Market Insights

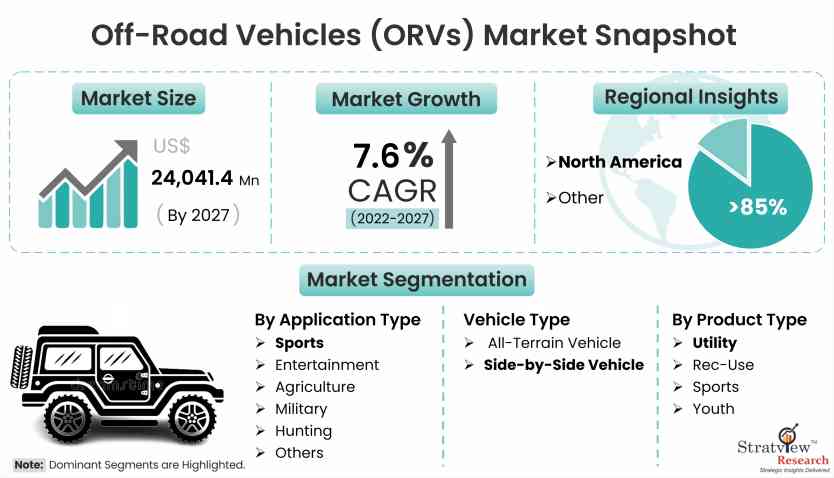

The off-road vehicles (ORVs) market size was estimated at USD 14,882.4 million in 2021 and is likely to grow at a CAGR of 7.6% during 2022-2027 to reach USD 24,041.4 million in 2027.

_57927.jpg)

Wish to Get a Free Sample? Register Here

Unlike other transportation segments, such as automotive and trucks which recorded a humongous decline amid the pandemic, ORVs emerged as the savior and grew tremendously, especially in North America and Europe.

Overall, the market grew by 24% in terms of units in the year 2020, a growth rate that the industry never achieved or reached close to in the past decade. The long-term outlook is also extremely pleasing keeping the mind the growth and demand for ORVs, especially SSVs.

Market Dynamics

Introduction

Off-road vehicles are specifically designed vehicles that are used for driving on off-highway applications such as rugged roads. These vehicles provide higher durability, increased power outputs, and enhanced traction as compared to the other vehicles.

ORVs have a wide range of applications, including mining, agriculture, and construction. There has been a significant demand for such vehicles due to the increasing popularity of extreme sports, across the globe, which is fueling the overall market growth.

Market Drivers

The major drivers propelling the growth of the global market are-

- Rising demand for recreational activities - Off-road vehicles' demand is growing with the rising interest in recreational activities and outdoor adventures. Vehicles that can handle rugged terrains and provide a smooth off-road experience are high in demand.

- Growing interest in off-road activities – There is a significant popularity of off-road sports such as motocross, rally racing, rock crawling, etc. Enthusiasts or fans of such sports often purchase off-road vehicles to participate in any competition.

- Rising Disposable Income and Leisure Spending – As individuals’ disposable income rises, they have more financial capability to engage in leisure activities. Off-road vehicles have gained recognition as a symbol of luxury, consequently driving up the demand for such vehicles.

- Technological Advancements – There is a significant growth in Off-road vehicles due to rapid technological developments in this field. Features like improved performance, durability, and other safety features are appealing to consumers, which leads to a notable increase in the demand for off-road vehicles.

- Rise in Off-Road Tourism – Expanding off-road tourism has provided opportunities for individuals to explore and experience off-road adventures. This trend has resulted in increased off-road activities and encouraged more people to engage in such activities.

Get the full scope of the report. Register Here

Segments Analysis

|

Segmentations

|

List of Sub-Segments

|

Dominant and Fastest-Growing Segments

|

|

Vehicle-Type Analysis

|

All-Terrain Vehicle and Side-by-Side Vehicle

|

The side-by-side vehicles category is expected to dominate the global market during the forecast period.

|

|

Product-Type Analysis

|

Utility, Rec-Use, Sports, and Youth

|

The utility segment is projected to remain the most dominant product type in the global market over the next five years.

|

|

Application-Type Analysis

|

Sports, Entertainment, Agriculture, Military, Hunting, and Others

|

The sports segment is projected to remain the most dominant application type in the market over the next five years.

|

|

Regional Analysis

|

North America, Europe, Asia-Pacific, and Rest of the World

|

North America is expected to remain the largest market during the forecast period.

|

Vehicle Trends

"The side-by-side vehicles segment accounted for the largest market share."

