North American Spoolable Pipe Market Insights

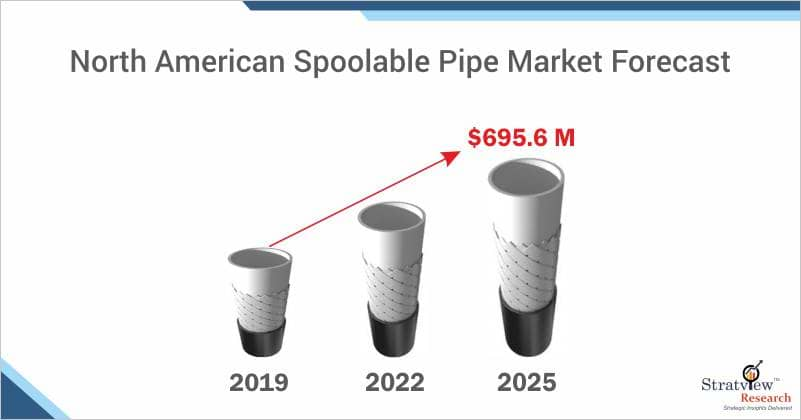

The North American spoolable pipe market offers a healthy growth opportunity for the entire ecosystem and is projected to reach US$ 695.6 million in 2025. The spoolable pipe market includes both spoolable composite pipe (SCP) and reinforced thermoplastic pipe (RTP). Despite the short-term fluctuations in the demand for spoolable pipes driven by decreasing rigs or wells count, the long-term business outlook seems promising with good growth potential over the next five years. An expected recovery in the rigs or wells count; cost competitiveness of spoolable pipes over steel pipes; excellent corrosion and erosion resistance; and higher preference of spoolable pipe over steel ones in small diameter pipes are the major factors that are proliferating the growth of the spoolable pipe market.

Wish to get a free sample? Click Here

Over 90% of the failures in pipes in the high-pressure applications are related to 6-inch diameter or smaller pipes. Most of the failures are due to the internal and external corrosion. Spoolable pipes offer excellent corrosion and erosion resistance properties, high fatigue resistance, reduced maintenance cost, faster commissioning, and improved flow rates. Spoolable pipes are used in the high-pressure applications in onshore, offshore, and downhole. They have gained a significant acceptance over a period of time and have been replacing steel pipes in the high-pressure applications. Spoolable pipes can be made up to the length of 600 meters to 3,000 meters with fewer joints in between.

Spoolable pipes are mainly composed of three materials. The first material is HDPE (High-Density Polyethylene) which is used in the inner layer of the spoolable pipe. It has a good erosion and corrosion resistance, impact resistance, and has a successful track record in the low-pressure oil & gas applications. The second material is used as reinforcement, which allows the pipe to handle higher pressure. Steel bands or cords, braided polyester, glass fiber, aramid fiber, and carbon fiber can be used as reinforcement material depending on the manufacturers. The third and final pipe material is extruded HDPE that is used in the outer layer of pipe with the purpose of providing protection to the pipe during the installation.

About eight to ten years back, the usage of spoolable pipes in high-pressure applications was at a nascent stage in the North American oil & gas industry. Since then, there has been a transformation in the acceptance of spoolable pipes in the regional oil & gas industry. North America has been the pioneer in the usage of the spoolable pipes.

Key Players

The supply chain of this market comprises raw material manufacturers, spoolable pipe manufacturers, distributors, drilling contractors, EPC contractors, and operators (oil & gas companies). The key EPC contractors are Fluor Corporation, Bechtel, McDermott, and CB&I and the key oil & gas companies are Shell, ExxonMobil, Chevron, and ConocoPhillips.

The key spoolable pipe manufacturers are National Oilwell Varco Inc., Shawcor Limited; Pipelife International; Flexsteel Pipeline Technologies, Inc.; Polyflow, LLC; Magma Global Ltd.; Airborne Oil & Gas BV; Cosmoplast Industrial Company LLC; and Pes.Tec. The regional expansion, new product development, and collaboration with customers are the key strategies adopted by the key players to gain a competitive edge in the market.

Research Methodology

For calculating the market size, our analysts follow either Top-Bottom or Bottom-Top approach or both, depending upon the complexity or availability of the data points. Our reports offer high-quality insights and are the outcome of detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders and validation and triangulation with Stratview Research’s internal database and statistical tools. We leverage multitude of authenticated secondary sources, such as company annual reports, government sources, trade associations, journals, investor presentation, white papers, and articles to gather the data. More than 10 detailed primary interviews with the market players across the value chain in all four regions and industry experts are usually executed to obtain both qualitative and quantitative insights.

Market Scope & Segmentation

|

Research Scope

|

|

Trend & Forecast Period

|

2014-2025

|

|

Size in 2025

|

US$ 695.6 million

|

|

Countries Covered

|

The USA, Canada, Mexico

|

|

Figures & Tables

|

>150

|

|

Customization

|

Up to 10% customization available free of cost

|

The market is segmented in the following ways:

North American Spoolable Pipe Market Size, Share & Forecast by Reinforcement Type:

- Fiber Reinforcement

- Glass Reinforcement

- Carbon Reinforcement

- Other Reinforcements

- Steel Reinforcement

North American Spoolable Pipe Market Size, Share & Forecast by Product Type:

- Spoolable Composite Pipe

- Reinforced Thermoplastic Pipe

North American Spoolable Pipe Market Size, Share & Forecast by Application Type:

- Onshore Applications

- Production and Gathering Lines

- Injection Lines

- Disposal Lines

- Others

- Offshore Applications

- Water

- Others

North American Spoolable Pipe Market Size, Share & Forecast by Diameter Type:

- Small Diameter Pipe

- Large Diameter Pipe

North American Spoolable Pipe Market Size, Share & Forecast by User Type:

- Operators

- EPC Contractors

- Drilling Contractors

- Others

North American Spoolable Pipe Market Size, Share & Forecast by Sales Channel Type:

- Direct Sales

- Distributors

North American Spoolable Pipe Market Size, Share & Forecast by Country:

Report Features

This report, from Stratview Research, studies the North American spoolable pipe market over the period of 2020 to 2025. The report provides detailed insights on the market dynamics to enable informed business decision making and growth strategy formulation based on the opportunities present in the market.

The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, product portfolio, product launches, etc.

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors.

Report Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

- Detailed profiling of additional market players (up to 3 players)

- SWOT analysis of key players (up to 3 players)

Market Segmentation

- Current market segmentation of any one of the vehicle class types by technology type.

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Product portfolio, geographical reach, regional presence, and strategic alliances

Custom Research: Stratview Research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry at [email protected].