Market Insights

The FRP pipe & tank market is likely to grow at a healthy CAGR during 2021-2026 to reach an estimated value of USD 8.0 billion in 2026.

Market Dynamics

Introduction

FRP (fiberglass-reinforced plastic) pipe & tanks are fabricated using resins such as polyester, vinyl ester, and epoxy reinforced majorly with glass fiber. FRP pipes & tanks are gradually replacing traditional materials, such as concrete, iron, and plastics because they offer a gamut of advantages over these materials, such as lightweight, durability, excellent corrosion resistance, chemical resistance, high level of stiffness, freedom of design, and low maintenance & installation costs.

FRP tanks are being installed underground as well as aboveground. Underground FRP tanks are used to store petroleum products such as gasoline, diesel fuel, motor oil, kerosene, methanol blends, oxygenated motor fuels, etc. Aboveground tanks are used to store acids, caustics, and other types of solvents. FRP pipes are used to transfer corrosive or other materials in corrosive environments. FRP pipe & tanks have a lower relative density between 1.5 and 2. Also, they have an excellent strength-to-weight ratio, only 20% to 25% of the weight of carbon steel yet provide strength similar to alloy steel. FRP has a low thermal insulating property, only about 1/100 to 1/1000 of that of traditional steel, which means they effectively maintain the temperature of liquids inside the pipe or tank.

Impact of COVID-19 on the FRP Pipe & Tank Market

The pandemic is rapidly ruthlessly affecting the business environments of major markets. FRP is the fastest-growing category in the total pipes & tanks family but could not escape themselves from it and are witnessing massive declines in their demand in all the market segments across regions. Some regions, particularly North America and Europe, are witnessing greater declines than Asia-Pacific. Amidst the ongoing crisis, the companies are operating at a lower capacity and will scale up their operations after carefully assessing the course of COVID-19 in the near term.

In order to assess the impact of the pandemic in the FRP pipes & tanks market with high veracity, Stratview Research has conducted a large number of primary interviews across the FRP market value chain as well as studied the impacts and recoveries on FRP pipe demand in previous downturns. Based on interviews and study of previous downturns, Stratview Research believes that the FRP pipes & tanks market is likely to record a V-shaped recovery, with recovery taking place from 2021 onwards, ultimately pushing the market to cross the unprecedented figure of USD 8.0 billion in 2026.

Segment Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High Growth Opportunity

|

|

Type Analysis

|

FRP Pipe and FRP Tank

|

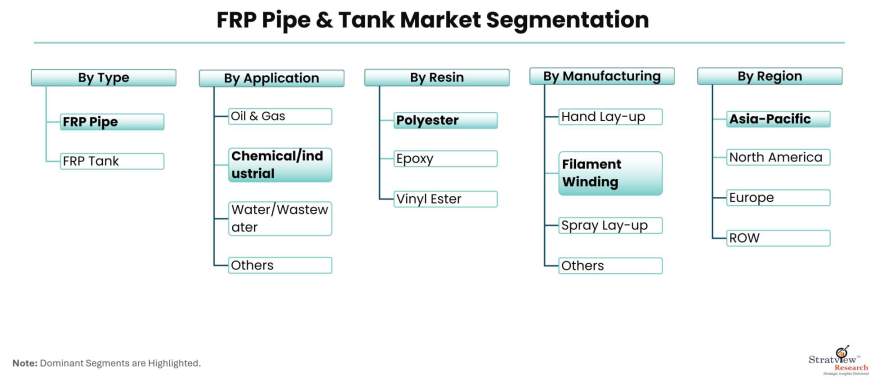

FRP pipe is estimated to maintain its huge dominance in the market in the coming five years.

|

|

Application Type Analysis

|

Oil & Gas, Chemical/Industrial, Water/Wastewater, and Marine & Offshore

|

Chemical/industrial is likely to remain the most dominant application type in the market during the forecast period.

|

|

Resin Type Analysis

|

Polyester, Vinyl Ester, and Epoxy

|

Polyester is likely to remain the most dominant resin type in the market during the forecast period.

|

|

Manufacturing Process Type Analysis

|

Filament Winding, Centrifugal Casting, Hand Lay-up, Spray Lay-up, and Others

|

The filament winding process is likely to remain the most dominant manufacturing process in the market by 2026.

|

|

Regional Analysis

|

North America, Europe, Asia-Pacific, and Rest of the World

|

Europe is expected to remain the largest market for food & beverage bearings during the forecast period in terms of regions.

|

FRP Pipe to maintain its unassailable lead in the market

Based on the type, the market is bifurcated into FRP pipe and FRP tanks. FRP pipe is estimated to maintain its huge dominance in the market in the coming five years. FRP pipe is also estimated to rebound at a healthy pace in the post-pandemic market scenario. FRP tanks also account for a considerable share of the market. There has been an increasing penetration of FRP in both, pipes as well as tanks, over the eons.

Chemical/Industrial to Remain the Most Dominant Application Type

Based on the application type, the market is segmented as oil & gas, chemical/industrial, water/wastewate, and marine & offshore. Chemical/industrial is likely to remain the most dominant application type in the market during the forecast period. In chemical/industrial applications, FRP pipe & tanks are gradually becoming the choice of product in a series of applications including petrochemical & refineries, power & desalination plants, fuel handling, storage tanks, etc. Vinyl ester and polyester resins are preferably used in the chemical/industrial application as both resins possess the high levels of chemical resistance even in the most aggressive environments.

The oil & gas industry segment is also expected to register the impressive growth in the post-pandemic market scenario. FRP pipes & tanks are becoming the apple of the eye for a wide range of applications such as flow gathering, water injection, downhole tubing, well casing, and transmission lines.