The market is segmented into all-terrain vehicles and side-by-side vehicles. The side-by-side vehicles category is expected to dominate the global market as they provide a few advantages over ATVs, including a superior riding experience, rollover protection, and portability. When compared to ATVs, these factors dramatically lower the number of accidents and injuries. Therefore, the ORV market has witnessed a steady movement from ATVs to SSVs over the eons.

Product Trends

"The utility segment accounted for the largest market share."

The market is segmented into utility, rec-use, sports, youth, and others. The utility segment is projected to remain the most dominant product type in the global market with a share of >45% in 2021. All the major players have an excellent product portfolio for the utility ORVs. The sports segment is likely to witness the highest growth during the same period, driven by increasing global tourism and recreational activities. The USA is the largest buyer of both utility and sports vehicles.

Application Trends

"The sports segment accounted for the largest market share."

The market is segmented into sports, entertainment, agriculture, military, hunting, and others. The sports segment is projected to remain the most dominant application type in the market with a share of more than 35% in 2021, driven by increasing demand for SSVs for sports and entertainment applications. More than 50% of the ORV sales came from sports and entertainment applications in 2020.

Regional Insights

"North America accounted for the largest market share."

North America is expected to remain the largest market with a share of more than 85% in 2021 for off-road vehicles. Europe, another significant continent, is expected to grow at a significant rate over the next five years. Although Asia-Pacific is a minor market, it is expected to expand the most throughout the projected period, thanks to rising demand for Powersports in various countries such as China, Japan, Australia, and India.

Know the high-growth countries in this report. Register Here

Critical Questions Answered in the Report

- What are the key trends in the global market?

- How the market (and its various sub-segments) has grown in the last five years and what would be the growth rate in the next five years?

- What is the impact of COVID-19 on the global market?

- What are the key strategies adopted by the major vendors to lead in the market?

- What is the market share of the top vendors?

Key Players

The supply chain of this market comprises raw material suppliers, component manufacturers, ATV and SSV manufacturers, distributors, and buyers. The global ORV is a highly consolidated market with the presence of global as well as regional players.

The following are the key players in the market:

- Polaris Inc

- Honda Motor Company

- BRP Inc

- Yamaha Motor Corporation

- Kubota Corporation

- Arctic Cat Inc.

- Deere & Company (John Deere)

- Kawasaki Motors Corp.

- Kwang Yang Motor Co. Ltd

- Suzuki Motor Corporation

- American Land Master

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Write to us at [email protected]

Research Methodology

- This strategic assessment report, from Stratview Research, provides a comprehensive analysis that reflects today’s off-road vehicle market realities and future market possibilities for the forecast period of 2022 to 2027.

- The report segments and analyzes the market in the most detailed manner to provide a panoramic view of the market.

- The vital data/information provided in the report can play a crucial role for the market participants as well as investors in the identification of the low-hanging fruits available in the market as well as to formulate the growth strategies to expedite their growth process.

- This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools.

- More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data.

- We conducted more than 15 detailed primary interviews with the market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Report Features

This report provides market intelligence in the most comprehensive way. The report structure has been kept such that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market. The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

- COVID-19 impact and its recovery curve

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors.

Market Segmentation

This report studies the market covering 12 years of trend and forecast. The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The off-road vehicles market is segmented into the following categories.

By Vehicle Type

- All-Terrain Vehicles

- Side-by-Side Vehicles

By Product Type

- Utility

- Rec-Use

- Sports

- Youth

By Application Type

- Sports

- Entertainment

- Military

- Agriculture

- Hunting

- Others

By Region

- North America (Country Analysis: the USA, Canada, Mexico, and the Rest of North America)

- Europe (Country Analysis: Germany, France, the UK, Russia, Spain, and the Rest of Europe)

- Asia-Pacific (Country Analysis: China, Japan, India, South Korea, and the Rest of Asia-Pacific)

- Rest of the World (Sub-Region Analysis: Latin America, the Middle East, and Others)

Click Here, to learn the market segmentation details.

Customization Options

Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

- Detailed profiling of additional market players (up to 3 players)

- SWOT analysis of key players (up to 3 players)

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Product portfolio, geographical reach, regional presence, and strategic alliances.

Custom Research:

Stratview Research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected].