies to expedite their growth process.

- This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools.

- More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data.

- We conducted more than 15 detailed primary interviews with market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Report Features

This report provides market intelligence most comprehensively. The report structure has been kept such that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market. The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

- COVID-19 impact and its recovery curve

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors.

The market is segmented into the following categories.

By Aircraft Type

- Narrow-Body Aircraft

- Wide-Body Aircraft

- Very Large Aircraft

- Regional Aircraft

- General Aviation

By Platform Type

- B737

- B747

- B777

- B787

- A320 Family

- A330 / A340

- A350XWB

- A380

- B737 Max

- B777x

- A320neo Family

- E175

- C Series

- Others

By Winglet Type

- Advanced Technology Winglets

- Blended Winglets

- Elliptical Winglets

- Raked Winglets

- Sharklet Winglets

- Split Scimitar Winglets

- Wingtip Fence Winglets

- Others

By Manufacturing Process Type

- Hand Layup Process

- Automated Process

- Other Process

By Region

- North America (Country Analysis: the USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, the UK, Russia, Spain, and the Rest of Europe)

- Asia-Pacific (Country Analysis: China, Japan, India, South Korea, and the Rest of Asia-Pacific)

- Rest of the World (Sub-Region Analysis: Latin America, the Middle East, and Others)

Report Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

- Detailed profiling of additional market players (up to 3)

- SWOT analysis of key players (up to 3)

Market Segmentation

- Current market segmentation of any one of the aircraft types by product type.

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Product portfolio, geographical reach, regional presence, and strategic alliances.

Custom Research: Stratview Research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to sales@stratviewresearch.com.