Polyester Remains the Choice of Resin Systems

Based on the resin type, the market is classified as polyester, vinyl ester, and epoxy. Polyester is likely to remain the most dominant resin type in the market during the forecast period. Polyester resin offers a multitude of advantages, including excellent corrosion and chemical resistance and moderate strength at a lower cost; hence, is considered a perennial choice for low-pressure applications. Glass fiber-reinforced epoxy pipes (GRE pipes) have high chemical and corrosion resistance as well as excellent mechanical, physical, and thermal properties. GRE pipes are capable to handle high pressure & temperature and resist corrosion caused by H2S and saltwater, which make them a preferred choice in oil & gas and marine/offshore applications.

Filament Winding is the Most Dominant Manufacturing Process Type

Based on the manufacturing process type, the market is classified as filament winding, centrifugal casting, hand lay-up, spray lay-up, and others. The filament winding process is likely to remain the most dominant manufacturing process in the market by 2026. Filament winding is the preferred process for the fabrication of FRP pipes, whereas spray lay-up is the dominant process for fabricating FRP tanks. The filament winding process allows continuous fiber reinforcement in the circumferential direction of pipe where the principal stress applies, resulting in high performing product development at a lower cost. Spray lay-up is the extension of the hand lay-up method where a spray gun is used to spray pressurized resin and chopped fiber on a mold. It is much faster than hand lay-up.

Regional Insights

All regions are expected to mark a huge decline in 2020 in the wake of the COVID-19. Asia-Pacific, the demand severely hit by the pandemic, is expected to manage its lead in the global market in the foreseeable future. Also, the region is likely to heal up with the fastest pace in the post-pandemic market scenario. China, India, Malaysia, and Japan are the major markets for FRP pipes & tanks. There has been an incessant shift from traditional materials to FRP pipes & tanks across the region. China is estimated to maintain its huge dominance in the global marketplace in the years to come. India to add consequential growth opportunities in years to come.

Know the high-growth countries in this report. Register Here

Key Players

The supply chain of this market comprises raw material suppliers, FRP Pipe & Tank manufacturers, distributors, and end-users.

The key players in the market are:

- Amiantit Fiberglass Industries Limited

- Amiblu Holding GmbH

- Farassan Man. & Ind. Company

- Future Pipe Industries

- Hengrun Group Co. Ltd.

- Kurimoto Ltd.

- Lianyungang Zhongfu Lianzhong Composites Group Co., Ltd.

- National Oilwell Varco

- Sekisui Chemicals

- WIG Wietersdorfer Holding GmbH

- ZCL Composites Inc.

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Write to us at [email protected]Some of the Key Strategic Alliances in the market:

- In 2019, Nation Oilwell Varco (NOV) acquired Denali Incorporated. With this acquisition, the company also acquired the Denali Incorporated brands including Belco, Ershigs, Fabricated Plastics, Fibra, and Plasti-Fab.

- In 2017, Two market-leading companies: Amiantit Europe & its Flowtite Technology, and Hobas Europe, part of WIG Wietersdorfer Holding form a 50:50 joint venture Amiblu in Klagenfurt, Austria. Amiblu’s goal is to develop and deliver world-class GRP pipes and fittings to sustainably solve the world’s water and sewer challenges.

- In 2019, Shawcor Ltd. acquired ZCL Composites Inc. This acquisition broadens Shawcor’s access to advanced composites technology and leverage material science expertize to provide customers with superior systems for their conveyance and storage needs.

Research Methodology

- This strategic assessment report from Stratview Research provides a comprehensive analysis that reflects FRP pipe & tank market realities and future market possibilities for the forecast period.

- The report segments and analyzes the market in the most detailed manner in order to provide a panoramic view of the market.

- The vital data/information provided in the report can play a crucial role for market participants as well as investors in the identification of the low-hanging fruits available in the market as well as to formulate growth strategies to expedite their growth process.

- This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools.

- More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data.

- We conducted more than 15 detailed primary interviews with market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Report Features

This strategic assessment report, from Stratview Research, provides a comprehensive analysis that reflects today’s FRP pipe & tank market realities and future market possibilities for the forecast period of 2021 to 2026. The report estimates the short- as well as long-term repercussions of the COVID-19 pandemic on the demand for FRP pipes & tanks at the global-, regional-, as well as country-level. Also, the report provides the possible loss that the industry will register by comparing pre-COVID and post-COVID scenario. The vital data/information provided in the report can play a crucial role for the market participants as well as investors in the identification of low-hanging fruits available in the market as well as formulate growth strategies.

The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, product portfolio, product launches, etc.

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors.

Market Segmentation

This report studies the market, covering a period of 12 years of trend and forecast. The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The FRP pipe & tank market is segmented into the following categories:

By Type

By Application Type

- Oil & Gas

- Chemical/Industrial

- Water/Wastewater

- Marine & Offshore

By Resin Type

- Polyester

- Vinyl Ester

- Epoxy

By Manufacturing Process Type

- Filament Winding

- Centrifugal Casting

- Hand Lay-up

- Spray Lay-up

- Others

By Region

- North America (Country Analysis: The USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, the UK, Russia, and Rest of Europe)

- Asia-Pacific (Country Analysis: China, India, Malaysia, and Rest of Asia-Pacific)

- Middle East (Country Analysis: Saudi Arabia, UAE, Oman, Qatar, and Rest of Middle East)

- Rest of the World (Country Analysis: Brazil, Argentina, and Others)

Click Here to learn the market segmentation details.

Report Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

- Detailed profiling of additional market players (up to 3 players)

- SWOT analysis of key players (up to 3 players)

Market Segmentation

- Current market segmentation of any one of the resin types or by application type.

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Product portfolio, geographical reach, country presence, and strategic alliances.

Custom Research: Stratview Research offers custom research services across the sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected].