Market Insights

"The North American FRP Pipe Market is likely to grow at a healthy CAGR during 2021-2026 to reach USD 0.97 billion in 2026."

Want to know more about the market scope? Register Here

Introduction

FRP (fiberglass-reinforced plastic) pipes have had a brilliant journey over the eons and have undoubtedly emerged as one of the most promising alternatives to steel and aluminum pipes. FRP pipes offer a long list of benefits over their counterparts, including 75% lower weight than steel pipes, the most prevalent type across industries. The lower weight of FRP pipes allows companies to quickly install pipes, substantially reducing the overall installation cost. Furthermore, FRP pipes have low thermal insulating properties—only about 1/100 to 1/1000 that of traditional steel, which means they effectively maintain the temperature of liquids inside the pipe.

Additionally, these pipes feature superior design ability; hence, they can be fabricated in various designs for different applications. Other noticeable advantages are ease of repair, low maintenance cost, corrosion resistance, and ease of handling. The non-toxicity property of FRP pipes is considered ideal for potable water applications. They are also extremely aging resistant and can withstand years of outdoor usage and can service for years without compromising their safety factor while maintaining 1.8 times of their pressure class.

Impact of COVID-19 on the North American FRP Pipe Market

The COVID-19 pandemic has devastated the FRP pipe demand in all the major markets across regions, with North America no exception. The region’s market for FRP pipes is estimated to record one of the biggest declines among regions in 2020. The demand for FRP pipes is estimated to plateau in 2020, followed by healthy market recoveries in years to come. All the major FRP pipe manufacturers are squeezing in their operational costs, halting their expansion plans, targeting their high-margin businesses, and reconfiguring their strategies with the sole aim of surviving in this breath-taking market environment.

Segments' Analysis

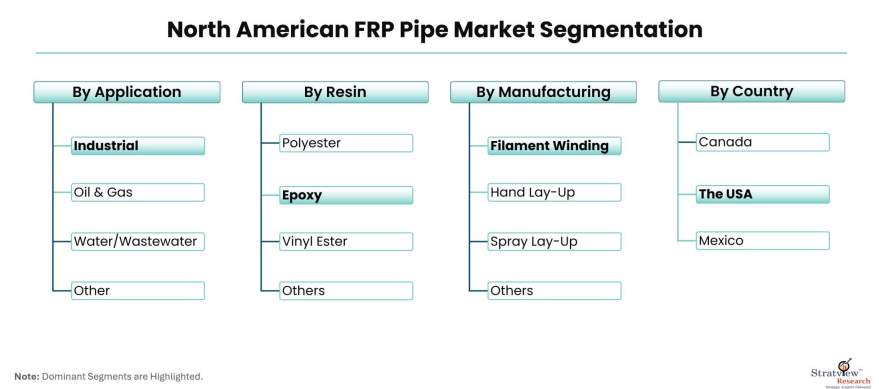

|

Segmentations

|

List of Sub-Segments

|

Segments with High Growth Opportunity

|

|

Application Type Analysis

|

Oil & Gas, Industrial [Chemical, Power & Desalination Plants, and Others], Water/Wastewater [Sewer & Storm Water, Water Transmission & Distribution, Drainage, and Others], and Marine & Offshore [Marine and Offshore]

|

Industrial is expected to remain the largest segment of the region’s FRP pipe market in the coming five years.

|

|

Resin Type Analysis

|

Polyester, Vinyl Ester, and Epoxy

|

Epoxy is estimated to remain the most dominant resin type during the forecast period.

|

|

Manufacturing Process Type Analysis

|

Filament Winding, Centrifugal Casting, Hand Lay-up, Spray Lay-up, and Others

|

Filament winding is likely to remain the most widely preferred manufacturing process in the market with both helical as well as continuous processes gaining market traction.

|

|

Regional Analysis

|

The USA, Canada, and Mexico

|

North America is estimated to register huge losses due to the pandemic. Despite the huge decline, the USA to maintain its lead in the years to come.

|

By Application Type

Based on the application type, the market is segmented as oil & gas, industrial, water/wastewater, and marine & offshore. The industrial segment is further bifurcated into chemical, power & desalination plants, and others. Analogously, water/wastewater into sewer & stormwater, water transmission & distribution, drainage, and others, and marine & offshore into marine and offshore.

Industrial is expected to remain the largest segment of the region’s FRP pipe market in the coming five years. FRP pipes are gaining preference over traditional pipes in a multitude of industrial applications, out of which chemical plants and power & desalination plants, with the consequential usage of FRP pipes across regions. All three resin types are used distinctively in order to cater to different market requirements. FRP pipes manufactured with vinyl ester and polyester resins offer high levels of chemical resistance even in the most aggressive environments.

Oil & gas, another major segment, is expected to register a similar growth trajectory as the industrial one during the forecast period. Years of continuous R&D coupled with the presence of major FRP pipe manufacturers led to the increased penetration of FRP pipes in the region’s oil & gas industry as compared to other regions. GRE pipes are mainly used in the oilfield applications and offer non-corrosive characteristics, making them a better choice for oil & gas transportation in a wide range of applications such as flow gathering, water injection, downhole tubing, well casing, and transmission lines in all pressures, temperatures, and mediums.

By Resin Type

Based on the resin type, the market is classified as polyester, vinyl ester, and epoxy. Contrary to other regional markets, here, in North America, epoxy is estimated to remain the most dominant resin type during the forecast period. Glass fiber-reinforced epoxy pipes (GRE pipes) have a high chemical and corrosion resistance as well as excellent mechanical, physical, and thermal properties. GRE pipes are capable of handling high-pressure & high-temperature and resist corrosion caused by CO2, H2S, and saltwater, which make them a better choice in oil & gas and marine & offshore applications.

By Manufacturing Process Type

Based on the manufacturing process type, the market is classified as filament winding, centrifugal casting, hand lay-up, spray lay-up, and others. All the major FRP pipe manufacturers have multiple manufacturing processes capabilities to serve a multitude of applications with a wide variety of diameters. Filament winding is likely to remain the most widely preferred manufacturing process in the market, with both helical as well as continuous processes gaining market traction. Centrifugal casting, hand layup, and spray layup also hold a considerable share of the market.

Regional Insights

North America is estimated to register huge losses due to the pandemic. Despite the huge decline, the USA to maintain its lead in the years to come. The country is currently the second-largest market in the world after China. Increase in domestic onshore oil & gas production, increasing investment in wastewater and sewage treatment pipelines to drive the market in the USA. The country is the manufacturing hub of FRP pipes with the presence of several top players such as Future Pipe Industries, LF Manufacturing, RPS Composites, and National Oil Varco.

Know the high-growth countries in this report. Register Here

Key Players

The supply chain of this market comprises raw material suppliers, FRP pipe manufacturers, and end-use industries.

The key players in the market are:

- Amiantit Fiberglass Industries Limited

- Conley Composites

- Endurance Composites, LLC

- Future Pipe Industries

- HOBAS Pipe USA

- LFM Fiberglass Structure

- National Oilwell Varco

- RPS composites

- Sekisui Chemicals Co. Ltd

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Write to us at [email protected]

The North American FRP pipe market is more consolidated than that of Asia-Pacific with the presence of a limited number of players. Also, over the years, major players have acquired a series of FRP pipe manufacturers with an aim to strengthen their position in the North American FRP pipe market.

The most noticeable strategic alliance in the region’s market was the acquisition of Denali Incorporated by Nation Oilwell Varco (NOV) in 2019. With this acquisition, NOV consequentially reinforced its position in the GRP pipe and tank business in the region.

Research Methodology

- This strategic assessment report from Stratview Research provides a comprehensive analysis that reflects North American FRP pipe market realities and future market possibilities for the forecast period.

- The report segments and analyzes the market in the most detailed manner in order to provide a panoramic view of the market.

- The vital data/information provided in the report can play a crucial role for market participants as well as investors in the identification of the low-hanging fruits available in the market as well as to formulate growth strategies to expedite their growth process.

- This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools.

- More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data.

- We conducted more than 15 detailed primary interviews with market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Report Features

This strategic assessment report, from Stratview Research, provides a comprehensive analysis that reflects today’s North American FRP pipe market realities and future market possibilities for the forecast period of 2021 to 2026. The report estimates the short- as well as long-term repercussions of the COVID-19 pandemic on the demand for FRP pipes at the regional as well as country-level. Also, the report provides the possible loss that the industry will register by comparing the pre-COVID and post-COVID scenarios. The vital data/information provided in the report can play a crucial role for the market participants as well as investors in the identification of low-hanging fruits available in the market as well as formulate growth strategies.

The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, product portfolio, product launches, etc.

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors.

Market Segmentation

This report studies the market covering a period of 12 years of trend and forecast. The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The North American FRP pipe market is segmented into the following categories:

By Application Type

- Oil & Gas

- Industrial (Application Type Analysis: Chemical, Power and Desalination Plants, and Others)

- Water/Wastewater (Application Type Analysis: Sewer & Stormwater, Water Transmission & Distribution, Drainage, and Others)

- Marine & Offshore (Application Type Analysis: Marine and Offshore)

By Resin Type

- Polyester Pipes

- Vinyl Ester Pipes

- Epoxy Pipes

By Diameter Type

- <18-inch Diameter

- 18-60-inch Diameter

- >60-inch Diameter

By Manufacturing Process Type

- Filament Winding

- Centrifugal Casting

- Hand Lay-up

- Spray Lay-up

- Others

By Pressure Rating Type

- <150 PSI Pressure Pipe

- 150-300 PSI Pressure Pipe

- >300 PSI Pressure Pipe

By Country

Click here to learn the market segmentation details.

Report Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

- Detailed profiling of additional market players (up to 3 players)

- SWOT analysis of key players (up to 3 players)

Market Segmentation

- Current market segmentation of any one of the resin types or by application type.

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Product portfolio, geographical reach, country presence, and strategic alliances.

Custom Research: Stratview Research offers custom research services across the sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry at [email protected].